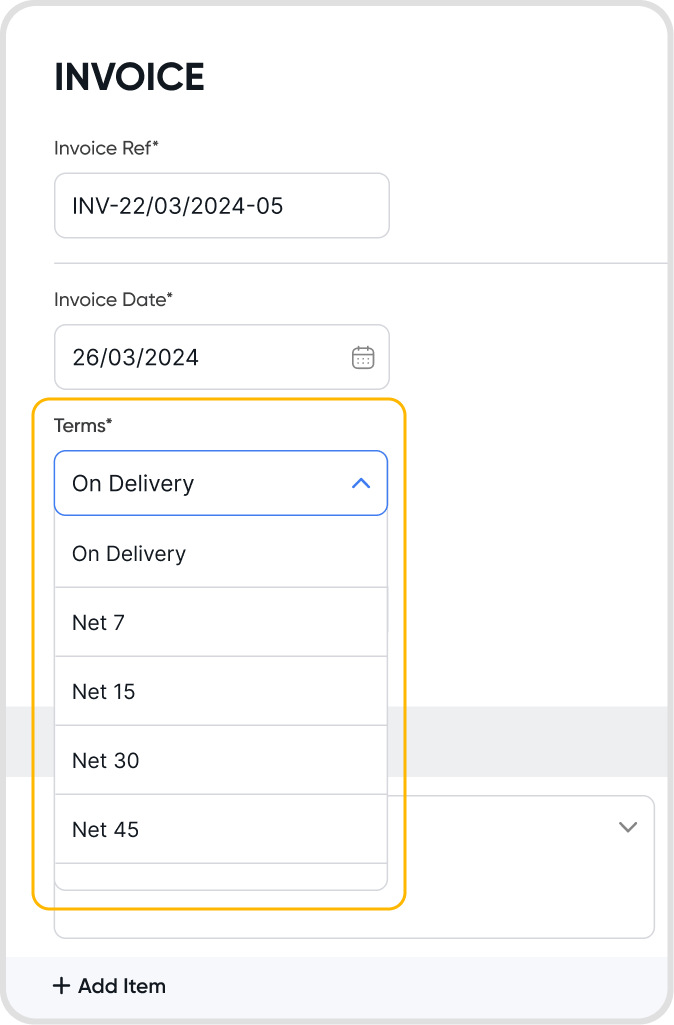

Under terms, choose the designated net days in which the invoice is due.

The due date will be the invoice date + the designated net days, e.g. 7 days after 20 Mar 2024 is 27 Mar 2024, so the invoice will be due on the 27 Mar 2024.

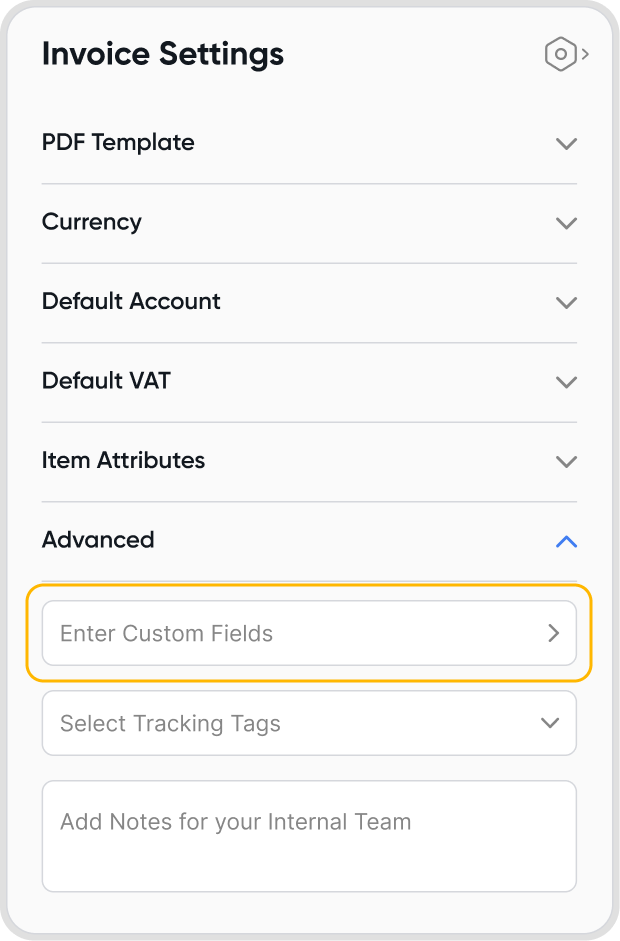

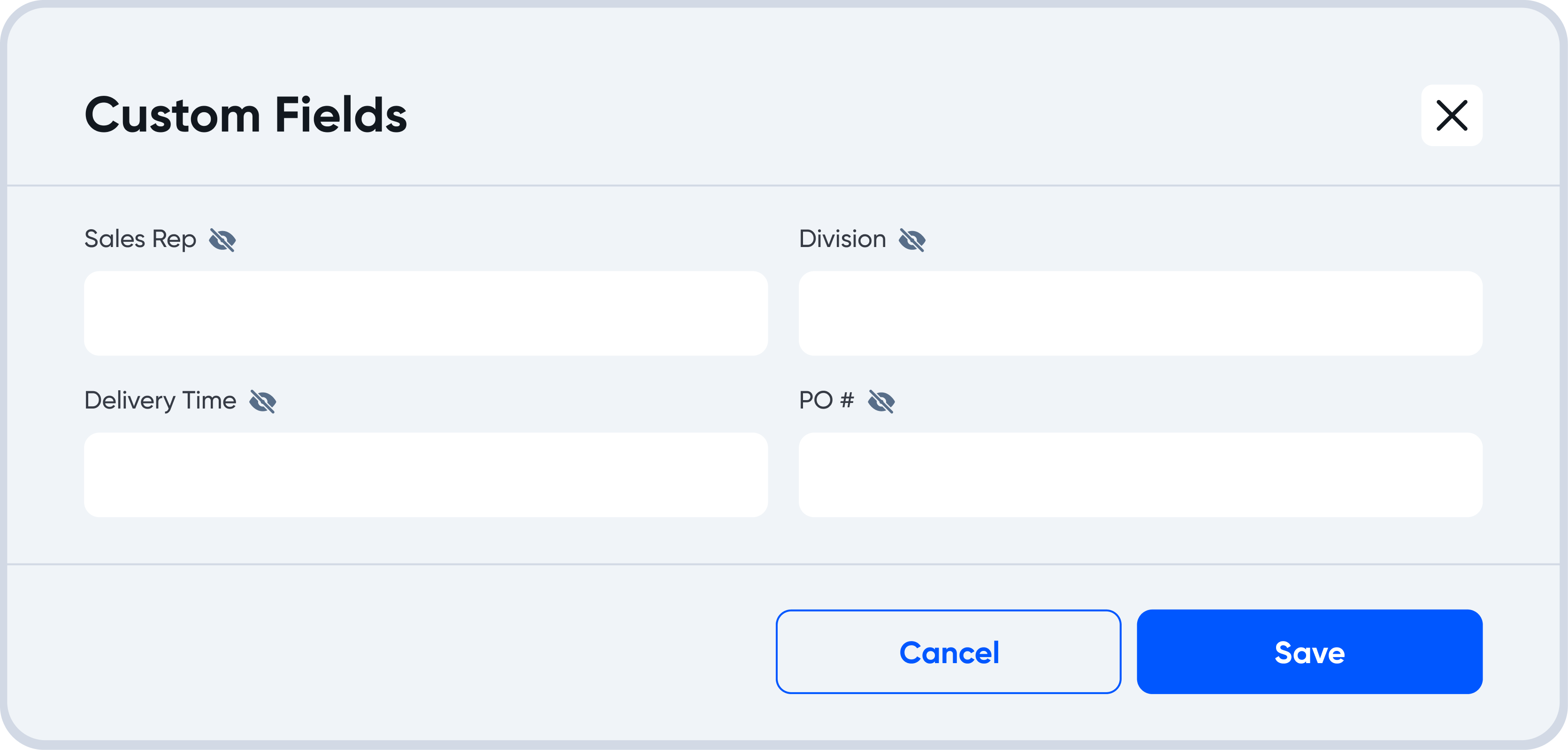

While creating a new invoice, under Invoice Settings > Advanced, enter Custom fields.

If you do not see this option available, it means that you currently do not have any custom fields set up. See Custom Fields for more information on setting custom fields.

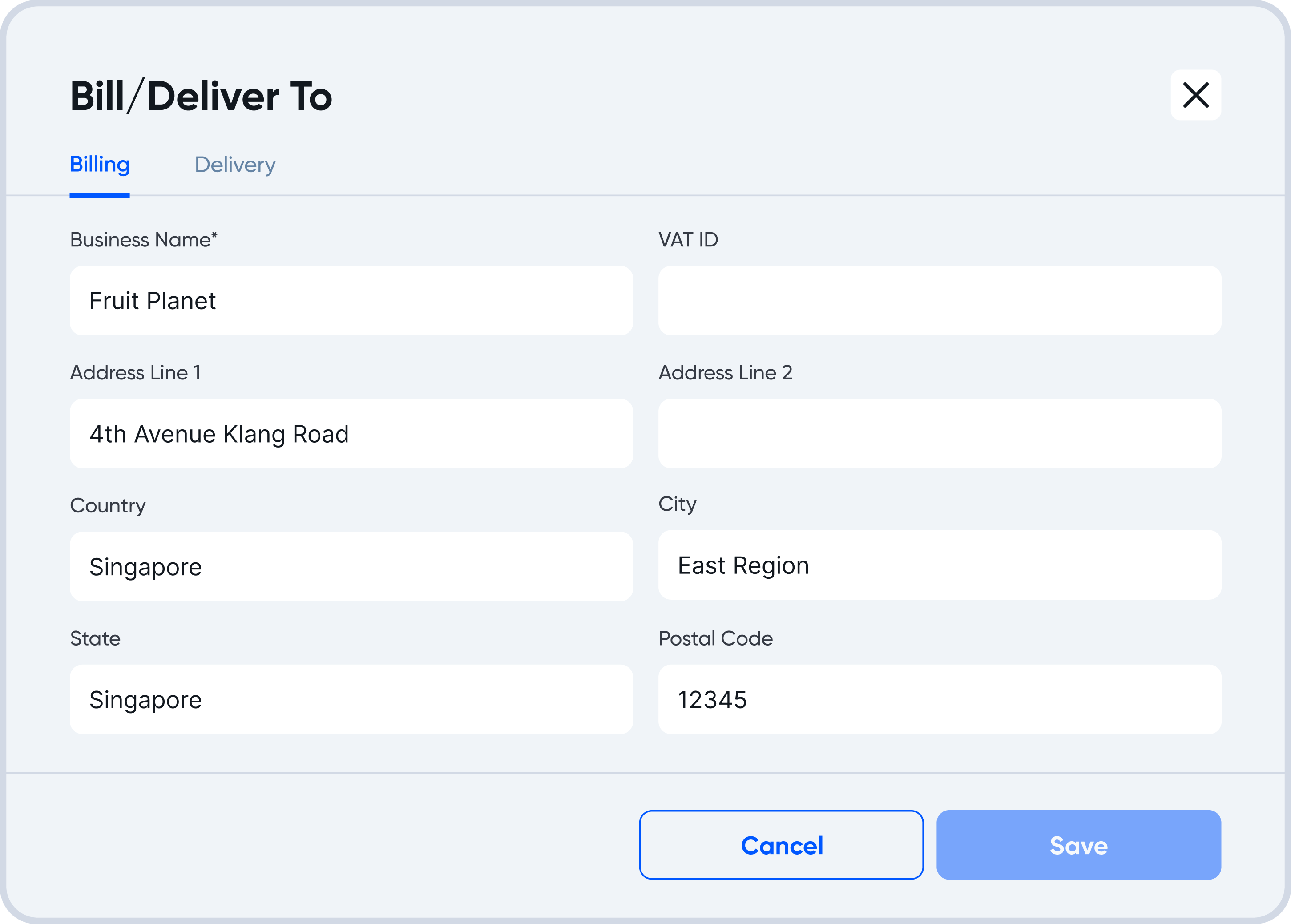

Find the pencil icon above the customer name to edit the address.

The customer address will only be updated for the invoice.

To permanently update the customer address, locate your customer under contacts and update the customer address.

Refer to Contacts for more information.

Yes, you can download an Invoice PDF.

For more information on invoice downloads, see Invoice downloads.

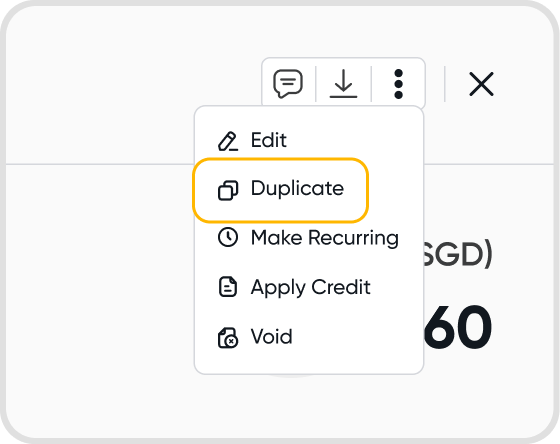

Yes, you can duplicate an invoice.

Upon duplication, a New Invoice creation screen will show, with the invoice fields automatically filled in following the duplicated invoice.

All the data on the selected invoice will be duplicated.

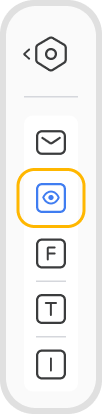

Yes, just tap on the preview icon located on the side bar.

Yes, you can. Just head to the PDF Templates to set a logo for each invoice template you create.

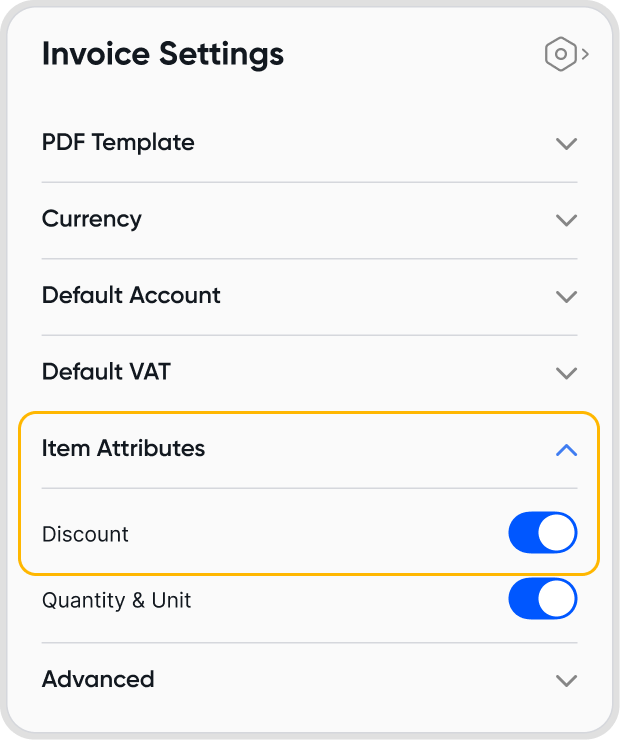

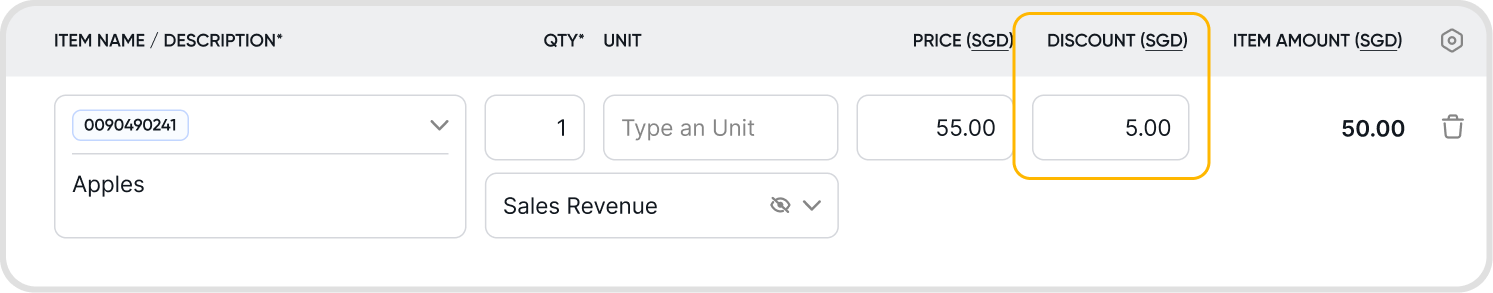

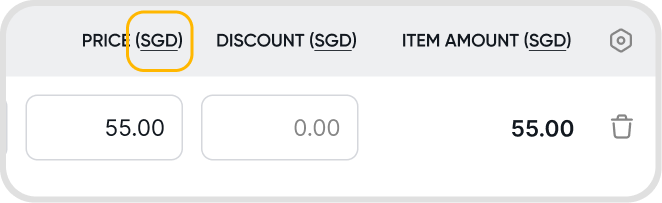

To add a discount, ensure that Discounts are enabled under Item Attributes in the Invoice Settings.

You will then be able to add a discount at a line item level.

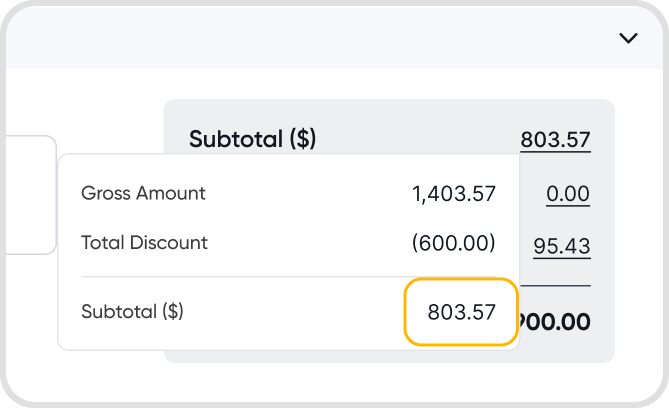

When discounts are applied, the Subtotal amount becomes clickable to view the breakdown of the applied discounts.

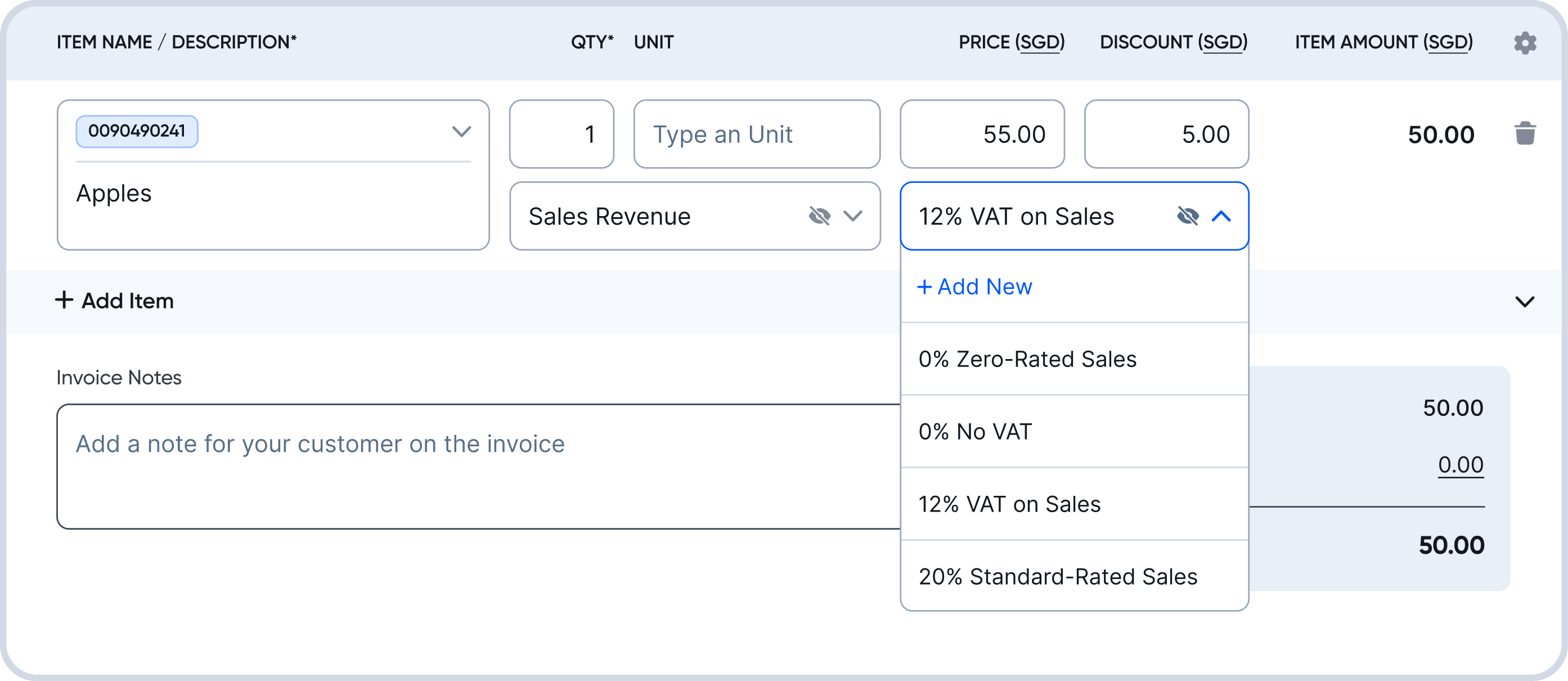

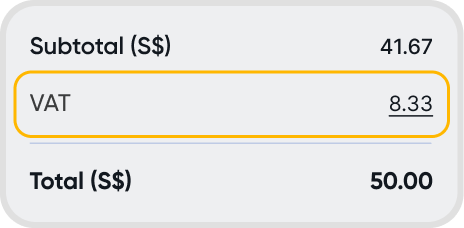

To add taxes for an invoice, ensure that you have selected a GST/VAT setting under default GST/VAT, either GST/VAT Included in Price or GST/VAT Excluded in Price.

Afterward, you will be able to select a tax profile at a line item level.

These taxes will also show up in the invoice total summary.

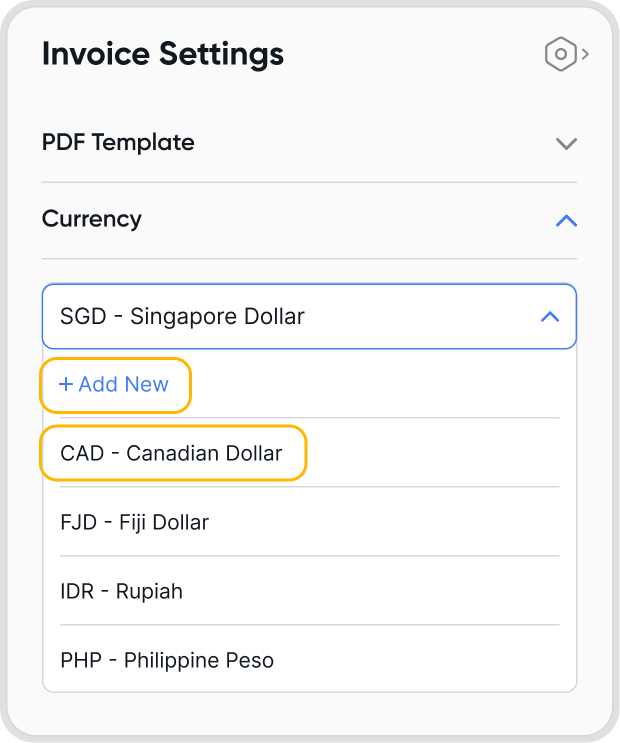

Click on the currency label within the invoice. You will be brought to the currency settings.

Select the currency that you would like the invoice to have.

Yes. There are a few ways where the currency can be automatically determined:

Via the contact's default currency setting.

If you have selected a contact for the invoice, the currency will be automatically set to the contact's default currency.

Your invoice default settings

Under Default Settings > Accounting, you can also set a default invoice currency there.

Your organization's base currency

If both are not available, the organization's base currency will be used.

If you would like to choose a currency outside of these options, you can select it from the list of currencies already added to your organization. If not, you can also add a currency.

Invoice setting: Settings that will only be applied to a single invoice (the one being created or looked at)

Invoice default setting: Settings that will automatically be applied by default at the start of the invoice creation process for all invoices

Customer-selected currency options: The currency that you have associated the customer contact with, typically the currency that you transact in with this contact.

Selecting a non-base currency may lead to foreign-exchange gains & losses due to differences in exchange rates when the transaction was created and when payment was made.

Yes, currencies can be set at an invoice level.

Customers will be charged in the currency selected on the invoice. For example, even if the organization's base currency is set to USD, but the invoice level currency is set to CAD, the customer will still be charged and receive an invoice in CAD.

For payments received in base currency for an invoice in a non-base currency, there may be foreign-exchange gains & losses incurred. See When does realized FX gain-loss (RGL) happen, and how is it calculated?

Yes, you can change the currency for an invoice after it has been created by editing the Invoice Settings.

No, Juan does not charge a fee for making use of different currencies in your invoices.

However, do be mindful of any potential foreign exchange differences, as mentioned in: Q16. Will the selected currency affect how my customers are charged or how payments are processed?

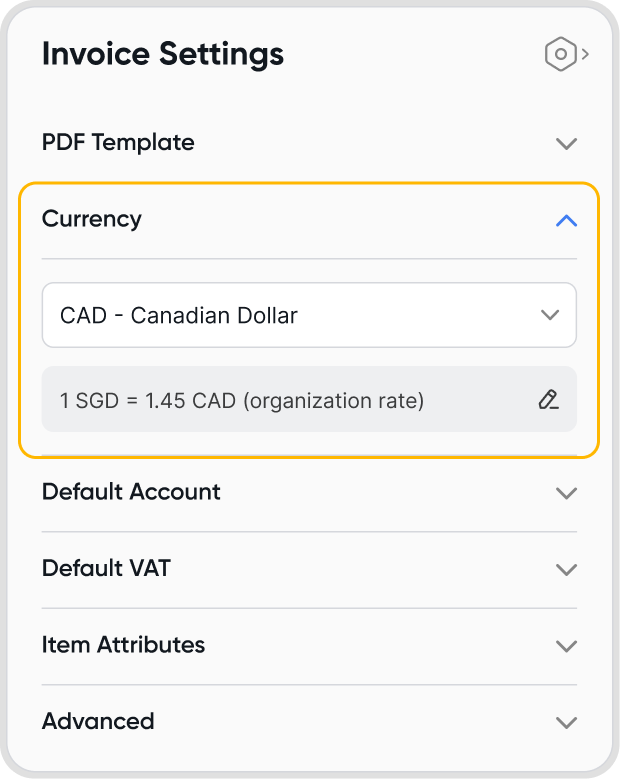

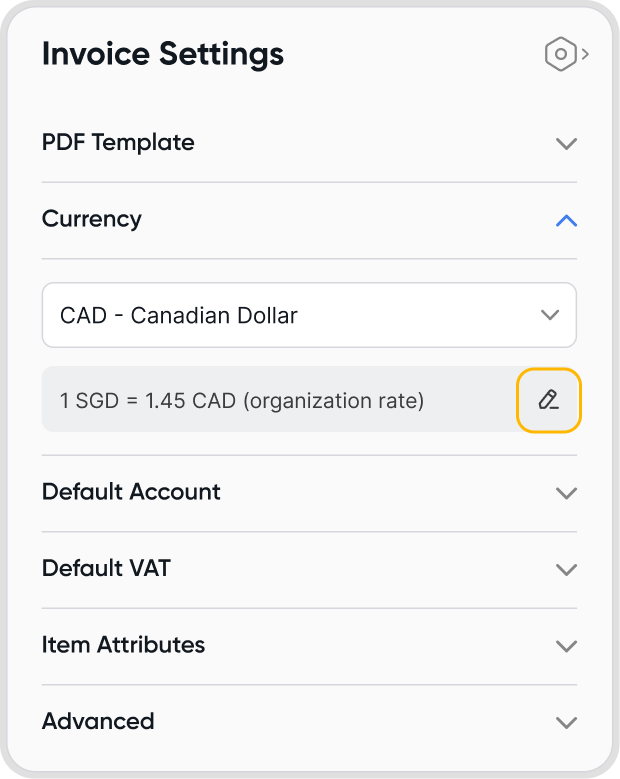

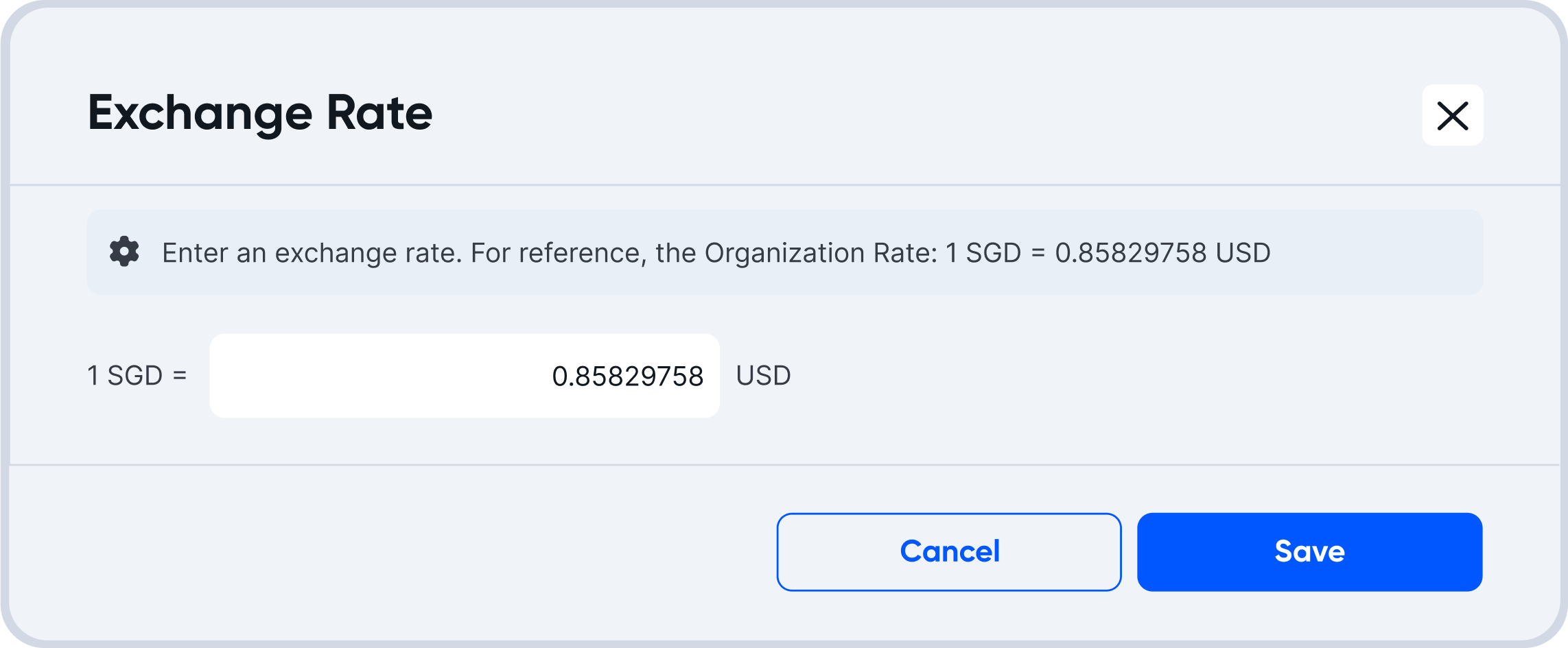

When choosing a currency under Invoice Settings,

If an organization's custom exchange rate has been set for the currency & time range when the invoice was created, Juan will make use of this exchange rate.

You can also set an exchange rate on a transaction level by clicking on the pencil icon to edit the exchange rates.

If not, Juan will use a third-party service to determine a mid-market exchange rate, and use that instead.

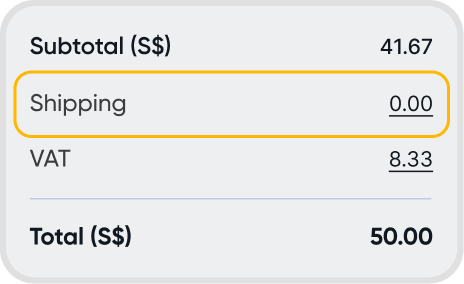

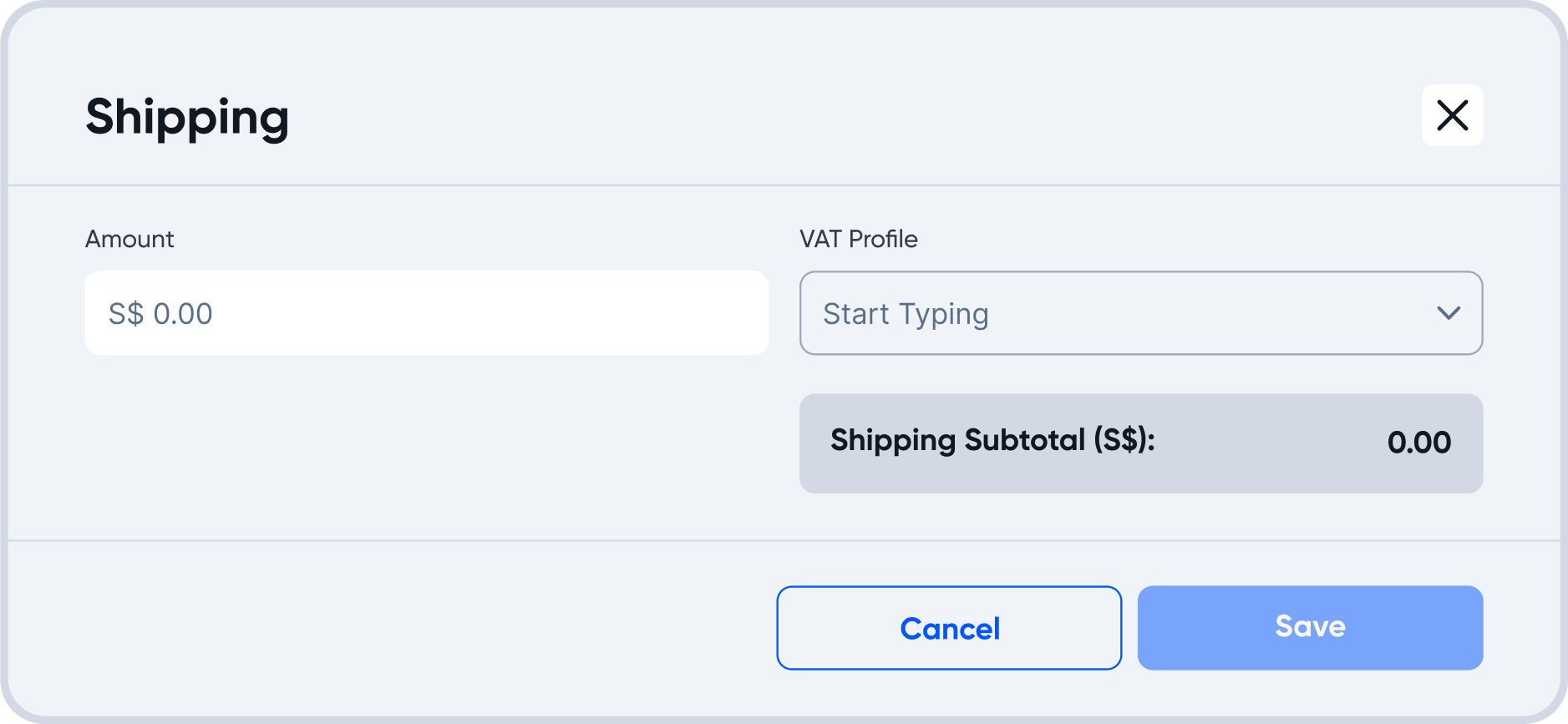

To add shipping fees to your invoices, you can click on the amount next to Shipping on your invoice total summary.

Enter the amount to charge for shipping, as desired.

To add GST/VAT for shipping fees to your invoice, select a GST/VAT Profile when adding shipping fees to your invoice. Refer to Q20. How can I add shipping fees to my invoice? to learn more about adding shipping fees.

If a payment has been recorded as received for the invoice on the same date as the invoice date (i.e. payment date = invoice date), the transaction will be recorded on the ledger as a cash transaction.

The transaction will be recorded as a credit into the Cash on Hand account, and a debit from the account used on the invoice.