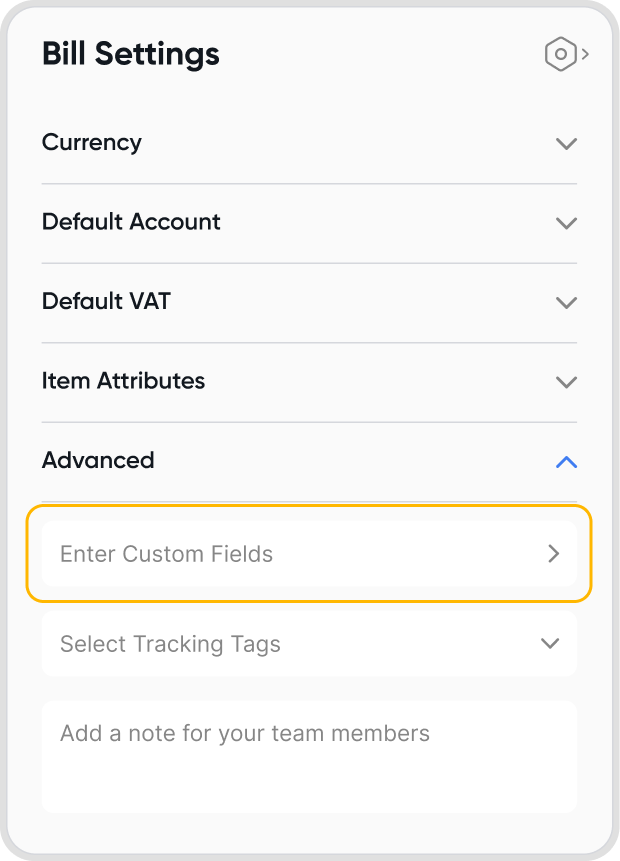

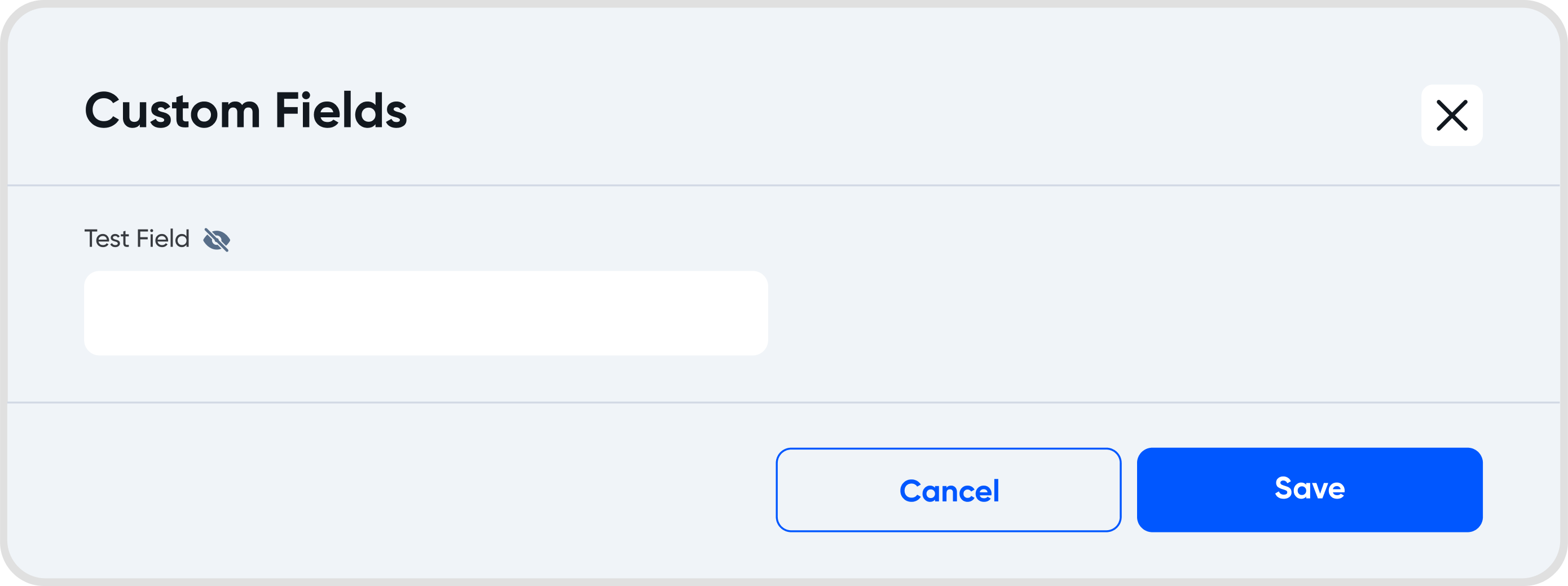

While creating a new bill, under Bill Settings > Advanced, enter Custom fields.

If you do not see this option available, it means that you currently do not have any custom fields set up. See Custom Fields for more information on setting custom fields.

You cannot edit a supplier's address through the bill creation workflow.

If you need to edit a supplier's address, please update their contact information directly.

Refer to Contacts for more help and information.

You can download a voucher from the bill details.

Refer to Bill Downloads for more information.

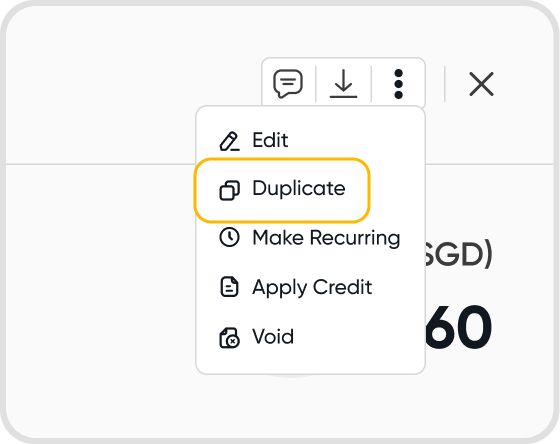

Yes, you can duplicate a bill.

Upon duplication, a New bill creation screen will show, with the bill fields automatically filled in following the selected bill.

All the data on the selected bill will be duplicated.

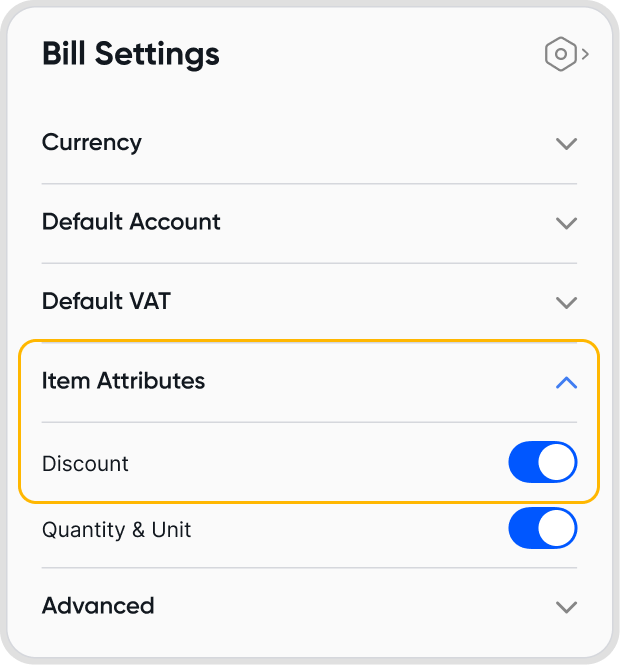

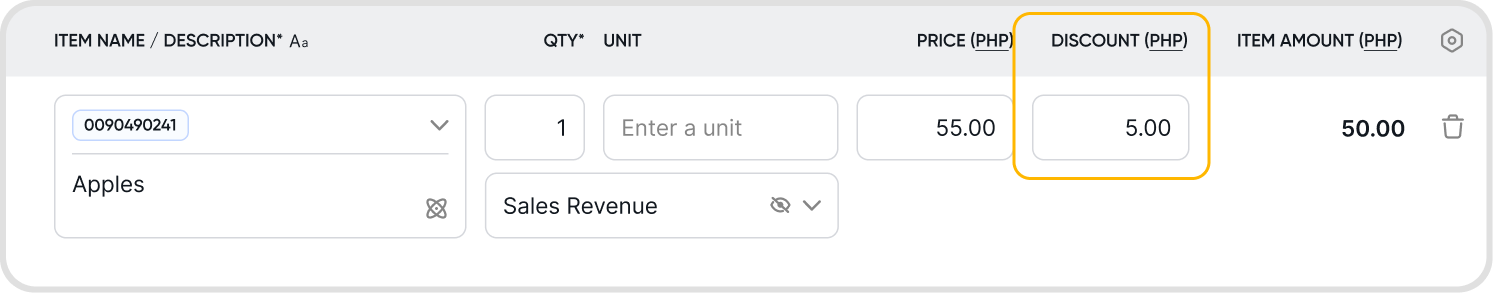

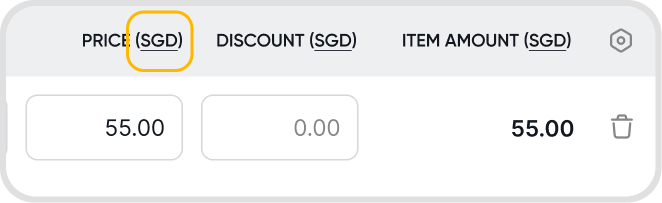

To add a discount, ensure that Discounts are enabled under Item Attributes in the bill Settings.

You will then be able to add a discount at a line item level.

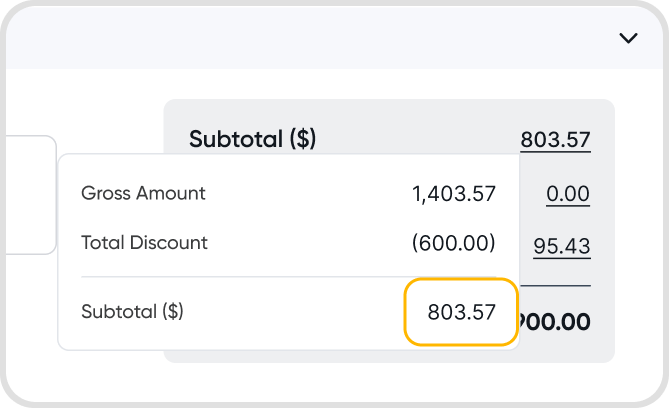

When discounts are applied, the Subtotal amount becomes clickable to view the breakdown of the applied discounts.

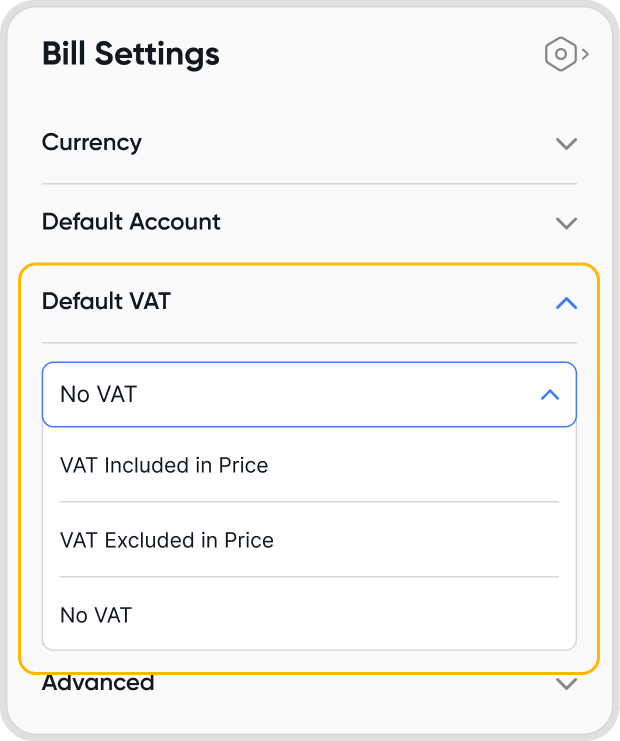

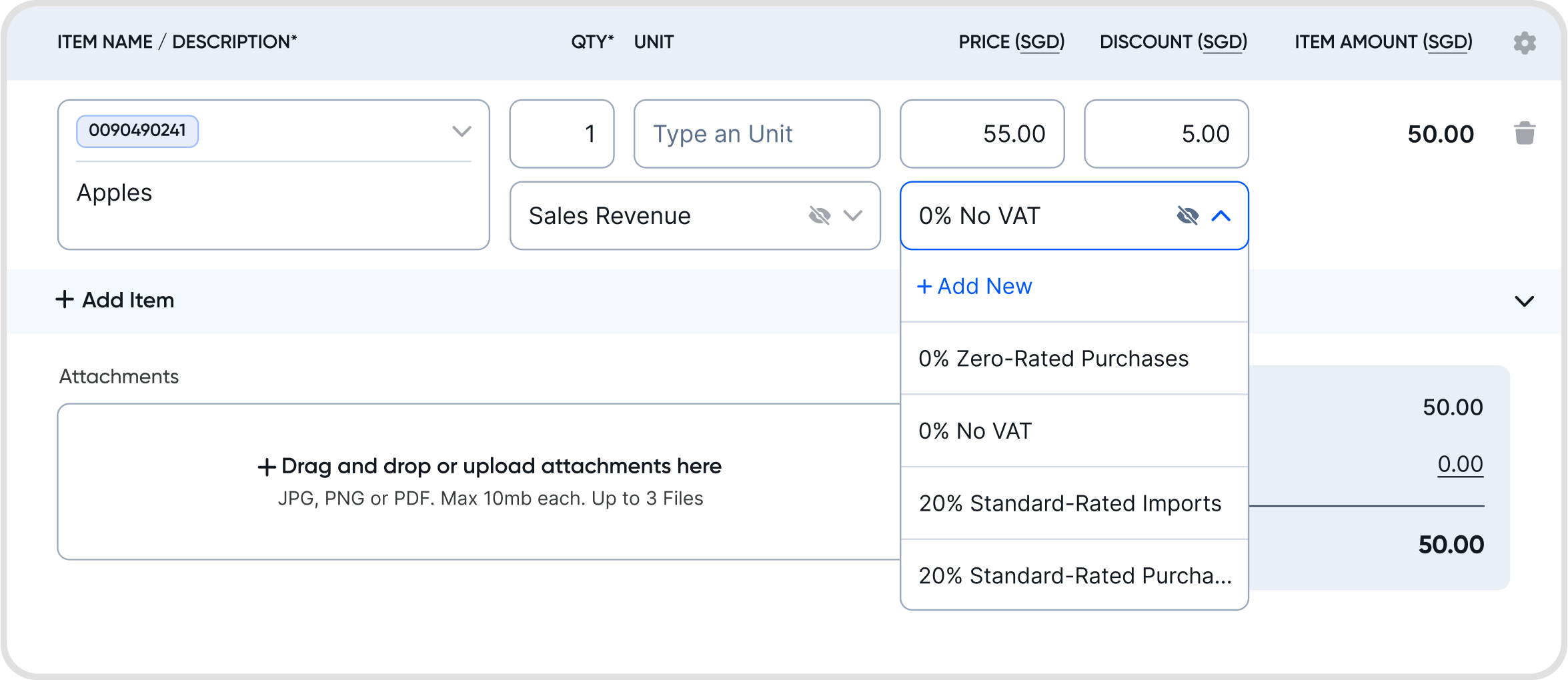

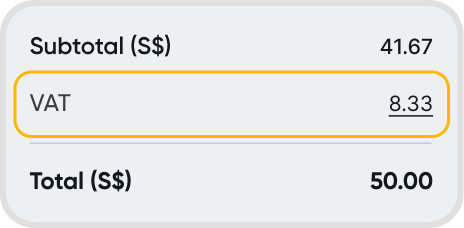

To add taxes for a bill, ensure that you have selected a GST/VAT setting under default GST/VAT, either GST/VAT Included in Price or GST/VAT Excluded in Price.

Afterwards, you will be able to select a tax profile at a line item level.

These taxes will also show up in the bill total summary.

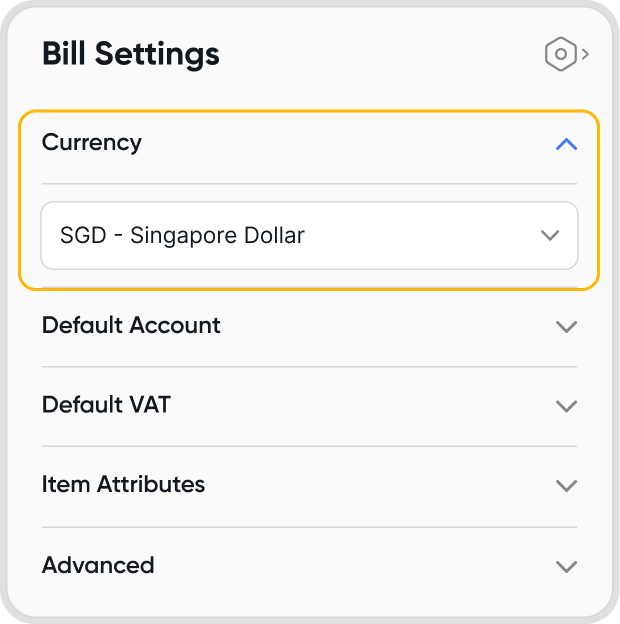

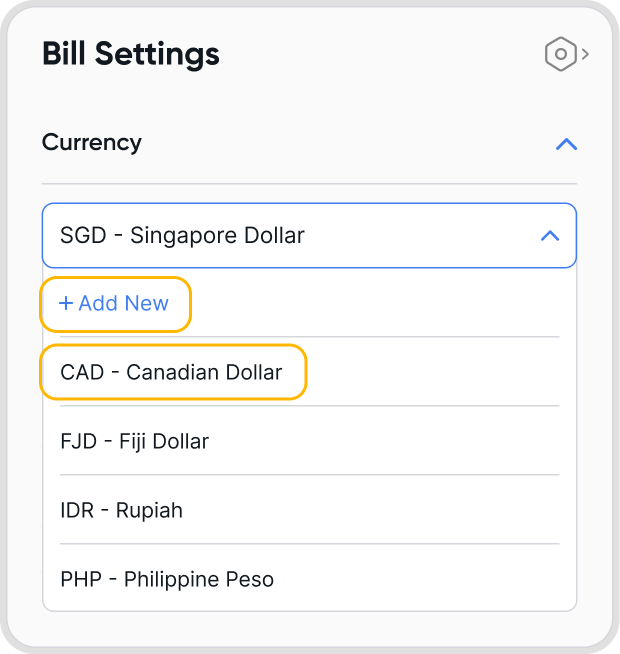

Click on the currency label within the invoice. You will be brought to the currency settings.

Select the currency that you would like the invoice to have.

Yes. There are a few ways where the currency can be automatically determined:

Via the contact's default currency setting.

a. If you have selected a contact for the bill, the currency will be automatically set to the contact's default currency.

Your bill default settings

a. Under Default Settings > Accounting, you can also set a default bill currency there.

Your organization's base currency

a. If both are not available, the organization's base currency will be used.

If you would like to choose a currency outside of these options, you can select it from the list of currencies already added to your organization. If not, you can also add a currency.

Bill setting: Settings that will only be applied to a single bill (the one being created or looked at)

Bill default setting: Settings that will automatically be applied by default at the start of the bill creation process for all bills

Supplied-selected currency options: The currency that you have associated the supplier contact with, typically the currency that you transact in with this supplier.

Selecting a non-base currency may lead to foreign-exchange gains & losses due to differences in exchange rates when the transaction was created and when payment was made.

Yes, currencies can be set at a bill level.

For payments made in base currency for a bill in a non-base currency, there may be foreign-exchange gains & losses incurred. See When does realized FX gain-loss (RGL) happen, and how is it calculated? for more information.

Yes, you can change the currency for a bill after it has been created by editing the bill Settings.

No, Juan does not charge a fee for making use of different currencies in your bills.

However, do be mindful of any potential foreign exchange differences, as mentioned: in Q13. Will the selected currency on a bill affect how payments are processed?

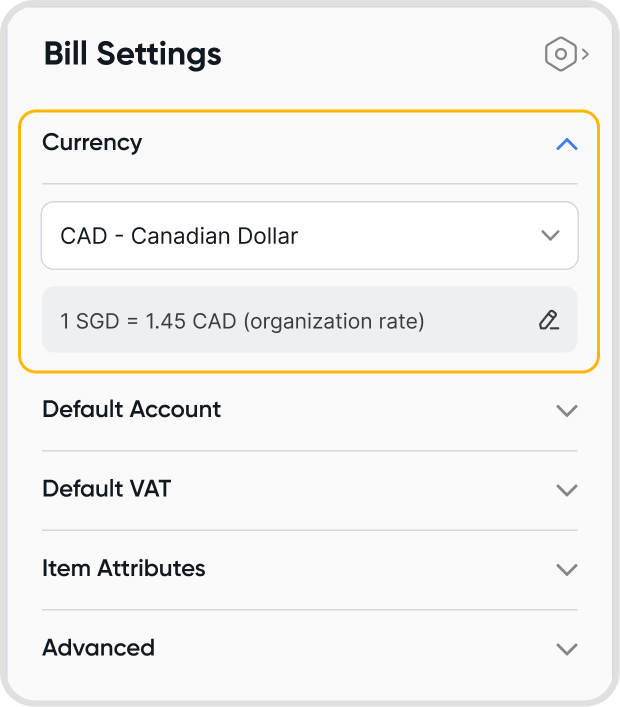

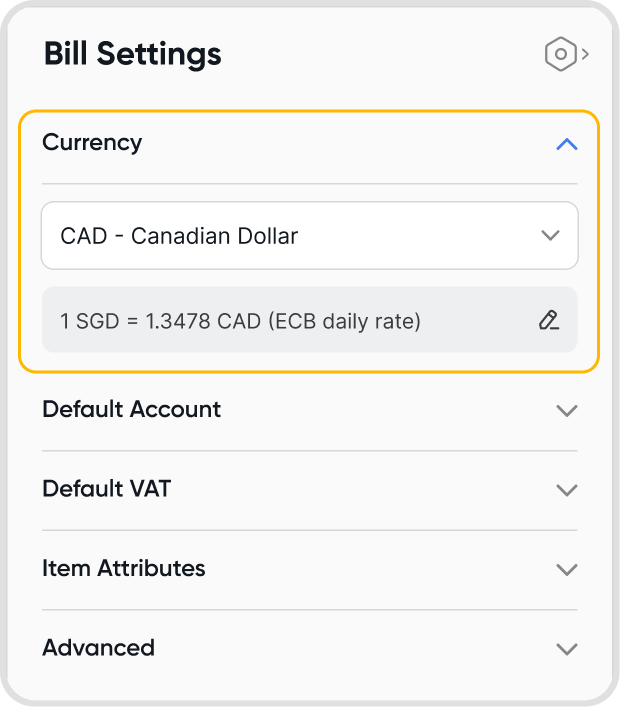

When choosing a currency under Bill Settings,

If an organization's custom exchange rate has been set for the currency & time range which the bill was created, Juan will make use of this exchange rate.

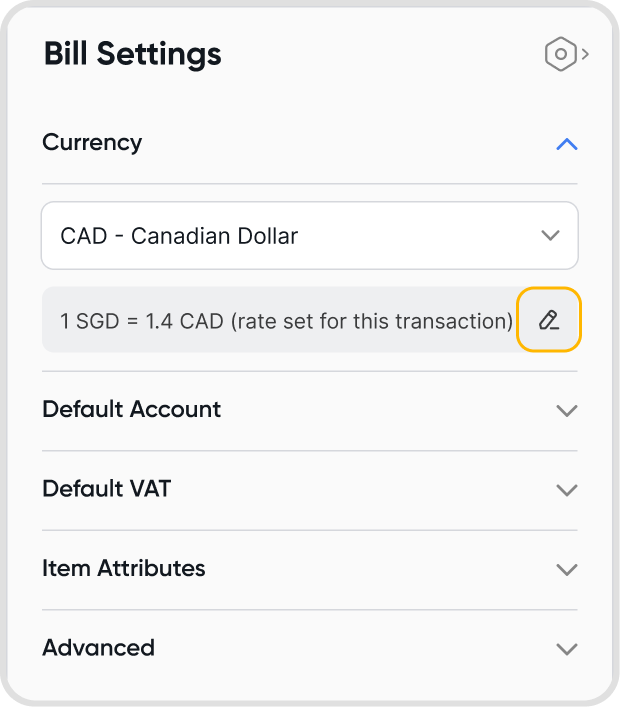

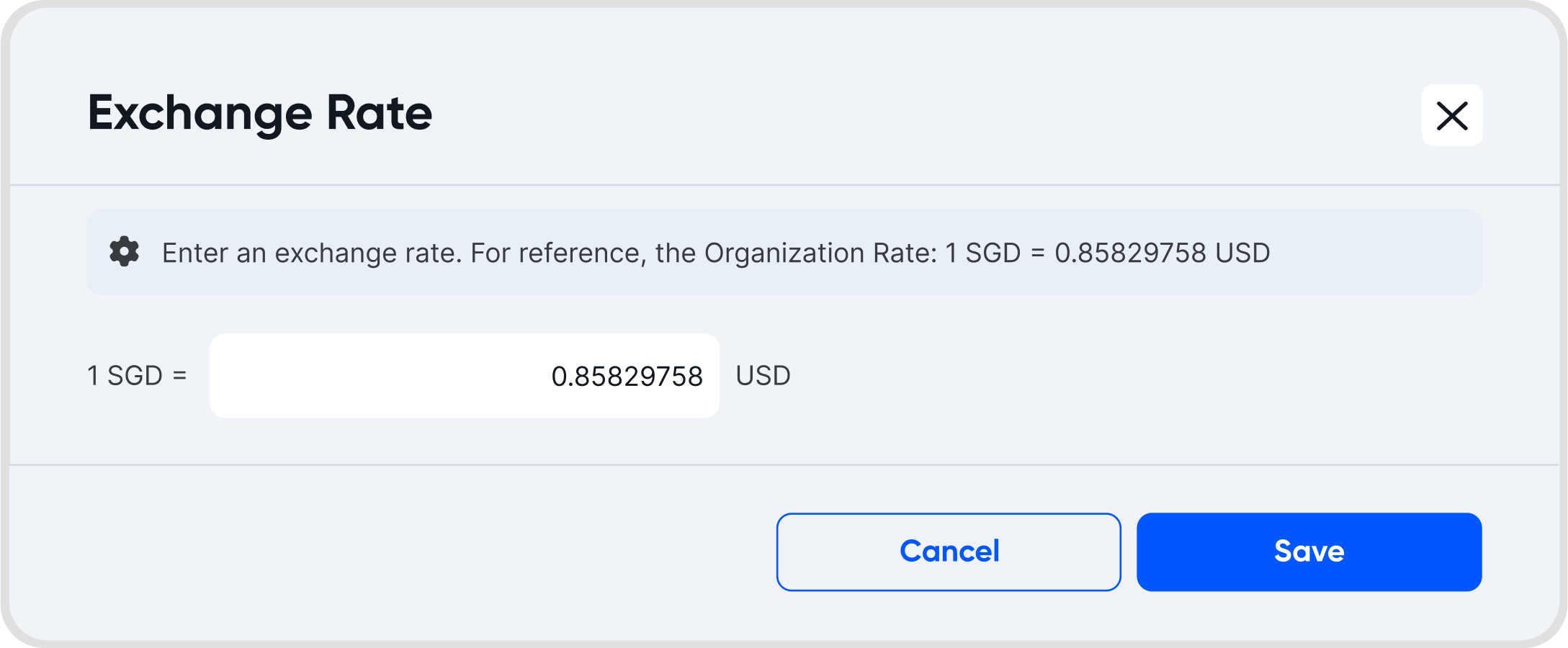

You can also set an exchange rate on a transaction level by clicking on the pencil icon to edit the exchange rates.

If not, Juan will use a third-party service to determine a mid-market exchange rate, and use that instead.

If a payment has been recorded as paid for the bill on the same date as the bill date (i.e. payment date = bill date), the transaction will be recorded on the ledger as a cash transaction.

The transaction will be recorded as a debit from the Cash on Hand account, and a credit into the account used on the bill.

Yes, each line item can have a different tax profile.

To apply the same tax profile to all line items in a bill, use the Bill Settings.

To apply the same tax profile across all bills, set the tax profile at the transaction level.