Yes, you can edit an invoice.

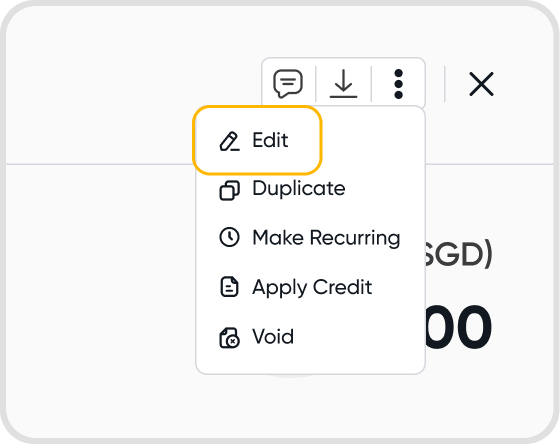

Choose the edit option from the 3-dot menu of the desired invoice details screen to edit.

Upon choosing edit, you will see an Edit Invoice page, where you can make changes to your invoice headers, line items, attachments, invoice notes or invoice settings.

Yes. Invoices will be automatically updated upon amendment.

Tip: Having issues where changes are not reflected on invoices? Do allow 2 minutes for the system to refresh before attempting to download them again.

Yes, an invoice's currency setting will not affect this.

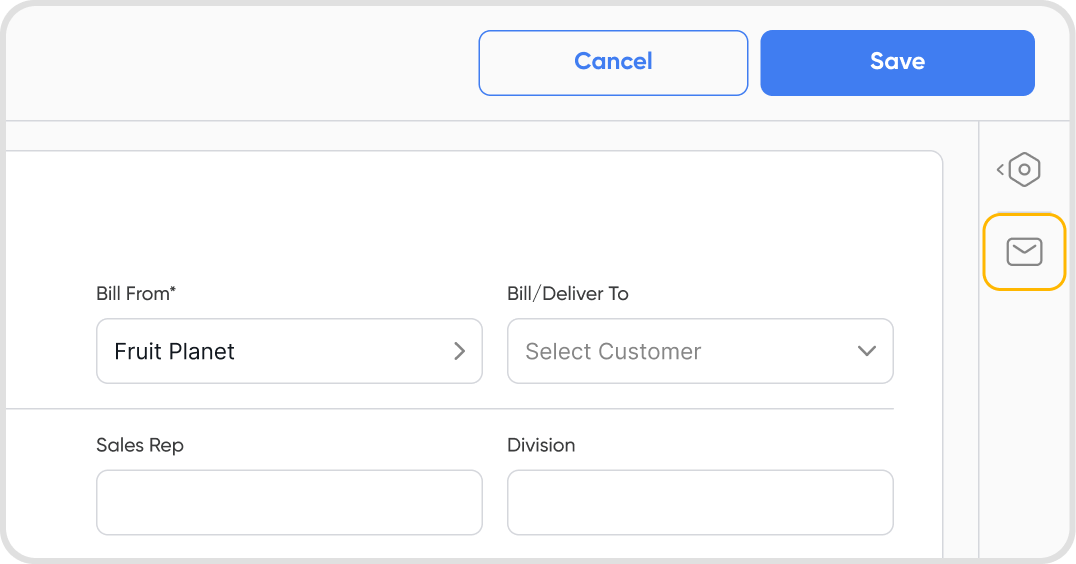

No, the recipient will not be automatically notified if you edit the invoice. You will have to enable sending the invoice by email again to re-notify the recipient.

No, there are no restrictions on the number of edits. You can edit an invoice as many times as you need to.

There are no restrictions on the fields that you can modify while editing an invoice.

If you edit any information on an invoice that will change the invoice amount, any associated invoice payments will be removed if they are not reconciled.

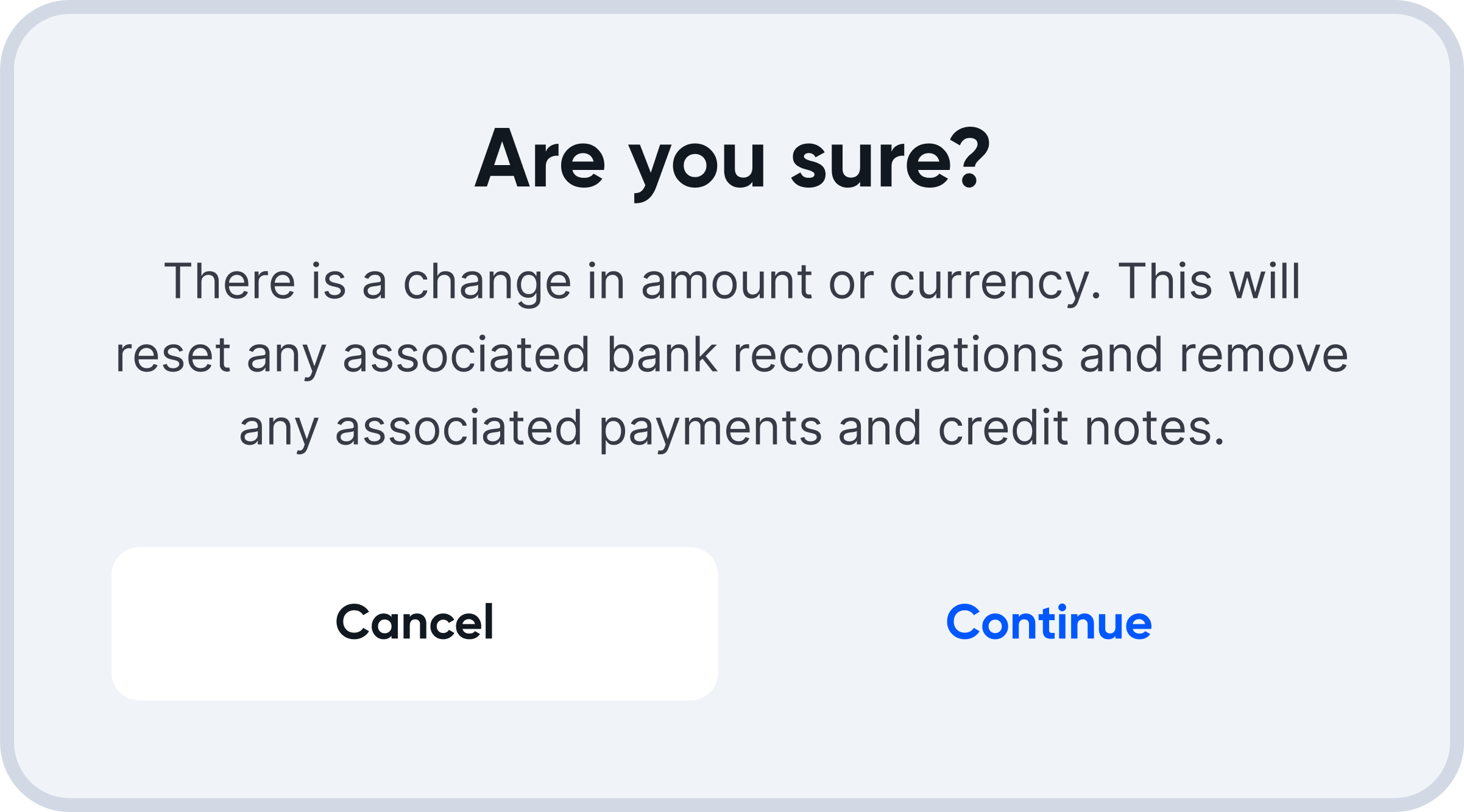

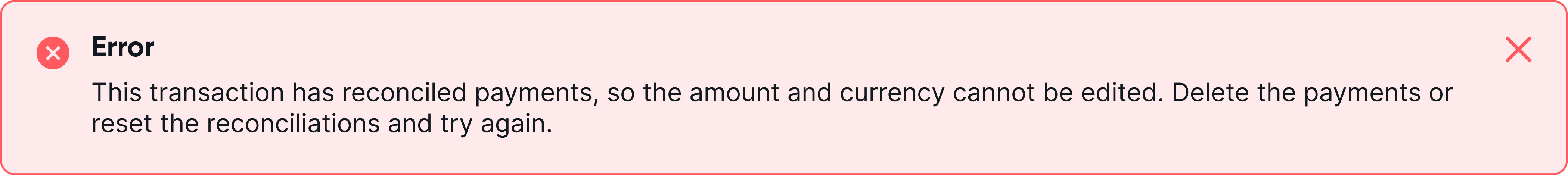

Juan will show you a warning if you attempt to update the invoice amount.

Note: If associated payments on an invoice have already been reconciled with statement lines, you will not be able to update the invoice amount. You will see an error message.

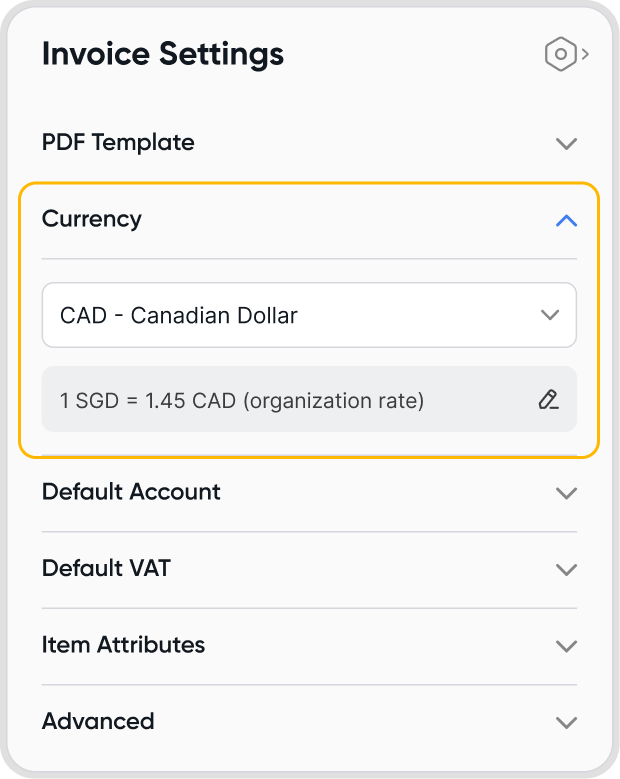

You can edit the exchange rate being used on an invoice even after creation.

You can edit the exchange rate via the invoice settings.

However, do note the following:

You cannot edit the exchange rate if the associated payments on the invoice have already been reconciled.

Editing the exchange rate will remove all associated payments and credit notes.

Editing the exchange rate is subject to account lock date restrictions, as described in Lock Dates (COA).

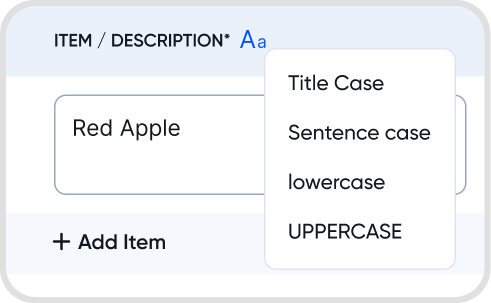

The Pretty Case feature allows you to easily format text fields within invoice transaction line items, ensuring consistency in text presentation according to your company's preferences.

Pretty Case offers four formatting styles:

Title Case: Capitalizes the first letter of each word (e.g., "Office Supplies").

Sentence Case: Capitalizes only the first letter of the first word (e.g., "Office supplies").

Lower Case: Converts all text to lowercase (e.g., "office supplies").

Upper Case: Converts all text to uppercase (e.g., "OFFICE SUPPLIES").

These options make it easy to standardize text formats across invoice item descriptions, unit fields, and other text-based fields.

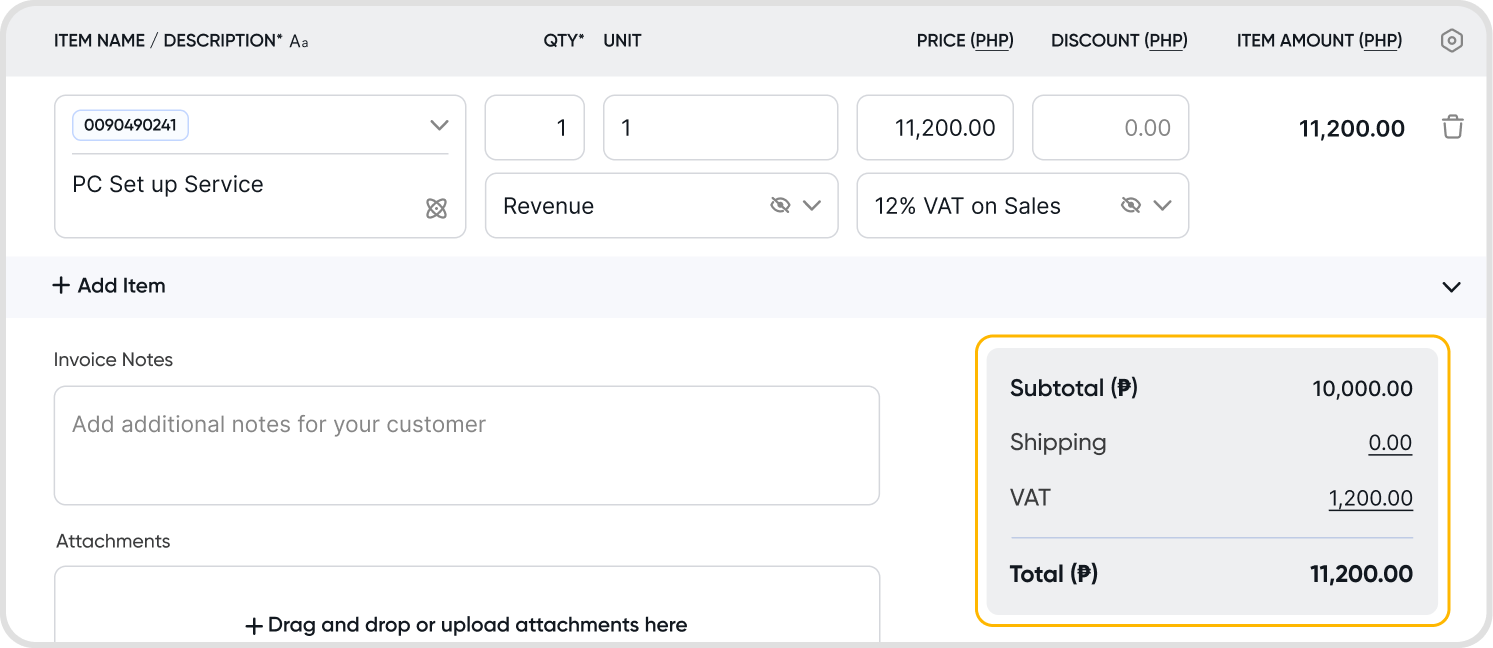

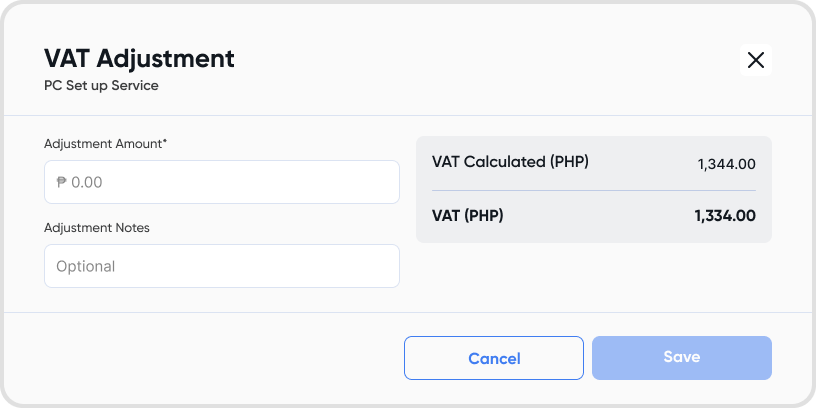

Click the GST/VAT amount in the totals section when editing an invoice transaction.

You can utilize GST/VAT adjustments for the following transactions:

Adjustments affect the GST/VAT total and transaction total. All amounts in reports are impacted but not recorded in the ledger.

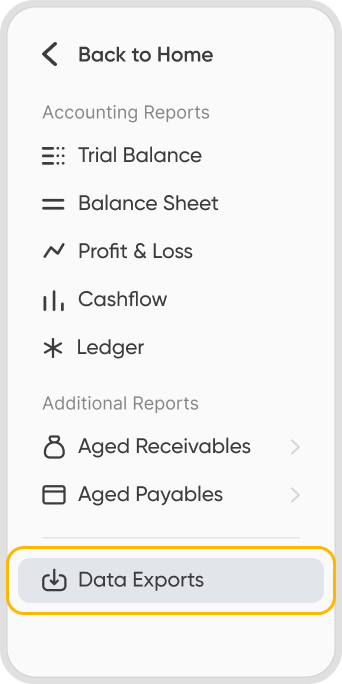

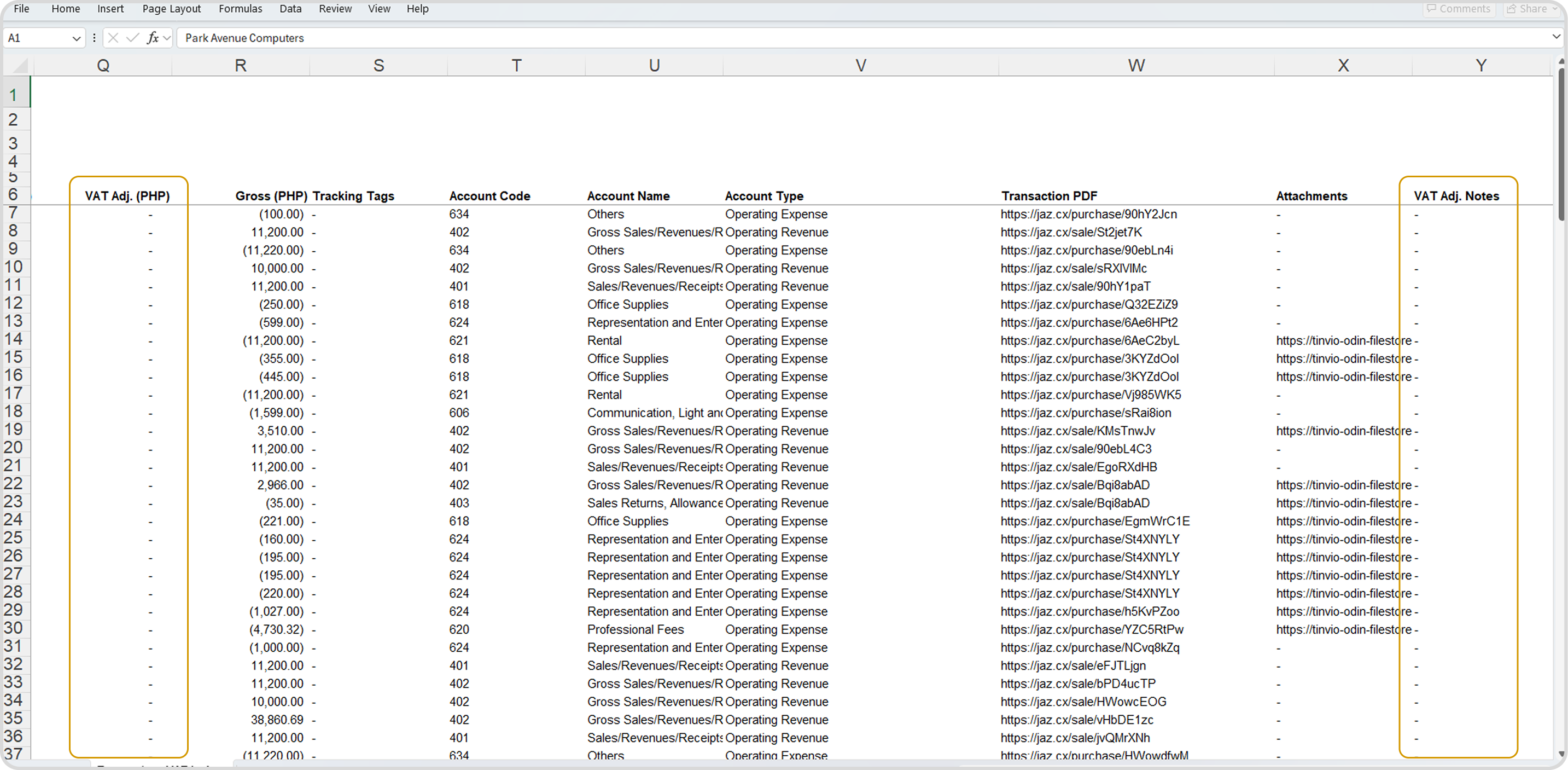

GST/VAT adjustments are shown in the "GST/VAT Adj. (Source)" and "GST/VAT Adj. (Notes)" columns in:

GST/VAT Ledger and related reports

Sales/Purchases Summary reports

Note: Adjustments are displayed in the item details column. No new adjustment columns are added to the Sales/Purchase Summary report.

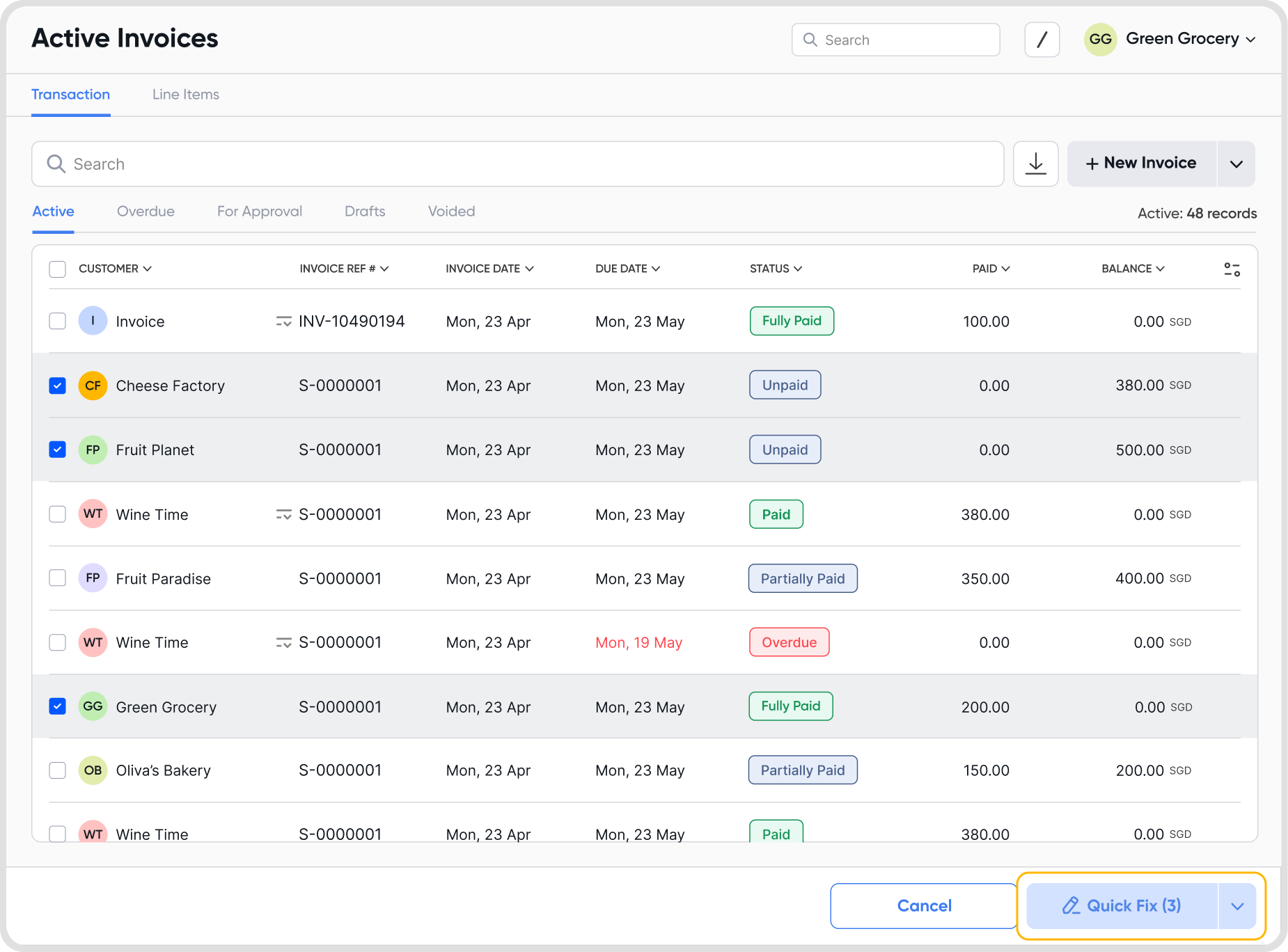

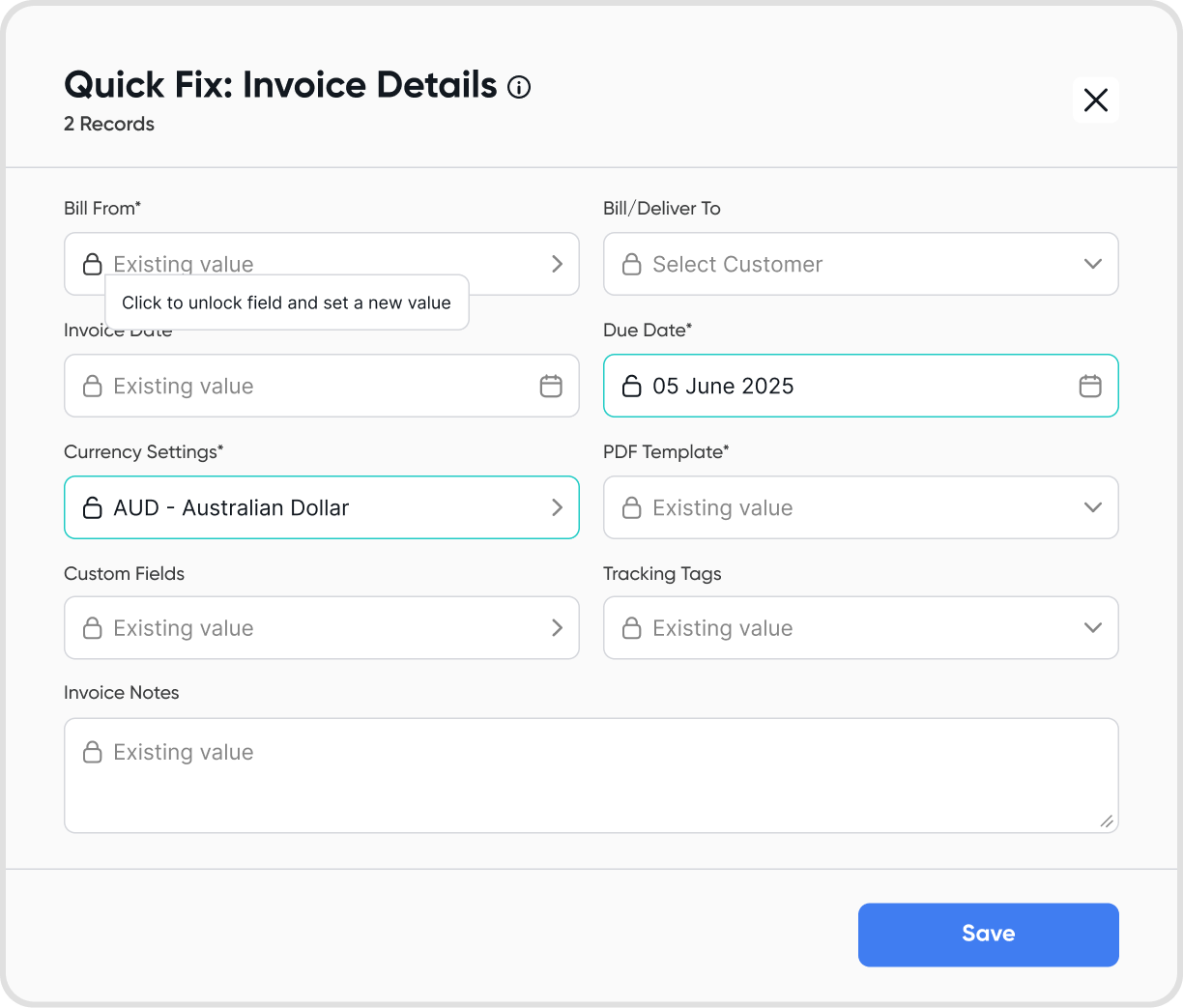

Yes, use Quick Fix to bulk update or edit invoices. It lets you edit multiple transactions or line items at once from the list view.

Select records in the list view, then choose Quick Fix from the bulk actions menu. You can update:

Contact

Bill From / Deliver To

Transaction & Due Dates

Currency

PDF Template

Tags

Custom Fields

Notes

Only unlocked fields are editable. Changes are highlighted before saving, and updates are processed only if changes were made. You'll get a success or error message after.

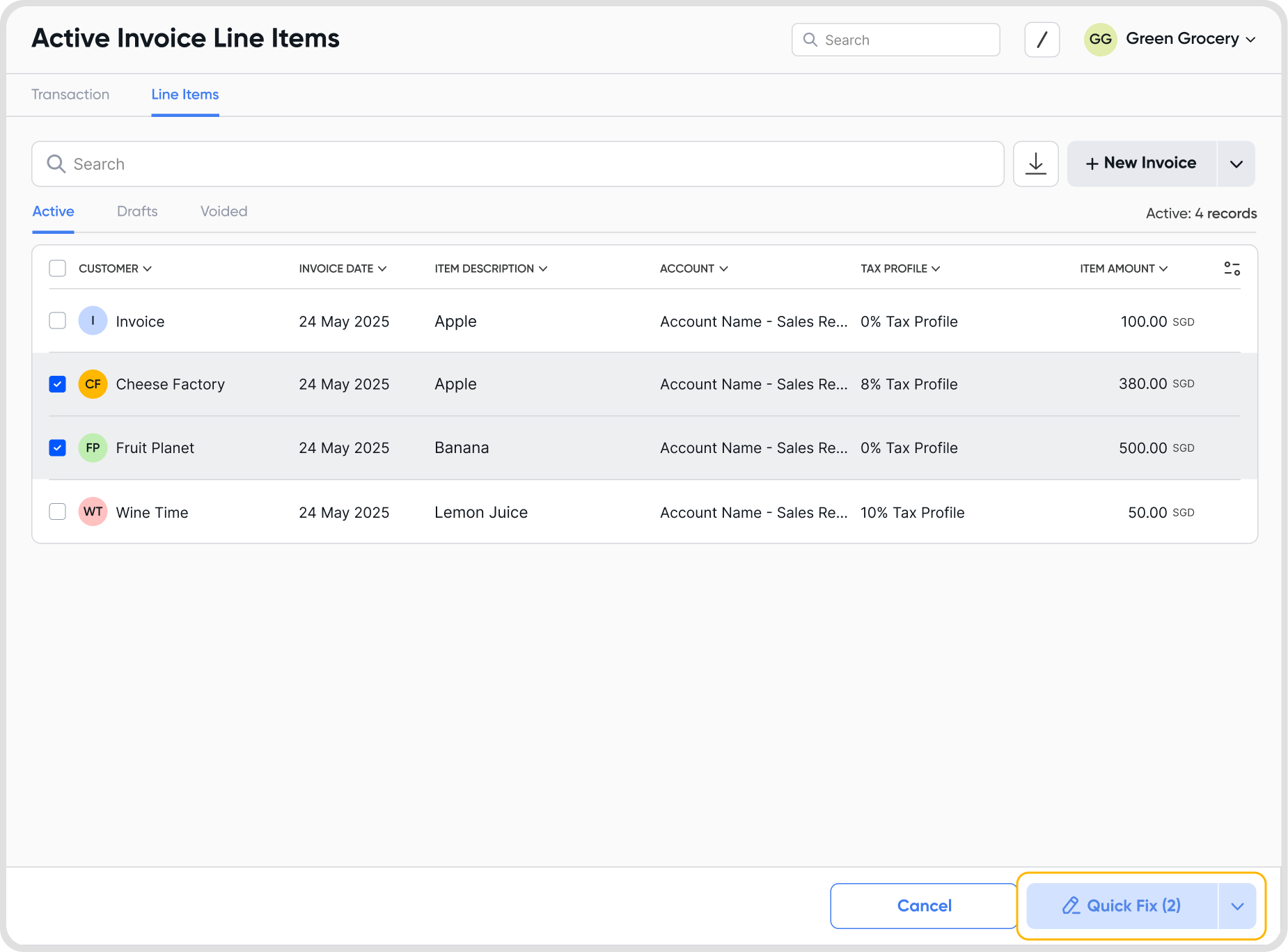

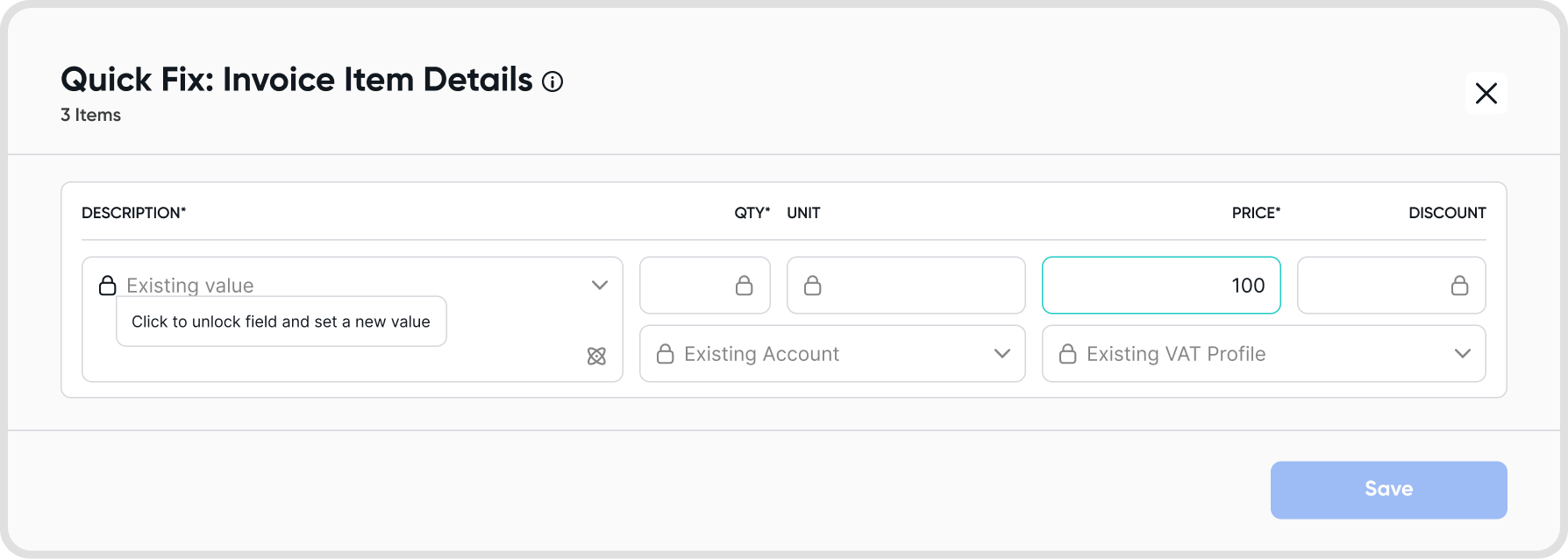

Yes, use Line Item Quick Fix to update multiple line items at once from the Active or Draft tabs in the Line Items list view.

Select multiple items, then click Quick Fix from the bulk actions menu. You can update:

Description (with classifier support)

Quantity, Unit, Price, Discount

Account

VAT/GST Profile

Smart locking ensures only unlocked fields are editable, reducing errors.