We’ve simplified the way to do your tax compliance in Juan with our integration to JuanTax Fast File.

Go to myfastfile.juan.tax

Login using the email address you are using in Juan Accounting

Input the OTP sent to your email

Create a tax organization in JuanTax Fast File

For easier management, it’s recommended to use the same organization name in Juan Accounting and Fast File.

Once you’ve created a tax organization in JuanTax Fast File, you are now ready to connect your Juan Accounting organization.

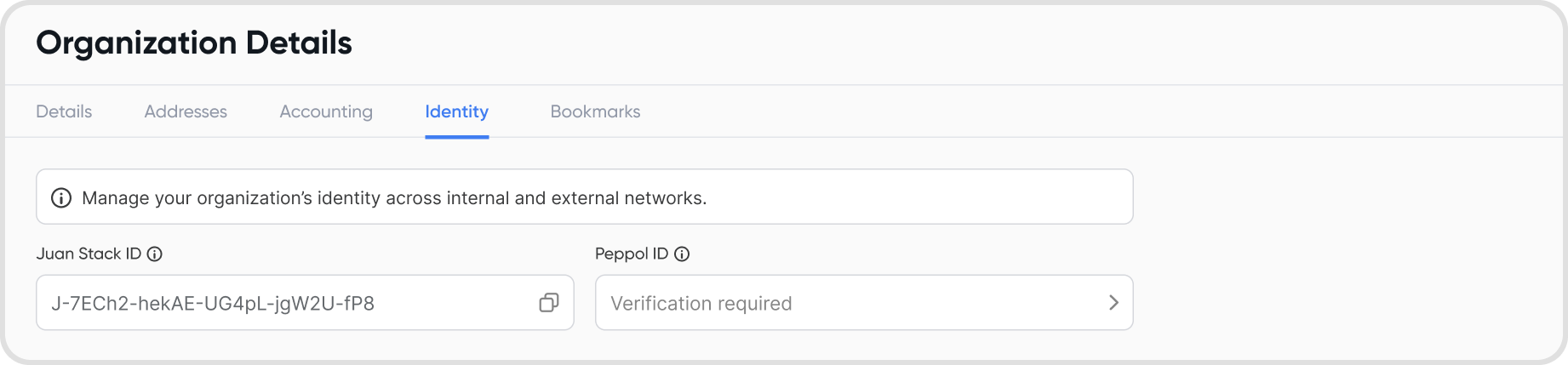

In your Juan Accounting organization, head over to Settings > Organization Details > Identity.

Copy the Juan Stack ID

Go back to JuanTax Fast File and click on “Connect to Juan Accounting”

Paste the Juan Stack ID and click Connect

Here’s a full video showing how it works:

Yes, the data in Fast File is updated automatically in real-time. To ensure the latest data from Juan Accounting appears on your tax form, simply open the specific tax form in Fast File and click the Refresh button to sync the most recent information.

Here’s a full video showing how it works:

Yes, you can edit transactions directly in Juan Accounting.

If you’re using Fast File, simply click on the transaction line to be redirected to the corresponding transaction in Juan Accounting. This feature works only if you are logged into the same organization on both platforms. For example, if you’re accessing Organization A in Fast File but Organization B in Juan Accounting, you will encounter an error. Make sure you are logged into the same organization on both sides.

Here’s a quick video for reference:

If the organization you are accessing in Fast File is synced to a Juan Accounting organization that is under a paid plan, there are no additional payments. This is already part of your subscription.

If the organization you are accessing in Fast File is not synced, the regular rate of ₱120 per generation form applies.

This gives you the flexibility to have manage tax compliance for different organizations, synced to Juan Accounting or not.

Yes, to disconnect follow these steps:

Choose a tax organization in JuanTax Fast File

Click “Connected to Juan Accounting”

Click “Disconnect Organization”

When you disconnect an organization, all pulled transactions from Juan Accounting software will disappear.

The “Juan Synced” status will disappear from the dashboard.

Previously recorded details in tax forms will not be affected.

The following tax forms can pull data from Juan Accounting Software

0619E

0619F

1601EQ

1601FQ

1701Q

1702Q

2550Q

2551Q

SLSP

QAP

Transactions pulled into your tax forms in Fast File depend on the data recorded in Juan Accounting. For instance, if you generate a form in Fast File for February but no transactions are recorded in Juan for that month, no data will appear in Fast File.

To ensure accurate results:

Verify that the period of your tax form aligns with data recorded in Juan Accounting. For example, generating a tax form for February 2025 requires having transactions for that month in Juan.

Ensure that transactions in Juan have accurate dates and all required details. For example, if you're filing a withholding tax form but no withholding transactions are recorded in Juan, no data will be pulled into the form.