Deposits are available under both the Sales and Purchases modules

It allows you to manage:

Customer Deposits (liabilities)

Supplier Deposits (assets)

This makes it easier to track advance payments, top-ups, and drawdowns.

By clearly separating deposit balances and integrating them into payments and invoice workflows, the module ensures accurate liability and asset reporting.

It reduces manual tracking, improves audit trails, and provides better control over prepayments and credit usage.

Here are some common scenarios where Deposits is useful:

Prepayments

Payments made before goods or services are received.

Examples

Tour deposits, prepaid medical procedures, software credit top-ups.

Security Deposits

Funds held to cover potential future obligations or damages.

Examples

Rental deposits, event space bookings, equipment rentals.

Retainers

Prepaid fees to retain services over time (common in professional services).

Examples

Legal retainer, freelance project retainers

Deferred Revenue

Money received for services not yet rendered.

Examples

Annual subscription paid upfront, booking fees, class packages.

Top-Ups / Recharges

Adding funds to a balance account (like digital wallets or service credits).

Examples

Wallet credits, prepaid internet.

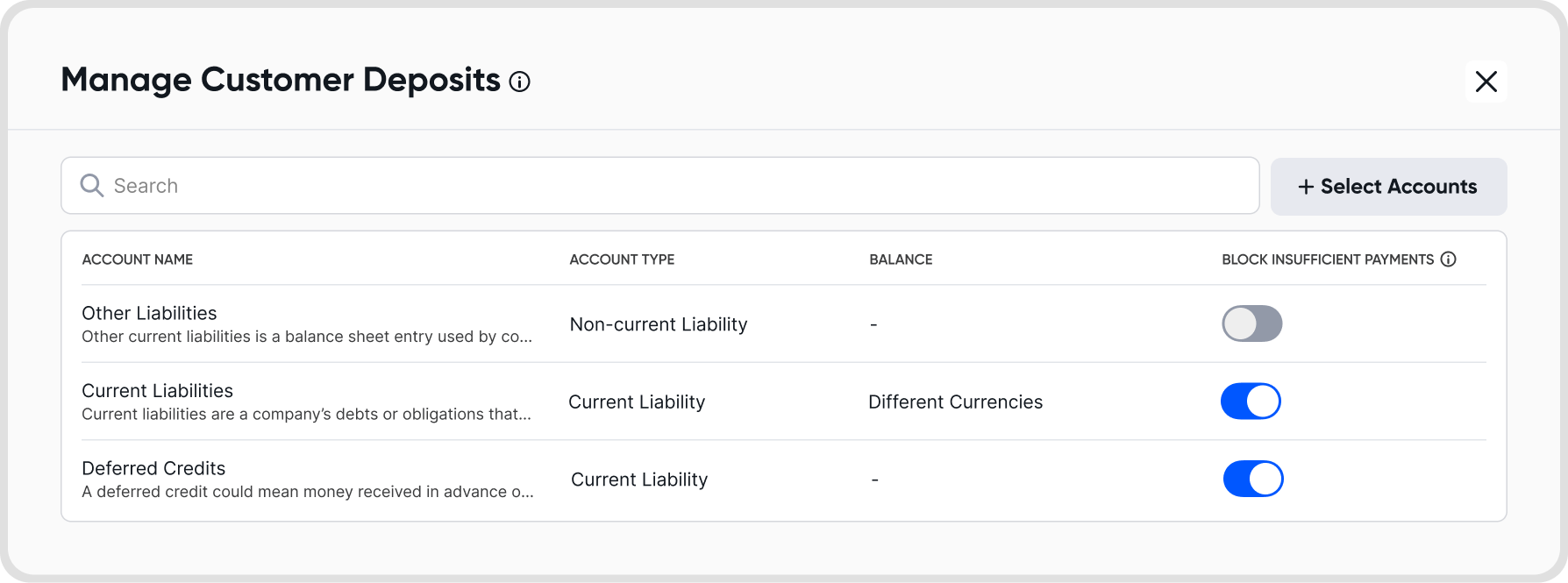

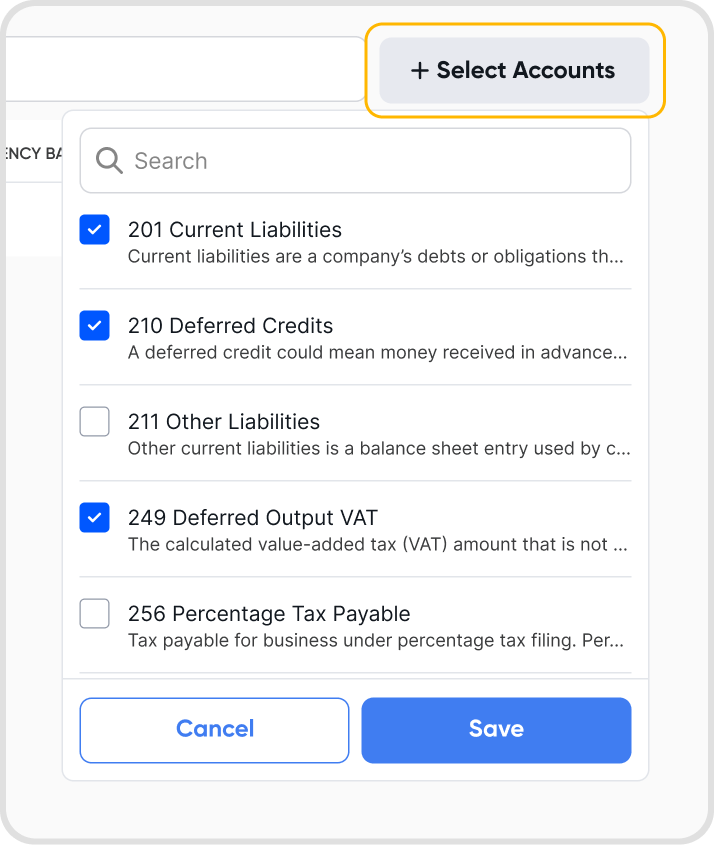

You can add and manage deposit accounts through the Manage Deposits settings.

This lets you define which account to use when tracking deposits for specific contacts. Simply go to Sales/Purchases > Manage Deposits to set up the appropriate accounts.

Enabling the Block Insufficient Payments setting prevents invoice or bill payments if the customer’s/supplier’s available deposit balance is insufficient for a transaction.

This ensures financial accuracy and protects against overdrawn balances.

The Balances tab shows a summary of all contacts with deposit activity

You can filter using these sub-tabs

All: All contacts with deposit records

Balance Available: Contacts with remaining balances

Fully Drawn: Contacts whose deposits have been fully used or are overdrawn

Deposit Transactions tab lists all deposit-related activity

You can filter using these sub-tabs

All: All deposit transactions

Deposits: Top-ups, such as cash-ins or invoice-linked/bill-linked deposits

Drawdowns: Usage of deposits, like payments applied to invoices or bills

Yes. The Deposits module supports multi-currency deposits, and all balances and transactions will reflect the relevant currency.

This is especially useful for businesses dealing with international customers or suppliers.

If you recorded an error in the deposit you can reverse it by voiding the related journals/transactions, or reverse it by creating journal entries reversing the error.

Record a drawdown transaction for the refund.

Optionally issue a credit note or a refund payment, depending on your workflow.