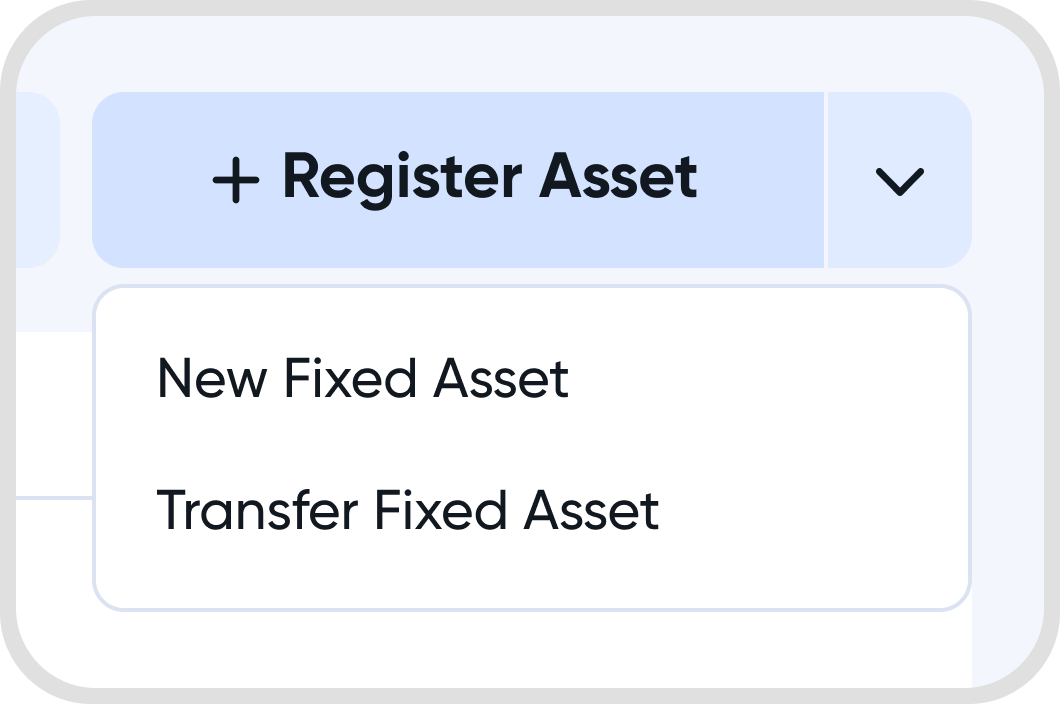

In Juan, there are two main ways of registering a fixed asset:

Adding a new fixed asset, that you have not registered elsewhere.

Transferring a new fixed asset, that you may have previously registered elsewhere and started depreciating.

Currently, only the Straight Line method is available in Juan.

Depreciation will take place in a linear fashion, with a depreciation expense being recorded every month.

Depreciation expenses are spread on a monthly basis, meaning that assets that are disposed of part way into a month will still see a full month's worth of depreciation.

You can also register fixed assets without depreciating them (Select No Depreciation under Depreciation Methods).

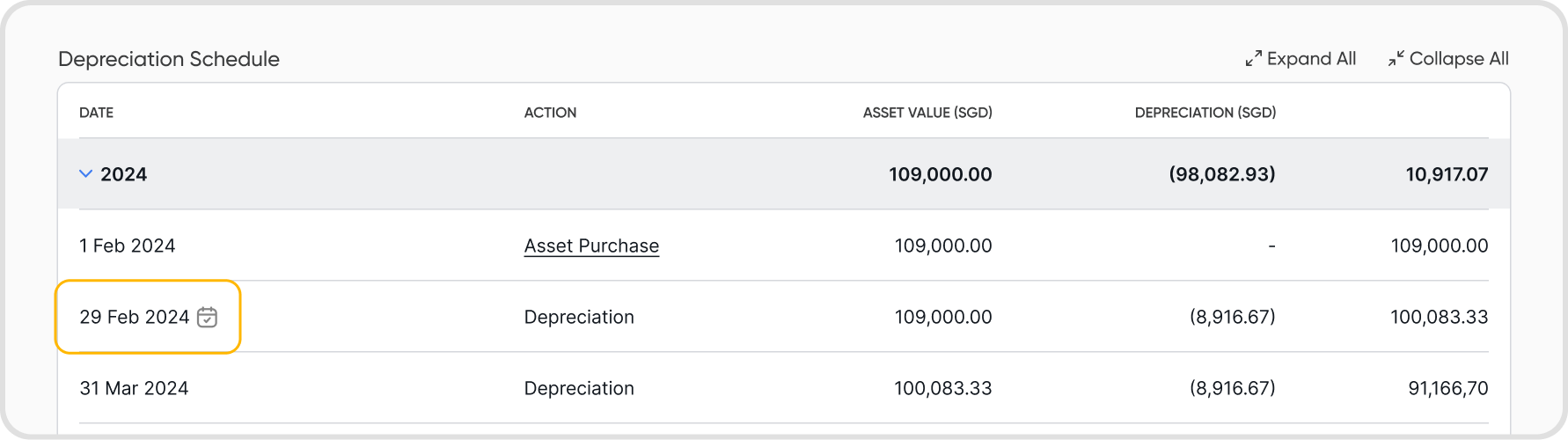

Currently, all depreciation entries will automatically be realized on the last day of every calendar month.

The most recent entry that was realized will be marked with a calendar icon on the depreciation schedule.

Currently, you may not change the date when expenses are realized.

For the Accumulated Depreciation Account for a fixed asset, you can only select accounts with the account type Fixed Asset.

For the Depreciation Expense Account for a fixed asset, you can only select accounts with the account type Expense.

There may be a lock date set on the account, that is after the date of the first scheduled depreciation expense entry.

For more information on how lock dates work and affect fixed assets, refer to Lock Dates (COA).

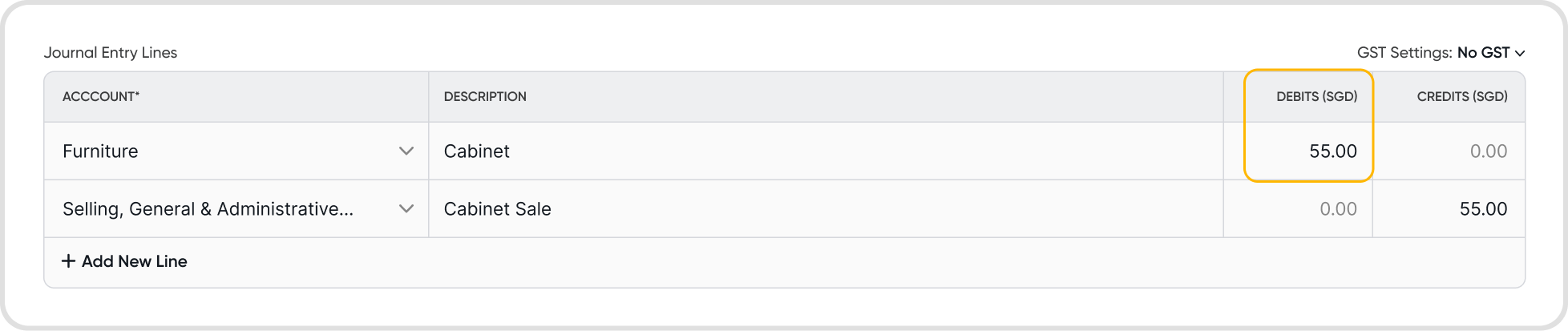

A purchase entry for a fixed asset on Juan refers to the business transaction recorded when buying a new fixed asset.

This can be created as:

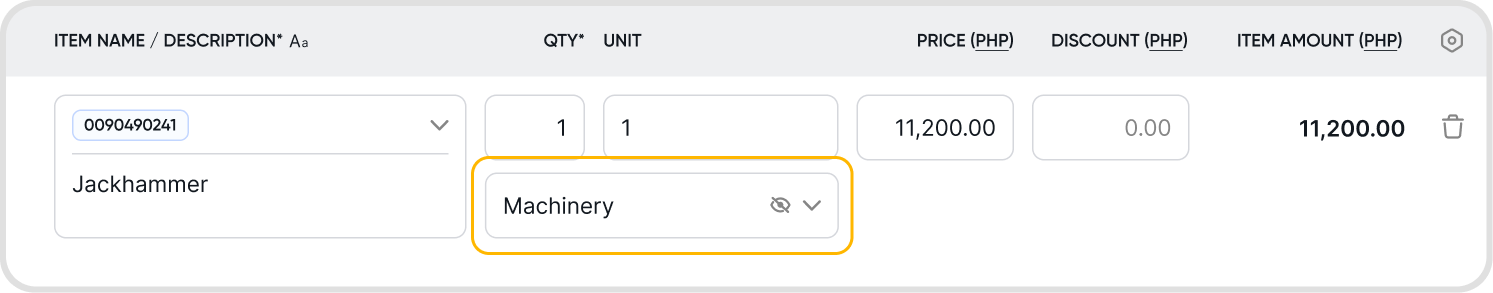

A bill, where one of the line items is a fixed asset being purchased, or

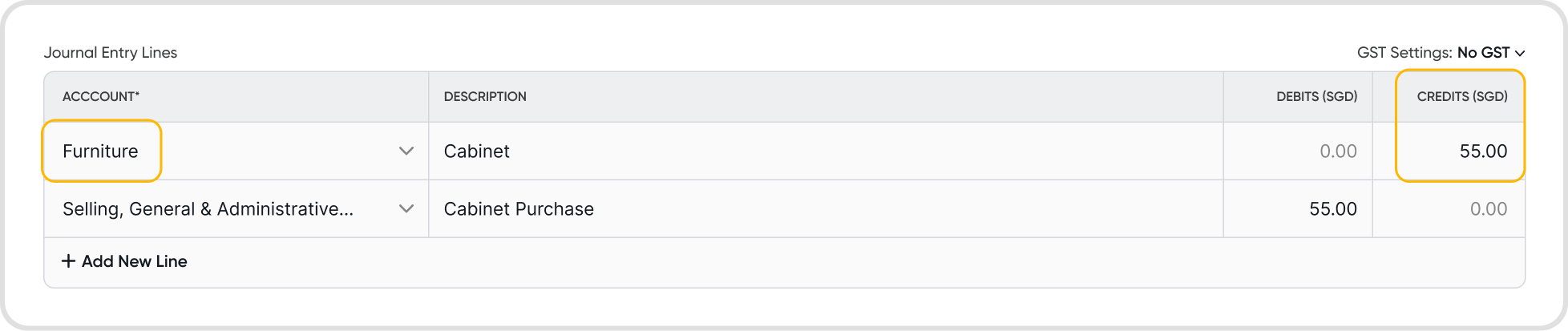

A journal entry, where the account for the debit entry has a Fixed Asset account type.

No, all newly created (not transferred) assets must have an associated purchase entry.

As such, you must create the purchase entry for the fixed asset before creating the fixed asset.

Note that once a purchase entry (bill line item or debit line on a journal entry) has been linked to a fixed asset, it cannot be linked to other new fixed assets.

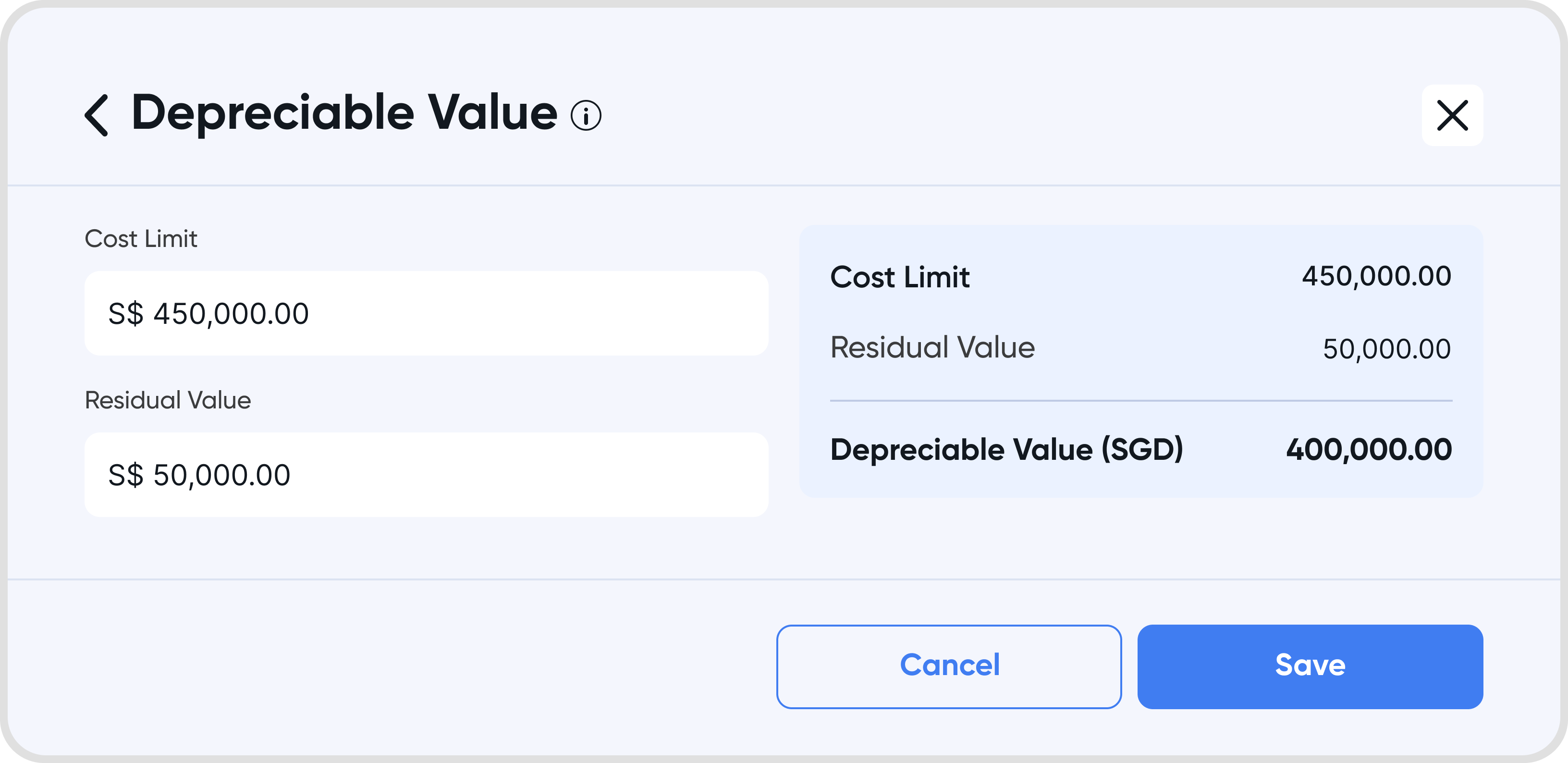

In Juan, Depreciable Value refers to the total depreciation expense that will be accumulated for a fixed asset over its useful life.

This is calculated in the following manner:

Depreciable value = Purchase Value - Residual Value

If a Cost Limit is set for the asset, this value will be used instead of the purchase value.

The Cost Limit is the maximum depreciable value for a fixed asset.

If set, this value must be less than the Purchase Value of a fixed asset.

If you do not want to account for or record the entire fixed asset expense for depreciation, you can set this value when adjusting the Depreciable Value of an asset.

Assets in the Active tab are all assets in your fixed asset register, regardless of whether they undergo any depreciation.

Assets in the In-Progress tab are assets that are still undergoing depreciation.

Assets in the Complete tab are assets that have completely depreciated.

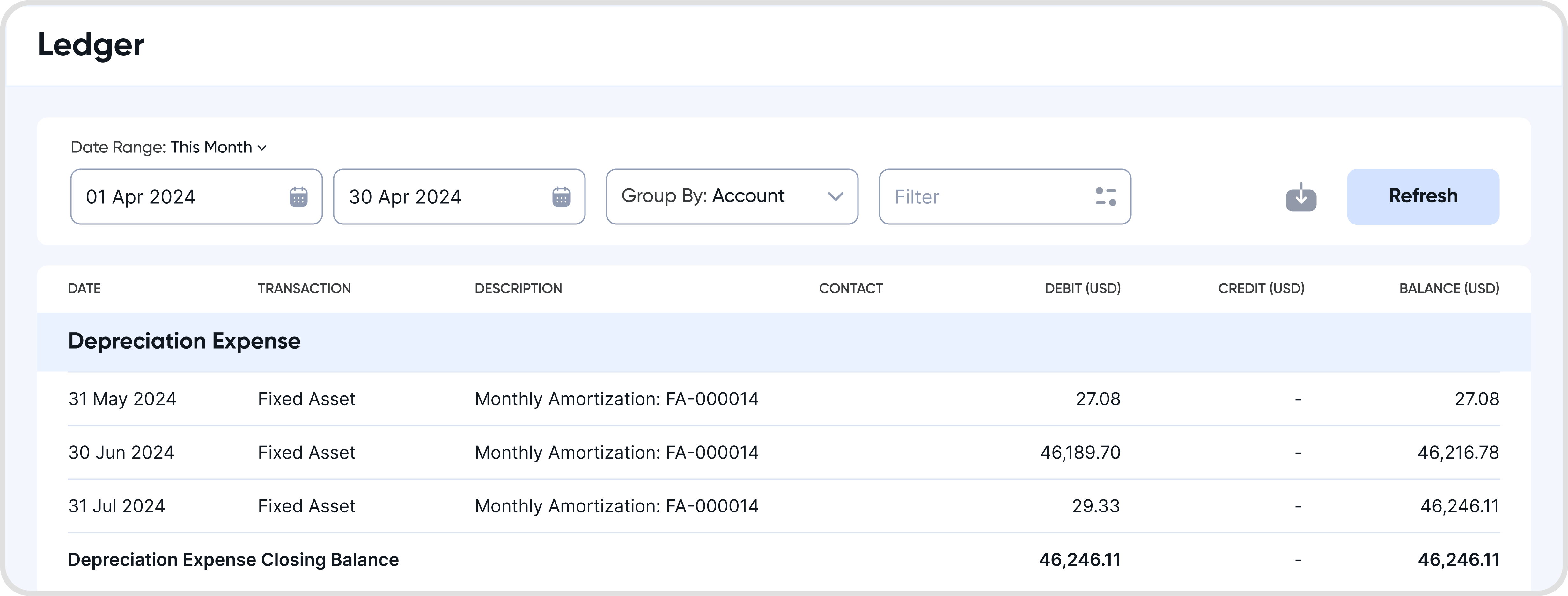

The records will show up as records in your General Ledger, under Depreciation Expense Account that you have selected.

No, Juan will only record new depreciation entries, starting from the date of transfer.

A sale entry for a fixed asset on Juan refers to the business transaction recorded when selling a fixed asset.

This can be created as:

An invoice, where one of the line items is a fixed asset being sold, or

A journal entry, where the account for the credit entry has a Fixed Asset account type.

No, all fixed asset sales must be linked to an existing sale entry.

As such, a sale entry for the asset sale must be created before marking an asset as sold.

Do note that once a sale entry (invoice line item or credit line on a journal entry) has been linked to a fixed asset sale, it cannot be linked to other fixed asset sales.

If your sale entry is an invoice, the line item for the asset that is sold must have the same fixed asset account as the fixed asset being marked as sold.

If your sale entry is a journal entry, the account that you select in the credit journal entry must be the same fixed asset account as the asset account of the asset being marked as sold.

When you dispose of a fixed asset while it is still undergoing depreciation, the following happens:

A final depreciation expense will be recorded on general ledger, on the depreciation end date that you have selected.

If you sold the asset, the record relating to the sale entry will show up in the general ledger as well.

When editing an asset, associated ledger entries (such as the ones to the fixed asset and depreciation expense account) will get recreated.

When deleting an asset, all associated general ledger entries will be deleted.

The recreation/deletion of ledger entries are still subject to the lock dates of associated fixed asset/expense accounts. For more information on lock dates, please refer to Lock Dates (COA).

In Juan, deleting a disposal is treated as deleting a disposed fixed asset. As such, all associated ledger entries will be deleted, including previously recorded depreciation entries, as well as the ledger entry relating to the disposal.

When undoing a disposal, the fixed asset will be returned to the register. The associated disposal ledger will be reversed, and depreciation entries that were previously reversed will be recorded again.

If the asset you are modifying makes use of an account with a lock date, you may not be able to modify or dispose of the asset.

Refer to Lock Dates (COA) for more information on how accounts with lock dates affect your fixed assets.

Make sure that you have permissions for activities relating to fixed assets - either Preparer or Admin permissions.

For more information on user permissions, see User Management.

Only users that have Preparer or Admin permissions for fixed assets can create or save draft fixed assets.

Only Admins can convert draft fixed assets to active fixed asset.