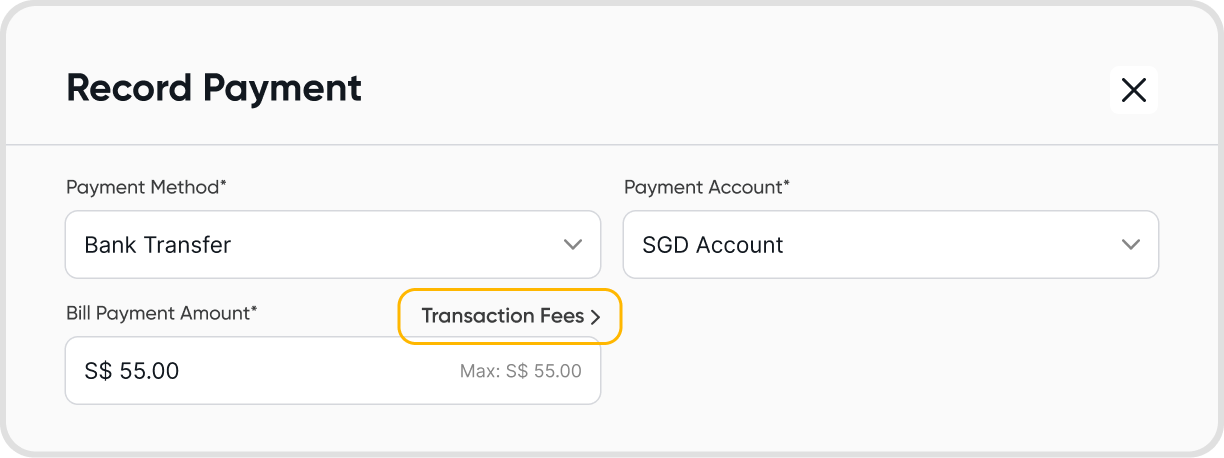

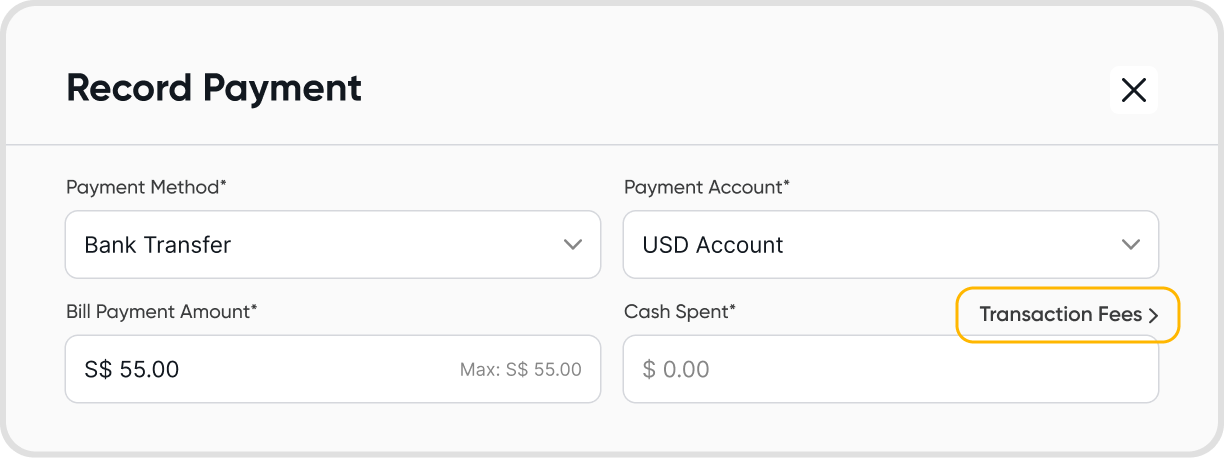

Yes, you can. When recording a payment for a bill, you will find an option to add transaction fees.

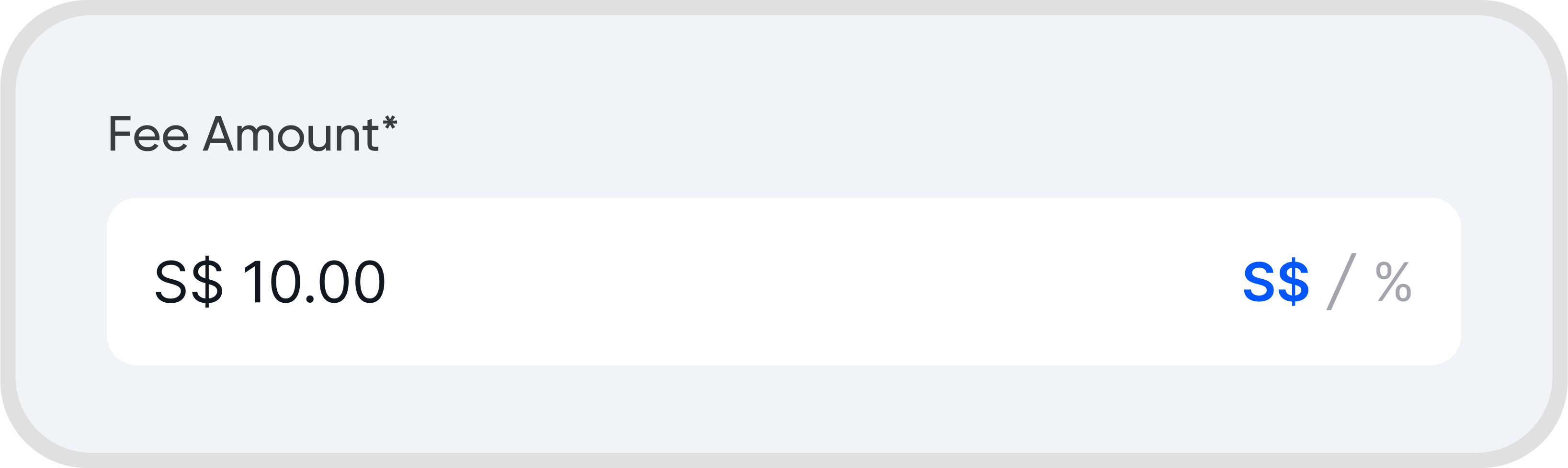

You can record transaction fees in absolute amounts or as a percentage of the cash spent.

The transaction fee option might be useful in some scenarios such as:

Your payment provider charges you a fee when you make a payment to your suppliers.

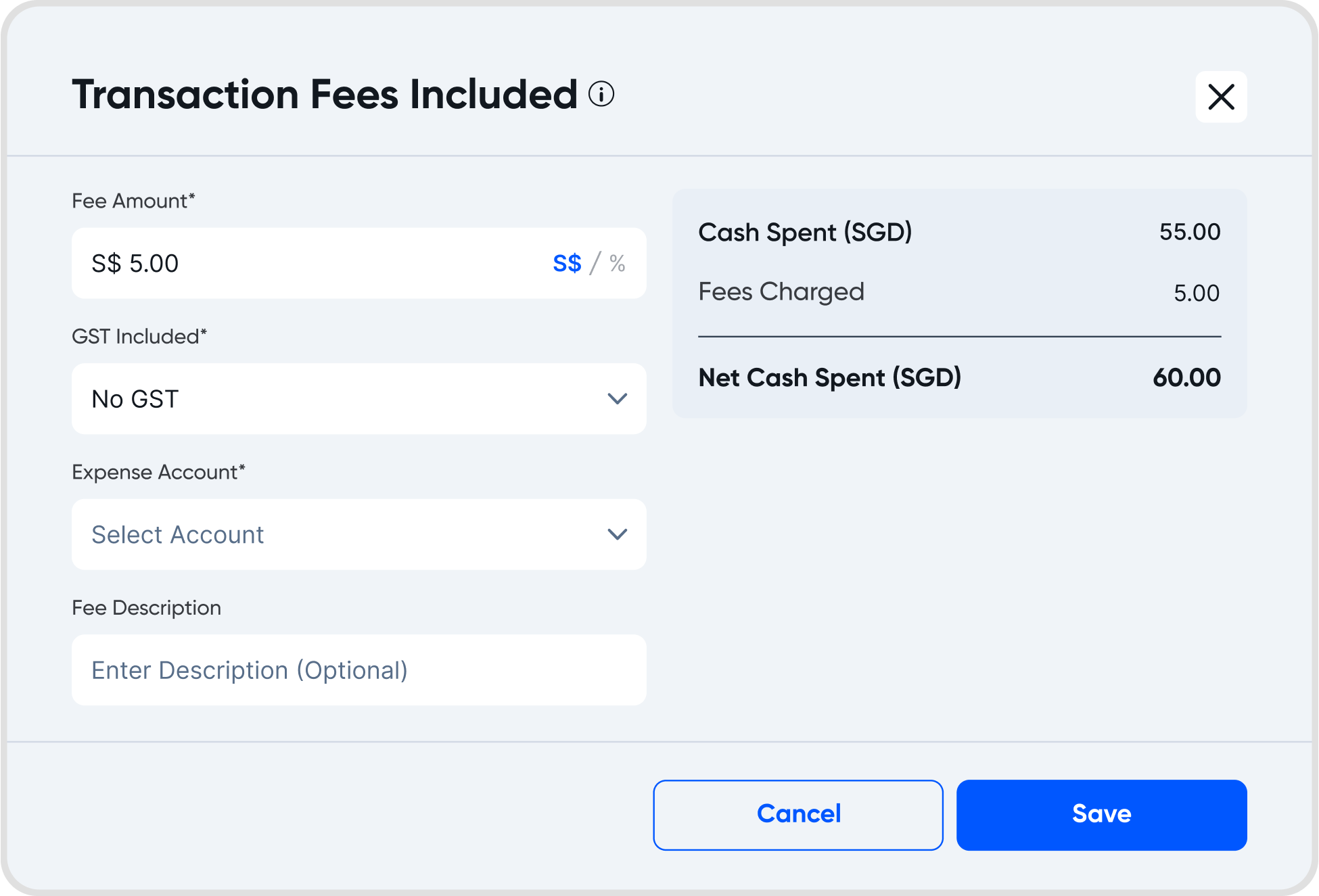

When you record a transaction fee for a bill payment, the transaction fee charged is added to the amount under Cash Spent.

The Net Cash Spent reflects the actual spent amount, including fees.

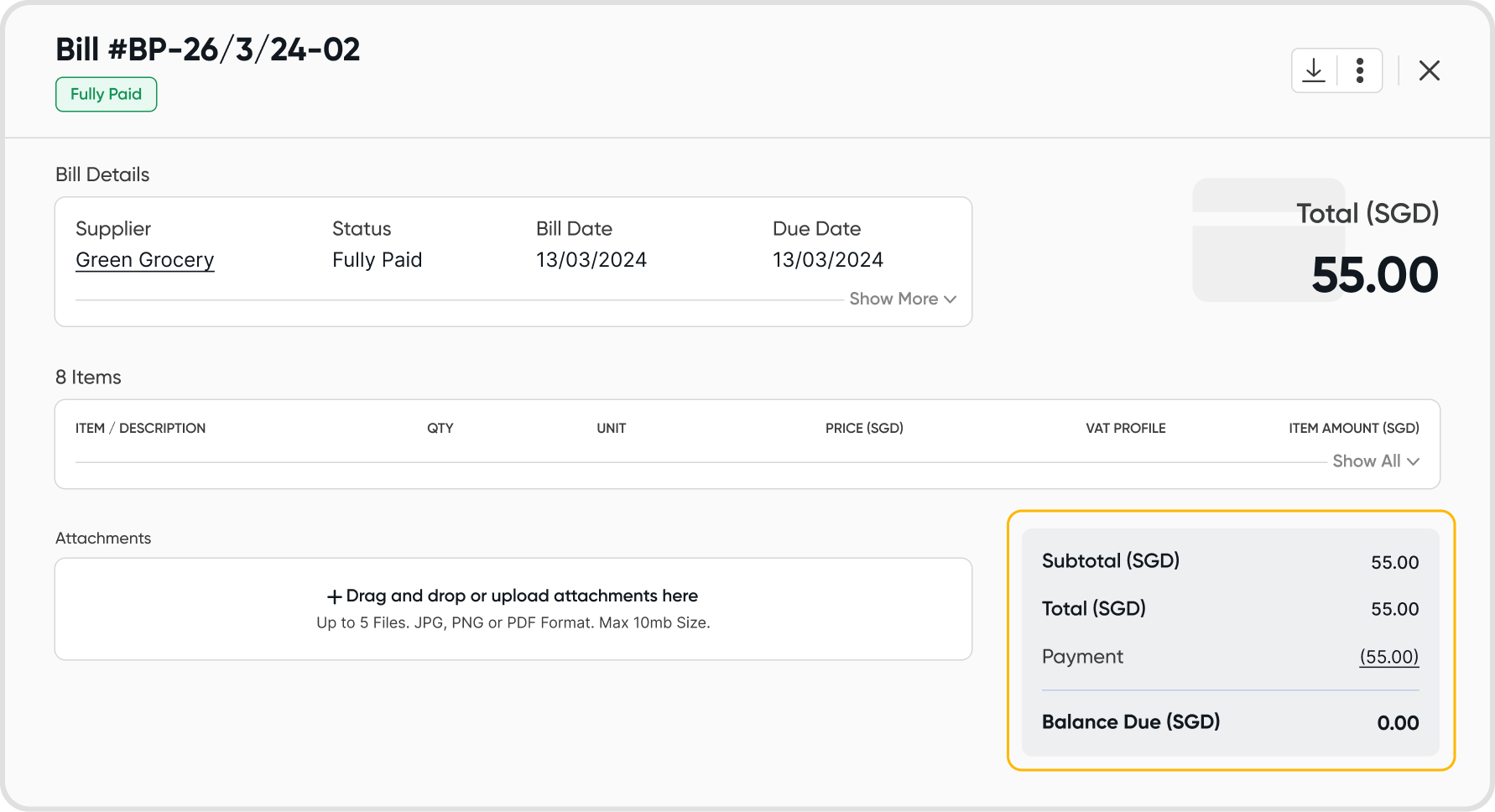

On the bill details, the payment amount shown in the bill total summary will reflect the Gross Cash Spent or the cash spent before fees.

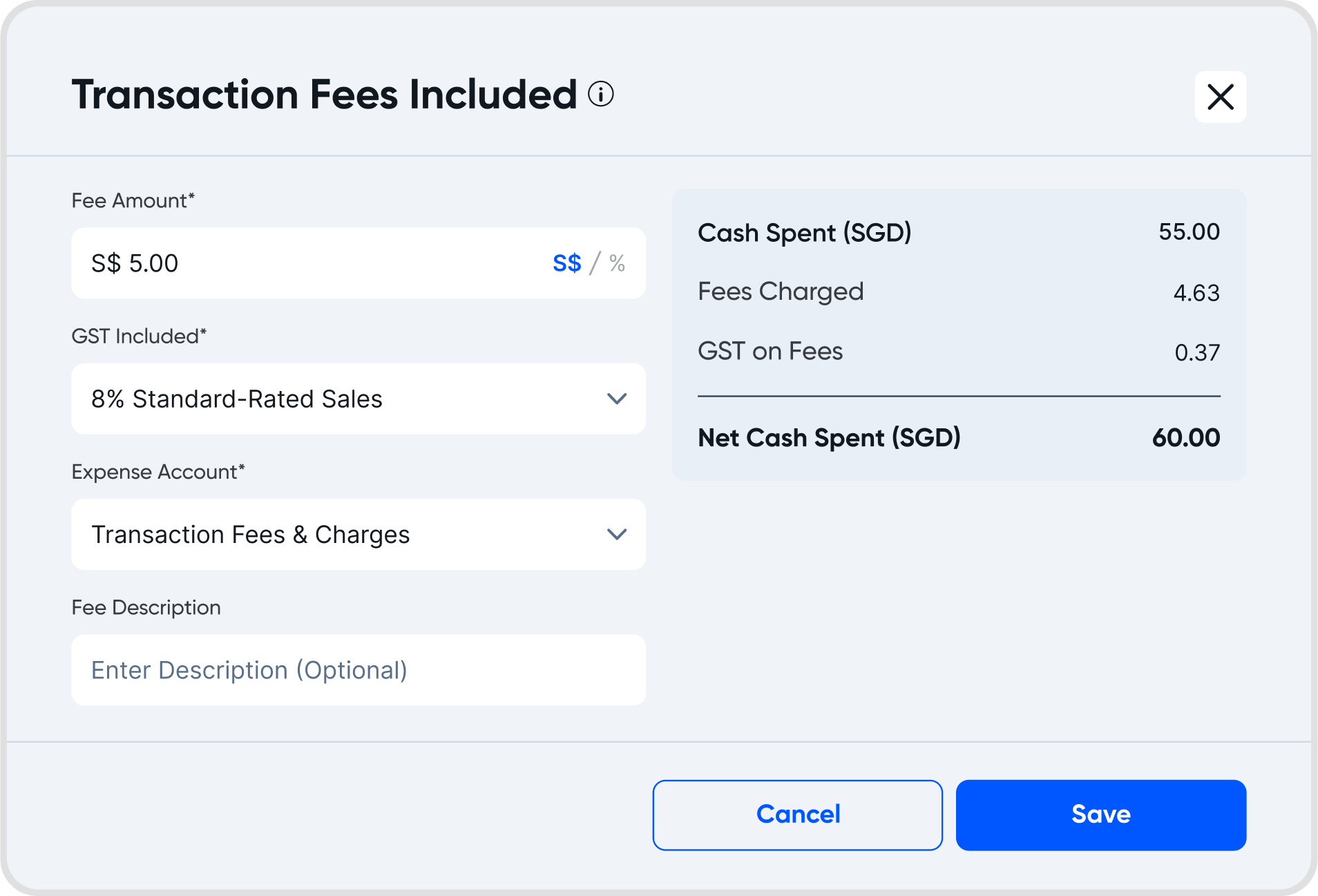

You can include VAT on fees easily by selecting a profile.

The summary will reflect a breakdown of the fees charged, showing the actual fees charged and the VAT on fees.

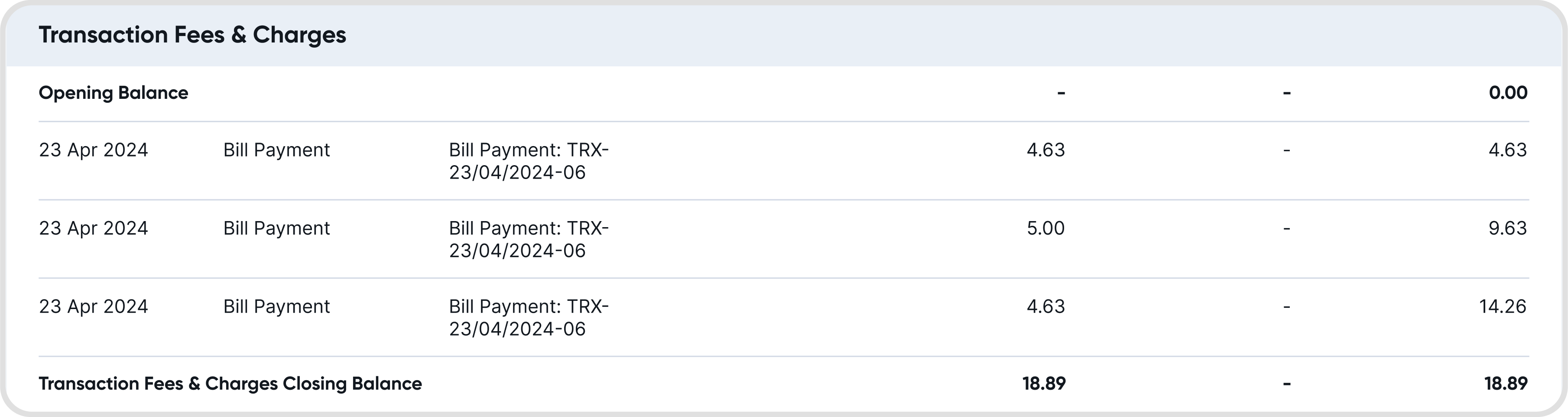

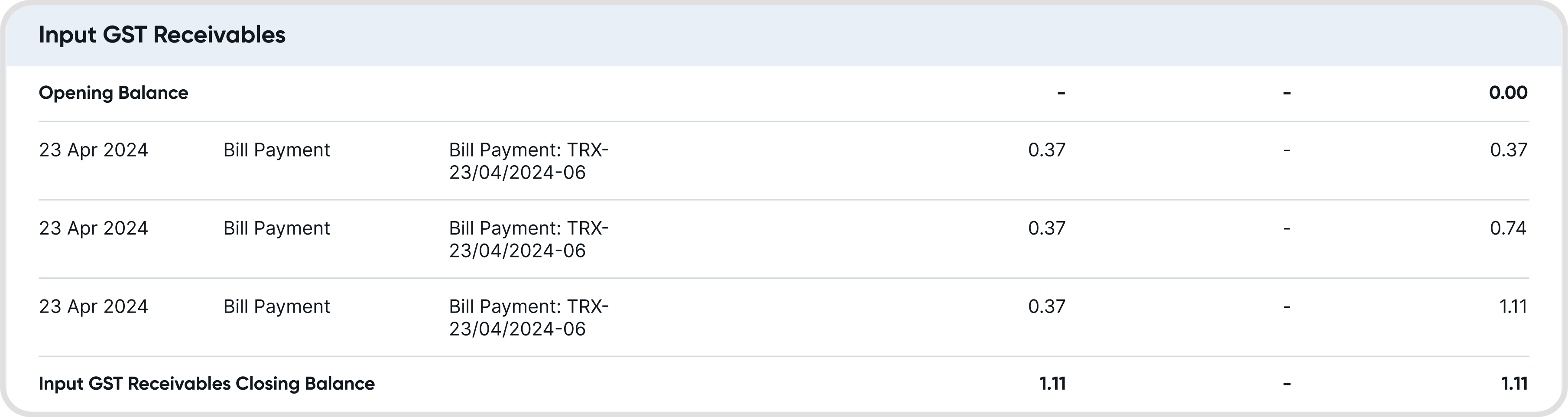

On the general ledger, you should see a record reflecting the transaction fees charged under the expense account (e.g. Transaction Fees & Charges) that you have selected when recording a transaction fee.

If you have indicated VAT included in the transaction fees, you should see an additional record for the included VAT under the Input VAT Receivable account.