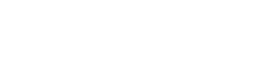

Q1. Can I save a supplier credit note as a draft?

Yes, a supplier credit note can be saved as a draft even if all the mandatory fields are not filled.

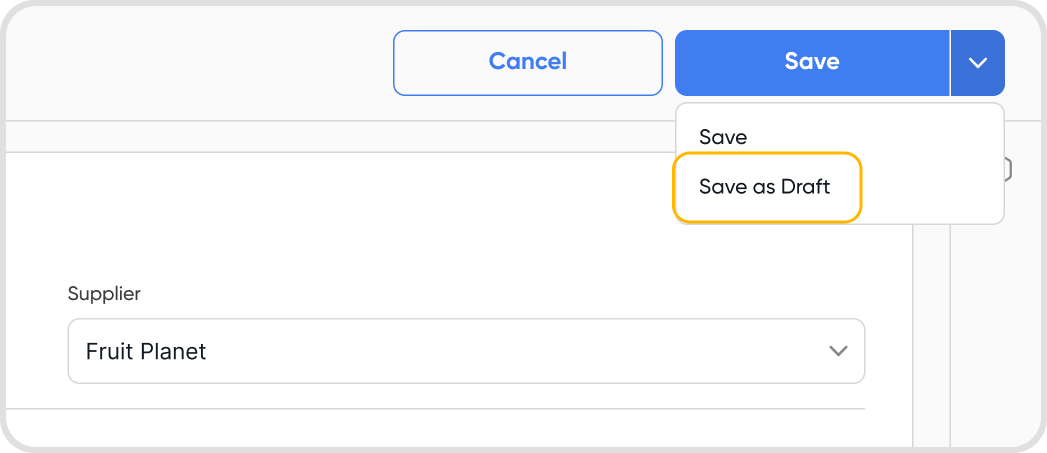

Q2. How can I convert a draft supplier credit note to an active one?

Any draft supplier credit note can be converted to active only after all the mandatory fields are filled.

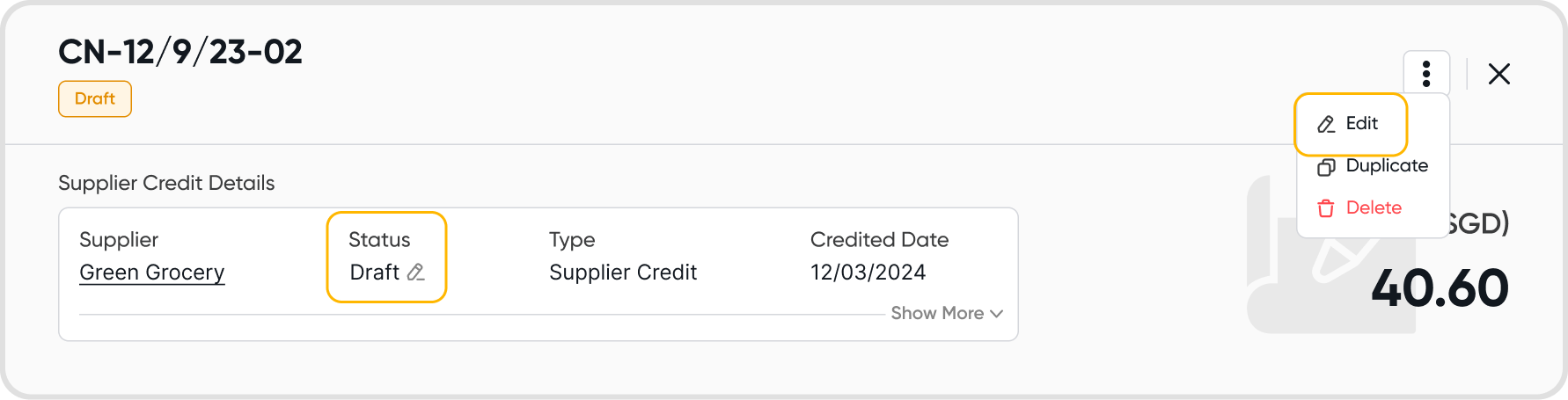

Q3. Can I save a supplier credit refund record as a draft?

Similar to a supplier credit note, a refund can also be saved as a draft against a credit note.

Q4. How can I convert a draft refund record to an active one?

For supplier credits, any draft refunds are converted only if the credit note is also converted to active.

Hence, to record the refund, the supplier credit note must be converted to active status.

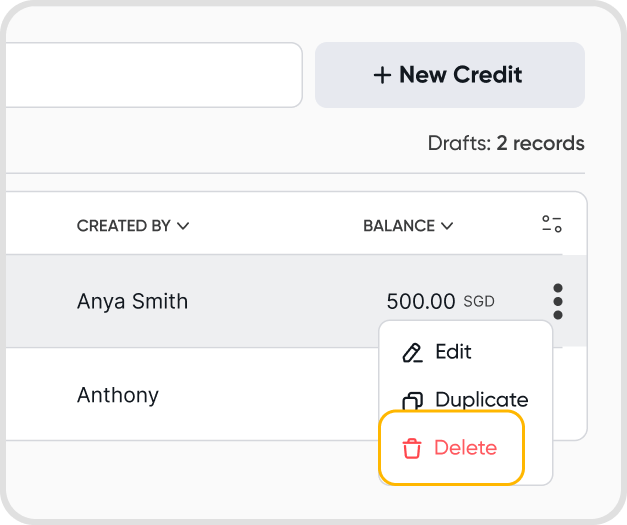

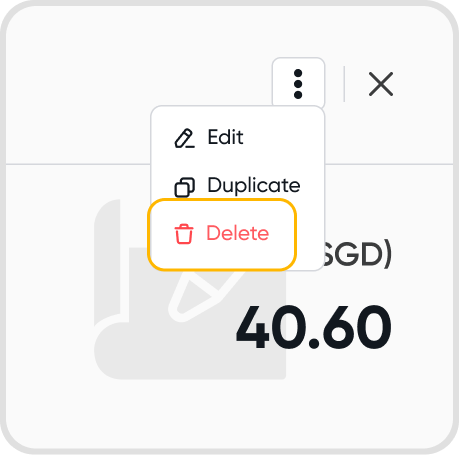

Q5. Can I delete a draft supplier credit?

Yes, you can delete a draft supplier credit note. If the note also had a linked draft refund record, it will also be deleted.

Q6. Do draft supplier credits affect my financial reports?

No, they do not. Financial reports are only affected once the supplier credit notes are active, and a refund has been recorded for it or it has been applied to a bill.

Q7. Can I create a non-base draft supplier credit note?

Yes, you can save a supplier credit note as a draft even if it is in non-base currency.

Q8. Do draft supplier credit refunds affect my financial reports?

No, draft supplier credit refunds do not affect financial reports.

Q9. Can I create a non-base draft supplier credit refund?

Yes, you can save a supplier credit refund even if it's in non-base currency.