No, supplier credit notes must be active before they can be applied.

If you would like to apply a supplier credit note to a bill, the supplier credit note must be in the same currency that the bill was created in.

For example, a bill that was created in USD can only make use of supplier credits that were also credited in USD.

Yes, you do not have to use the full amount in the supplier credit note.

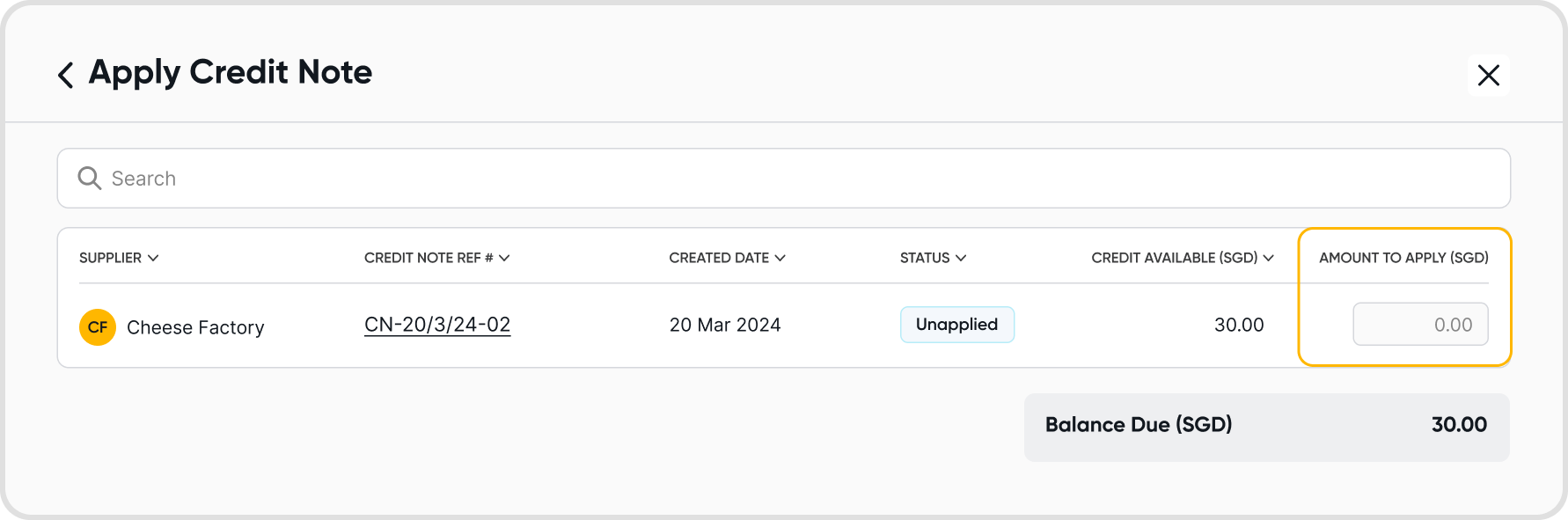

You can adjust this via the Amount to Apply field. Enter an amount smaller than the supplier credit note amount to only apply the credit note partially.

Yes, supplier credits do not have to cover the entire bill amount. You can apply as much of a supplier credit note as you would like to a bill.

The rest of the bill can be paid with other payment methods.

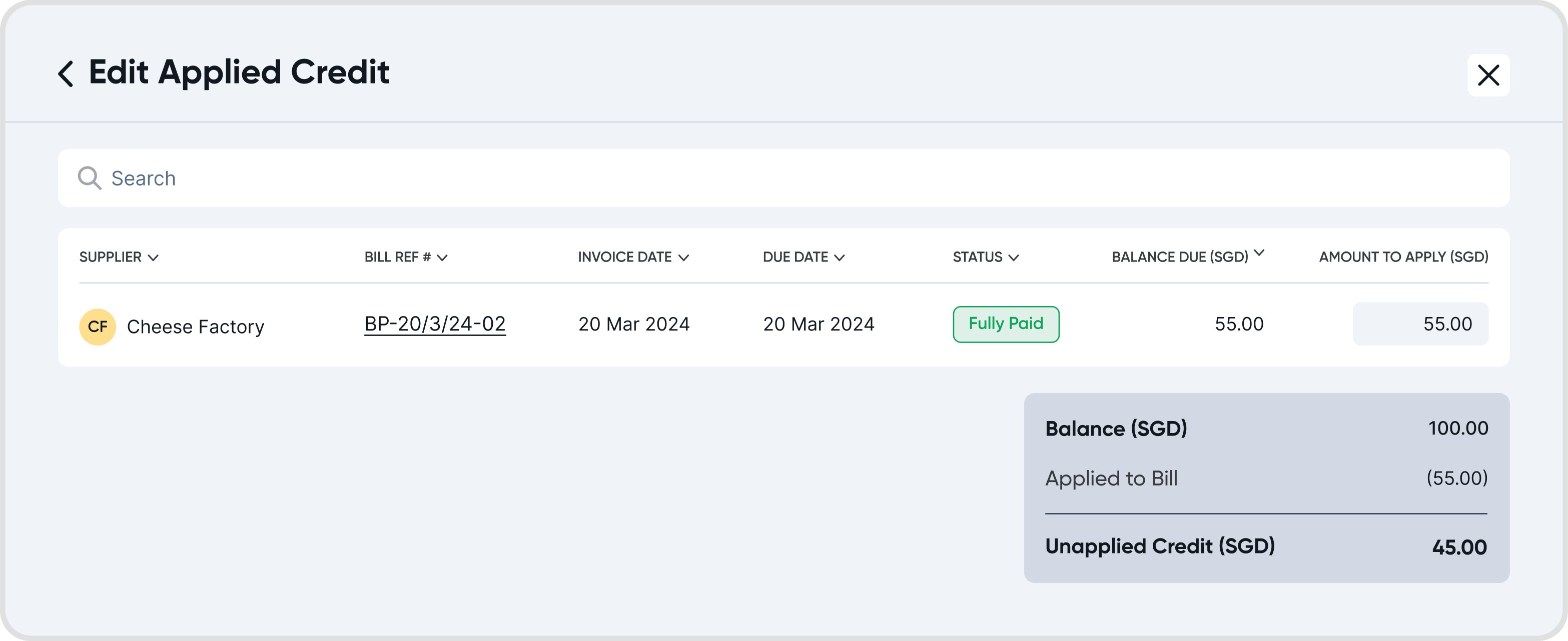

Yes, you can remove an applied supplier credit note on a bill by updating the applied amount to 0.

Change the Amount to Apply amount to 0 on the Edit Applied Credit modal. This will remove all applied credit from the bill.

There will be no further impact on your financial reports.

This is because the credits would have been accounted for during creation, appearing as a debit to Accounts Payable, and a credit to transaction account used on the bill.

The offset value date aligns with the later of the transaction date or the credit note date, ensuring accurate reporting across time zones. For example:

Transaction Date: 1 Jan 2025

Credit Note Date: 5 Jan 2025

Offset Value Date: 5 Jan 2025