Yes, you can void an invoice.

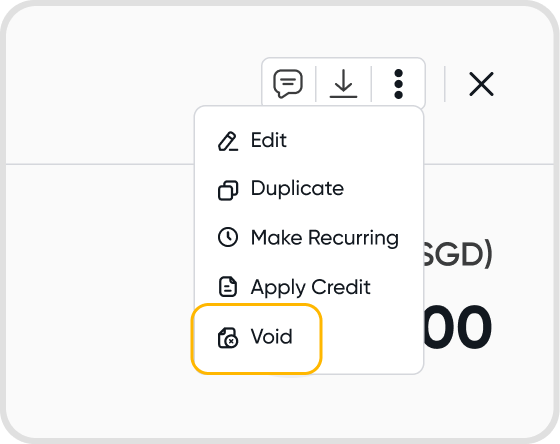

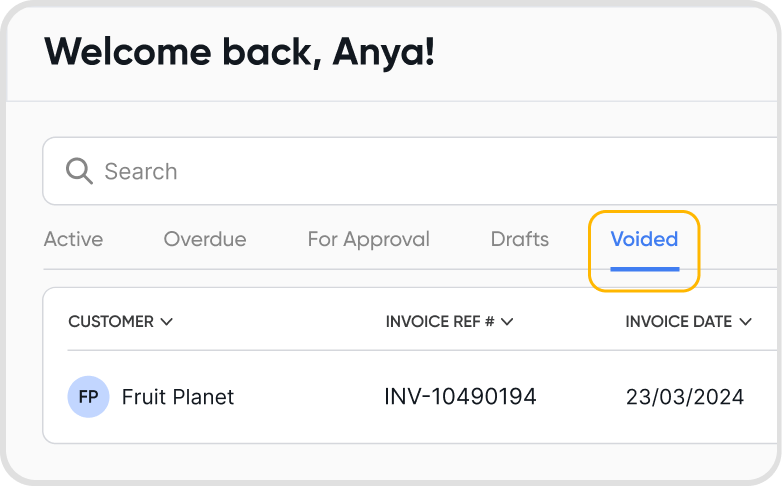

Find the void option in the invoice details. Once done, you can find the voided records under the voided tab.

No, voiding an invoice is permanent.

No, voiding an invoice will not do this.

However, deleting an invoice will remove it from the application permanently.

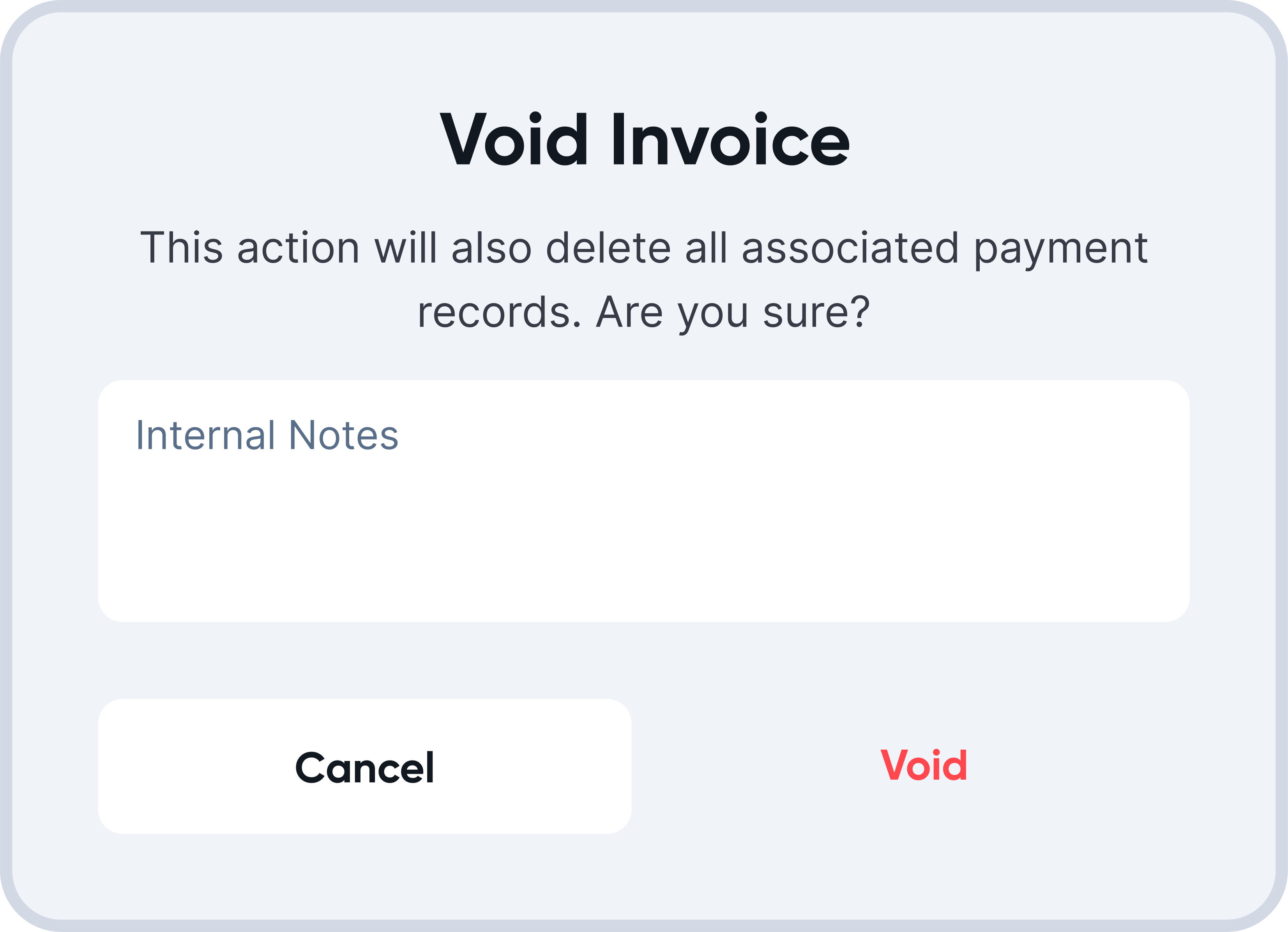

Voiding an invoice will also delete all associated payment records.

If you have applied any customer credit notes, the applied credit will be rolled back and unapplied.

Yes, voiding an invoice will affect your financial reports.

You may see a change in how different parts of your financial reports are calculated, due to the now voided transaction and removal of associated payments.

Here's how your financial records and reports may be affected:

Trial Balance - The debit and credit amounts of your accounts (especially Accounts Receivable) will be adjusted.

Balance Sheet - The total amounts of accounts previously used in the invoice and related payments may have changed.

Profit & Loss - The overall net profit amount may change as you might see changes to amounts in operating revenue and expense accounts.

Cashflow - Opening and Ending cash balances may be affected.

Ledger - The voided invoice will have its transaction record removed from the ledger.

Yes, you can. When voiding an invoice, a pop-up box will show up.

Other than confirming you want to void the invoice, you can also add internal notes at this stage for your team to view.

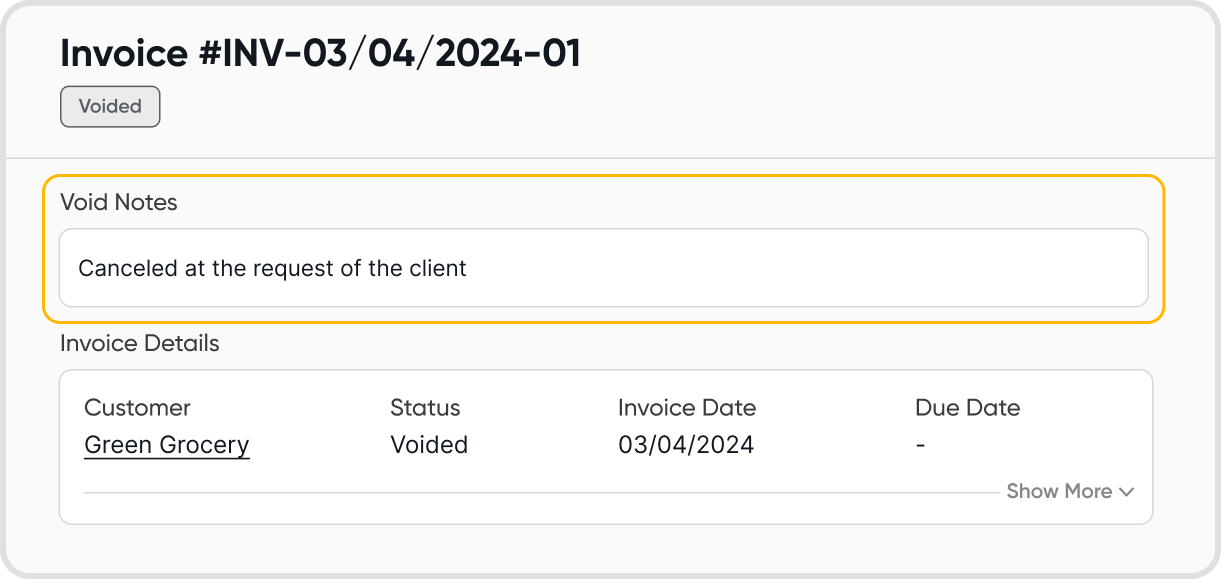

The void notes will show up on the voided invoice as shown below.

Yes. Voiding multiple transactions applies for the following transaction status

Active transactions

Balance Due

Select multiple transactions you want to void by ticking the checkboxes.

Adding a void note applies to all selected transactions.