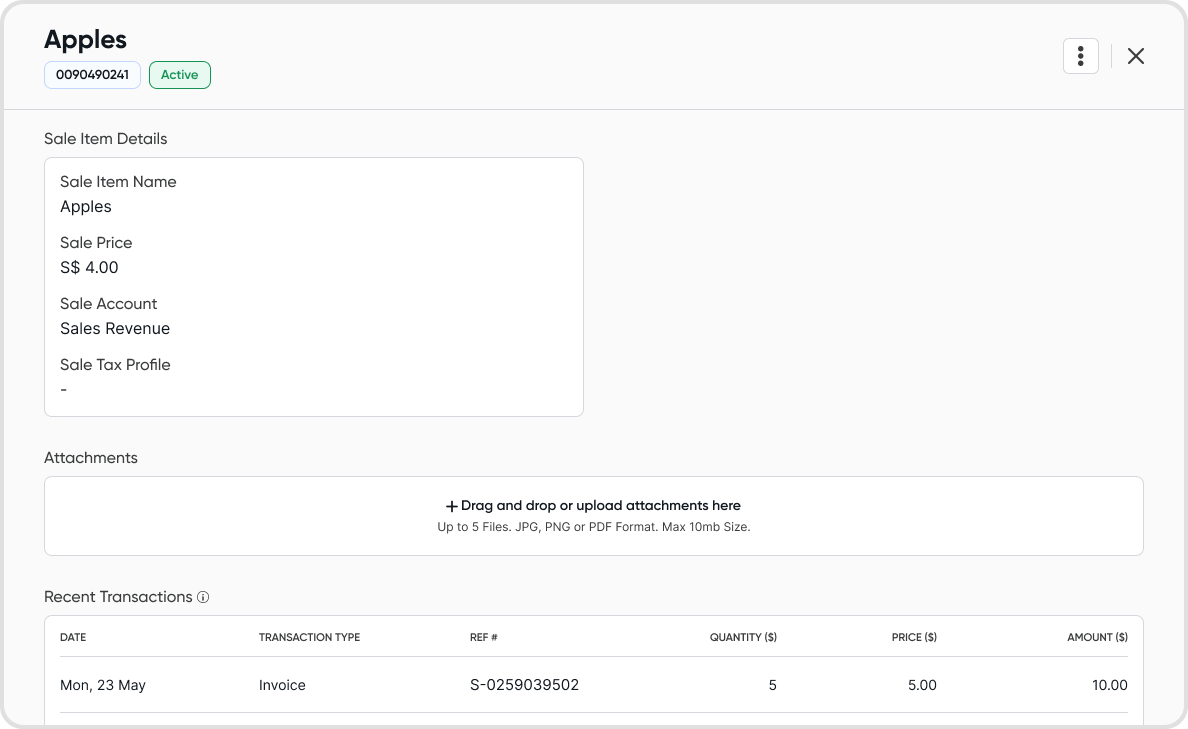

Active items will show up as options for selection in the business transactions. Inactive items will be hidden.

The transactions where an item is used can be found at the bottom of the item details.

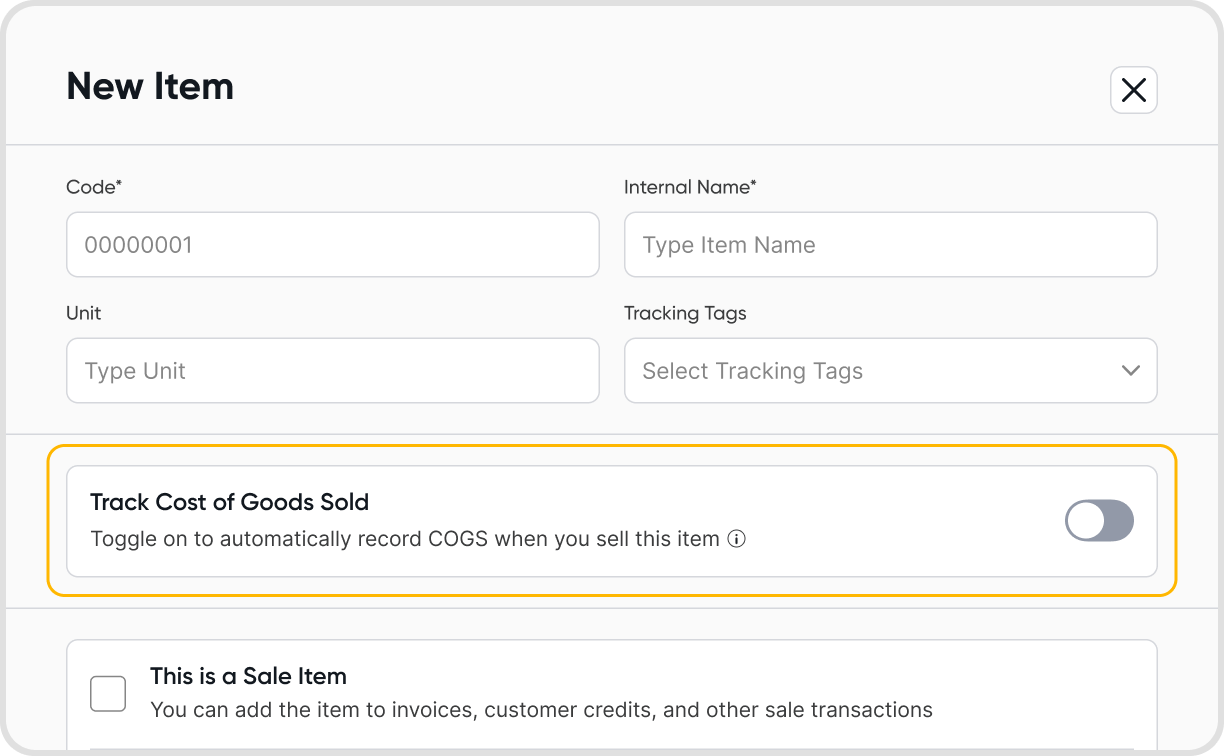

Toggle COGS on for the item.

Set the COGS account and inventory account for the item.

For every unit sold (any currency), the cost price (in base currency) excluding taxes will be added to the COGS account and deducted from the inventory account.

The Internal Name will be used as the name to identify the item within the organization. The internal name will not be displayed in the invoice/bill.

The Sale Name/Purchase Name will be used as the display name for each respective record. The generated PDF and record data will display the Sale Name/Purchase Name.

For a Sale Item: An account that you would use to track revenue, typically a Revenue Account.

For a Purchase Item: An account that you would use to track expenses, typically an Expense Account.

If you are tracking COGS for the item: Select an account that you're using to record and track expenses related to the cost of goods sold.

Currently, there is no limit to the number of items that you can add.

The tax profile will be removed from items that had the tax profile selected as their Sale/Purchase Tax profile.

The next time you select the item in a transaction the tax profile will be empty.

The account will be removed from items that have the inactive account selected as the Sale/Purchase/COGS account.

The next time you select the item in a transaction the account will be empty.

An item code is used to label and track items internally within Juan, for the organization's use.

The item code is not shown to customers.

No, all item codes must be unique.