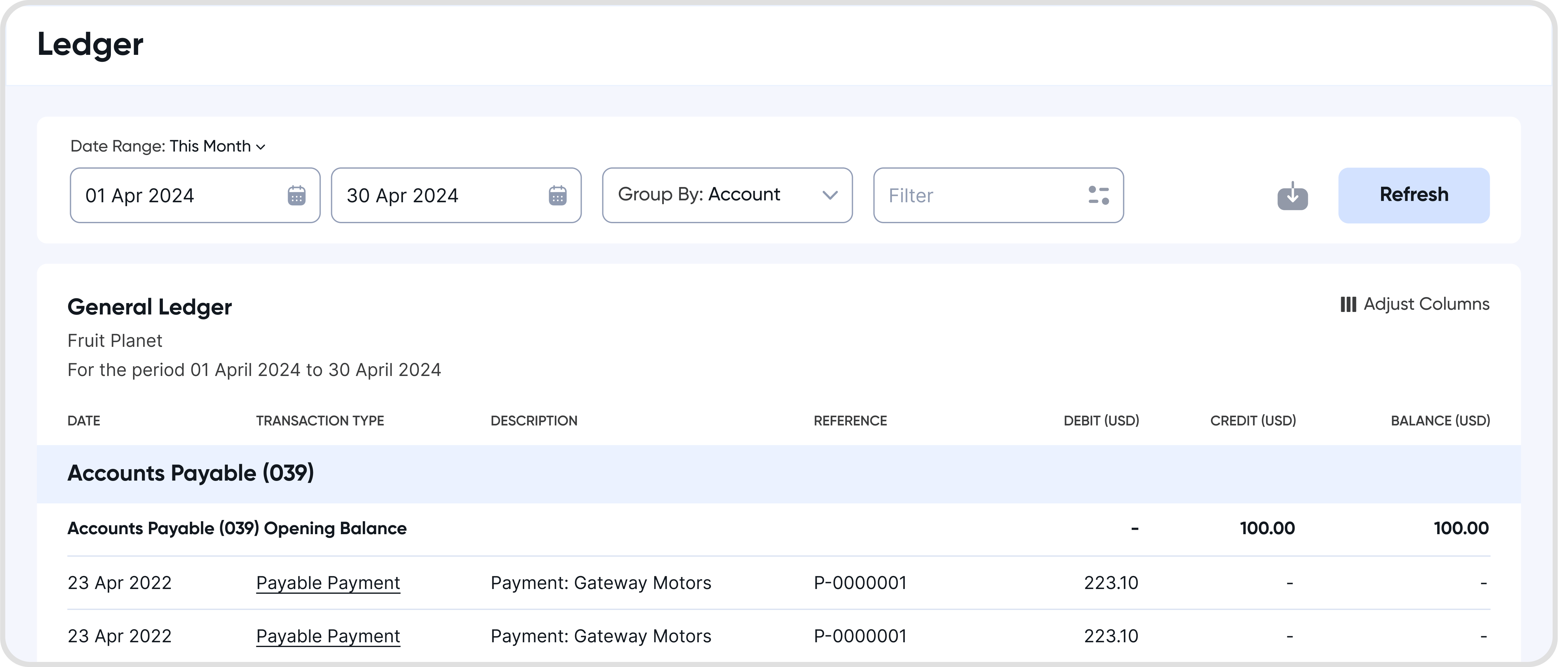

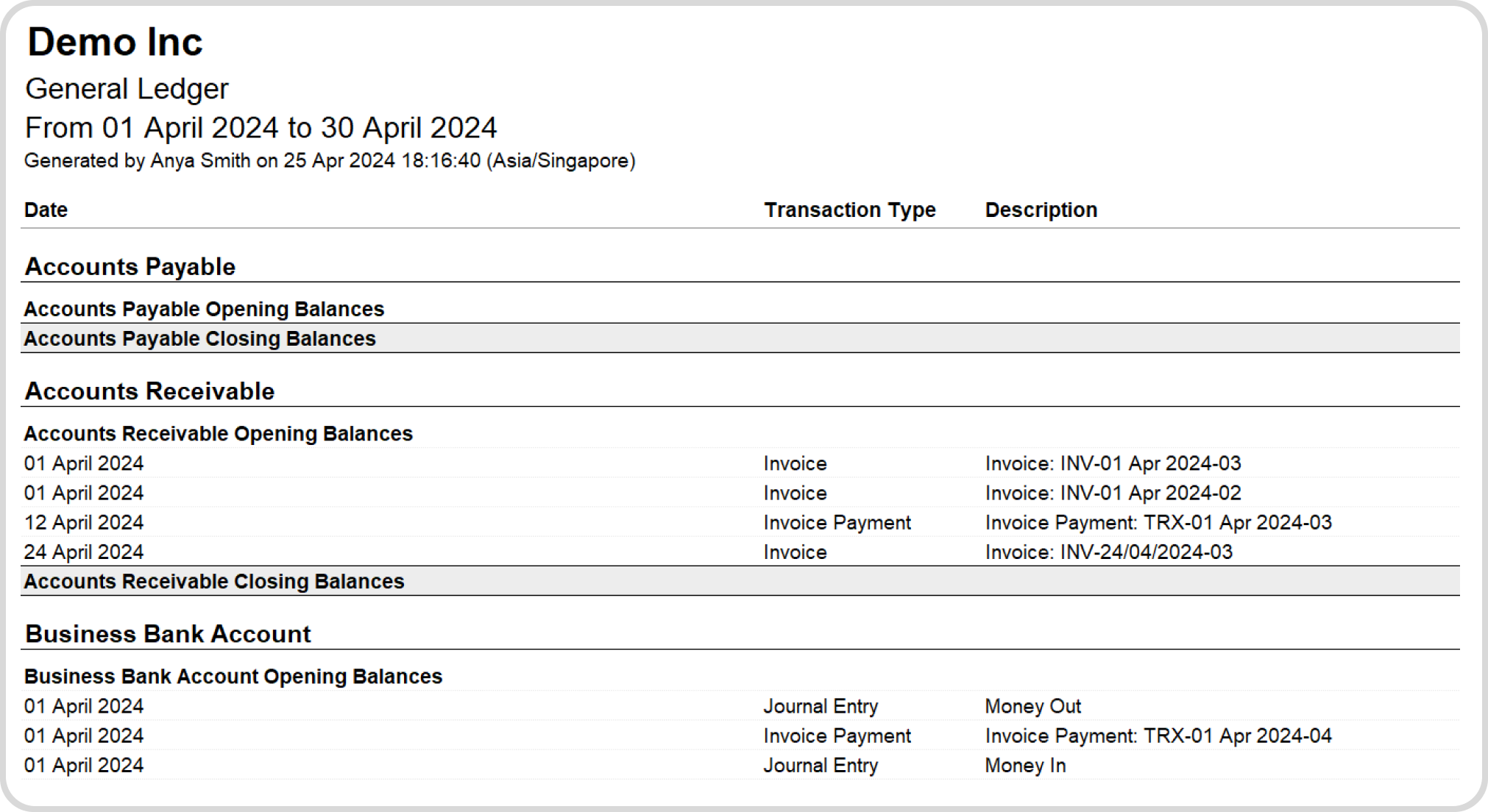

The General Ledger shows all the different accounts and financial transactions that have been recorded for your business. This includes all types and classes of accounts, as well all types of business activity.

It is a complete record of all financial transactions over the life of a company.

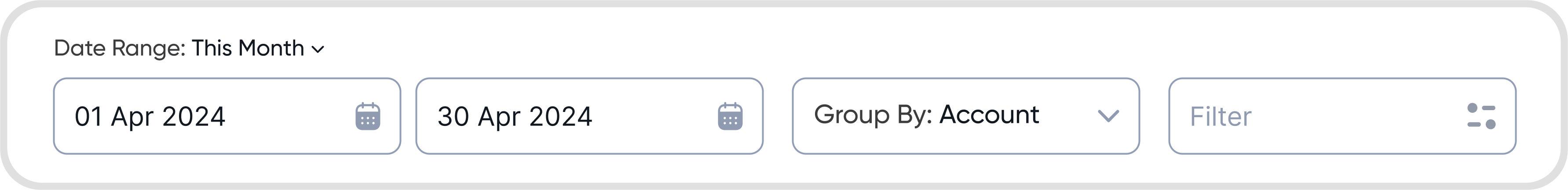

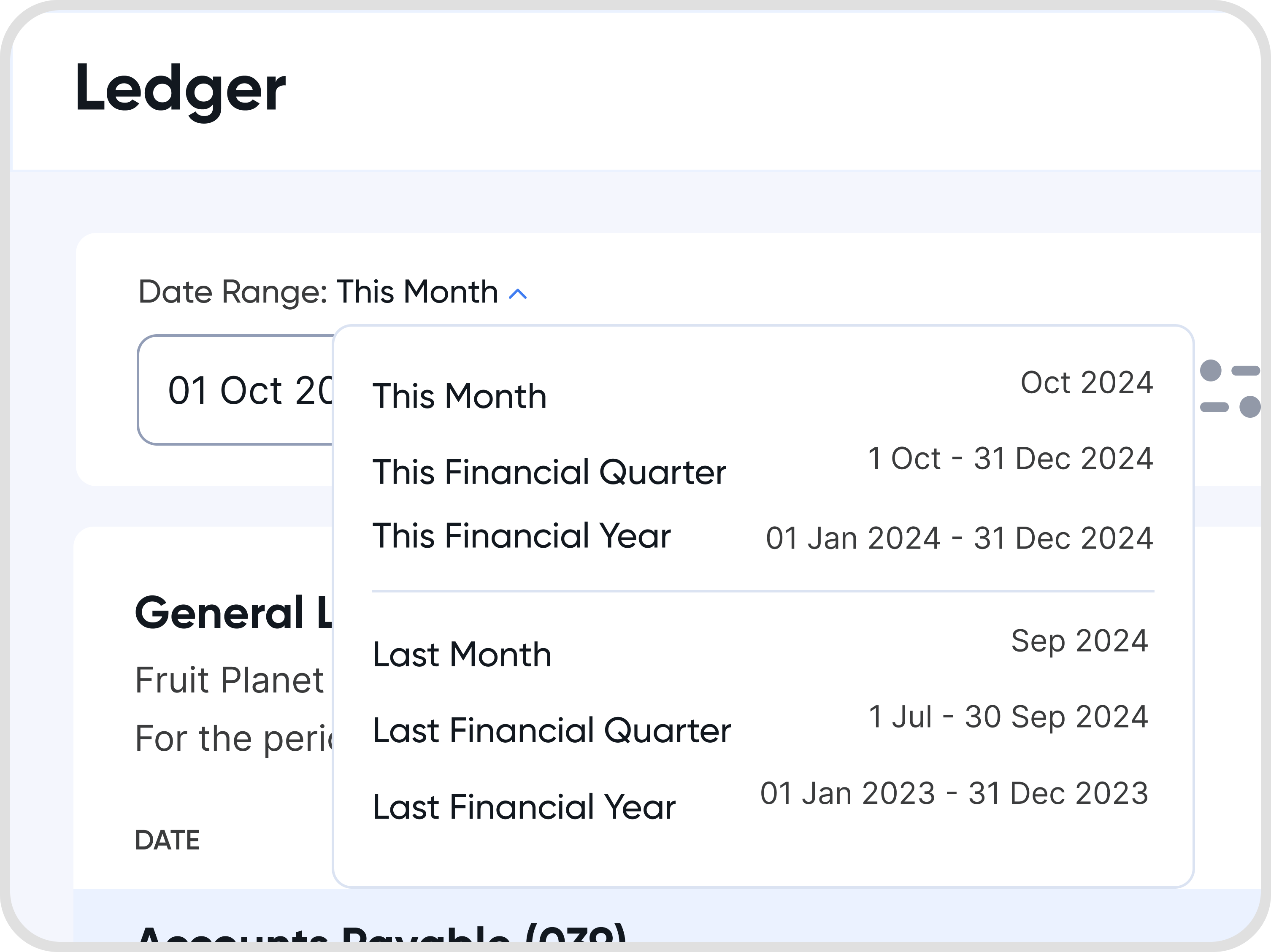

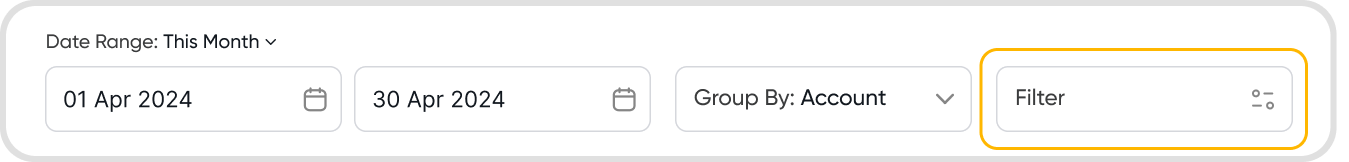

Yes, you can customize the date range using the date selectors or use pre-defined commonly used date ranges.

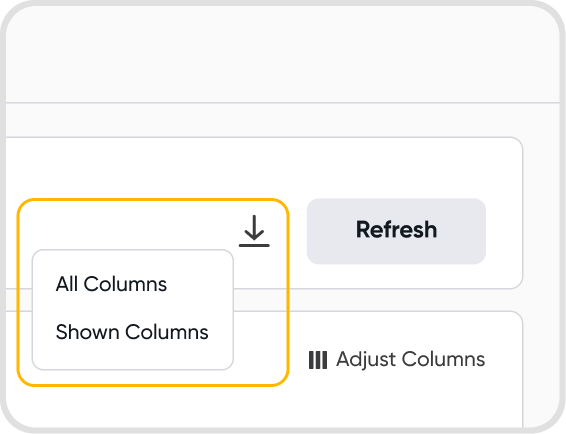

You can download the report either as it appears on the UI (with the shown columns) or with all columns, including the hidden ones.

See below for an example of the downloaded file.

Juan supports 5 options for grouping your transactions:

By accounts

By contacts

Note: For transactions that do not have an associated contact, they will be grouped under No Contact.

By transactions

By relationship

By tax profiles

Note: Only transactions that make use of tax profiles will show up here.

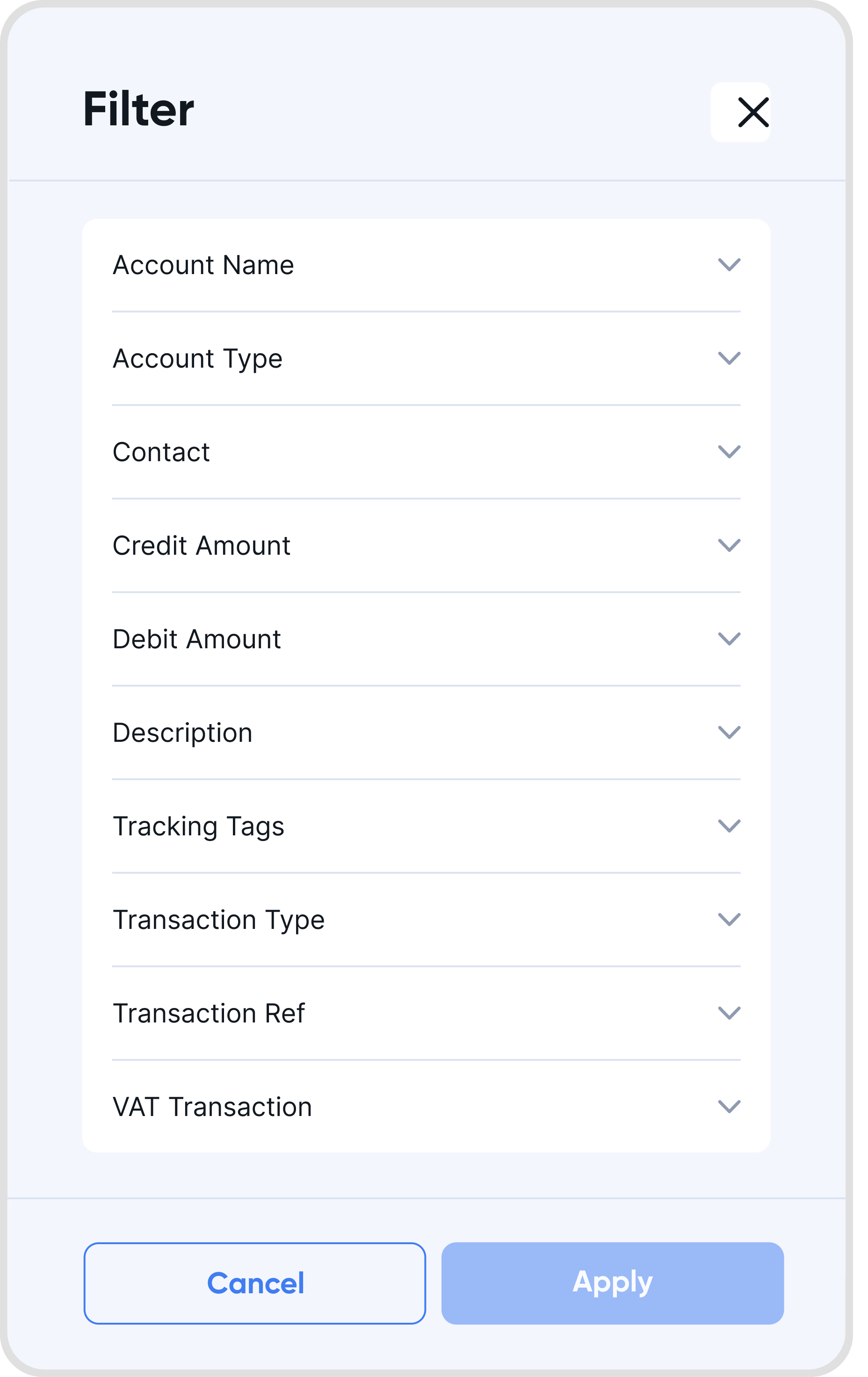

Yes, you can use filters on the general ledger.

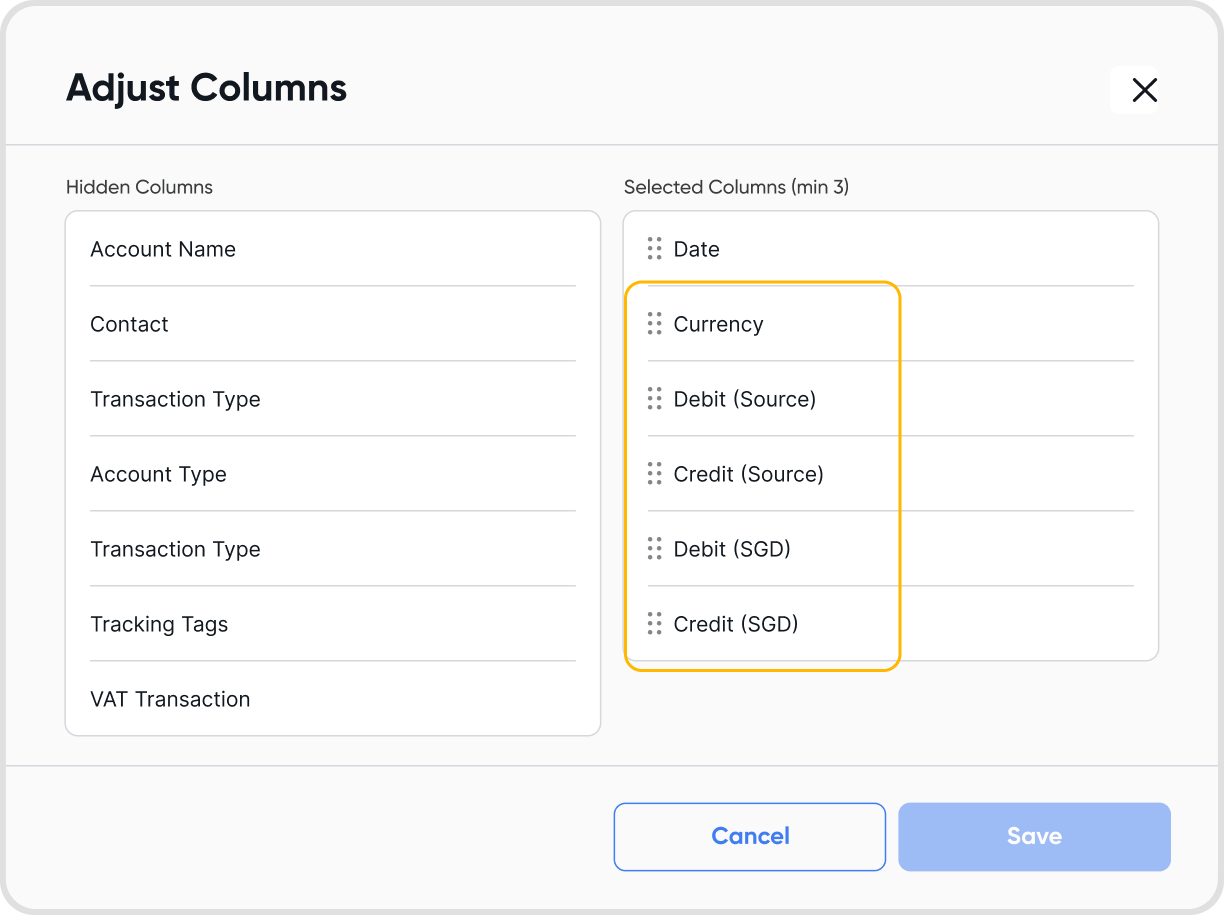

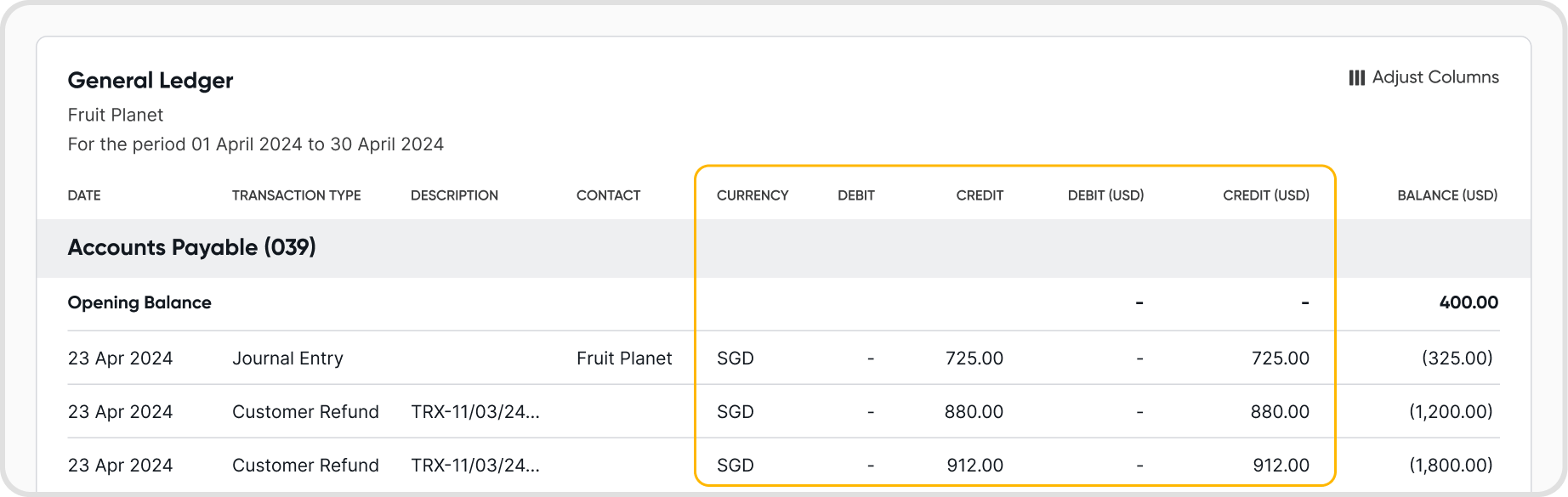

You can adjust the columns in the general ledger to view the display currency, source debit/credit, and base debit/credit amounts.

Alternatively, you can click on the transaction record in the General Ledger.

This will bring up the transaction details, where you can view the transaction's original amount in the currency that was used for the transaction.

There are 3 accounts that Juan provides for managing foreign exchange transactions:

FX Bank Revaluation (Gains)/Loss

This account is used to record the gain/loss incurred to the bank balance due to the change in exchange rates of the currencies

FX Realized Currency (Gains)/Loss

If a transaction was conducted in a foreign currency (i.e. a currency that is different from your organization's base currency), there may be FX currency gains/losses depending on exchange rate differences between the date of the transaction and the date of payment.

FX Unrealized Currency (Gains)/Loss

This account is used to record the gain/loss of unpaid cross-currency transactions due to fluctuations in exchange rates.

FX Rounding (Gains)/Loss

This account is used to record small rounding errors because of the conversion of foreign currency amounts into the base currency.

These rounded amounts may not perfectly match the original amounts due to exchange rates or decimal precisions.

If the rounded amount is less than the calculated amount, the difference is recorded as a debit to this account. Conversely, if the rounded amount is greater than the calculated amount, the difference is recorded as a credit to this account.

Yes, enable Print Report Notes in Options to add and format notes below the report. These notes will be included in the exported report.

Yes, enable Print Exchange Rates in Options to display them below the report. They will also appear in the exported report.

Use the custom date range feature in your Ledger to view the dynamically updated Retained Earnings balances for each financial year. These balances are automatically managed and adjusted based on changes to transactions or financial year settings.