Under Settings > Configurations > VAT Profiles

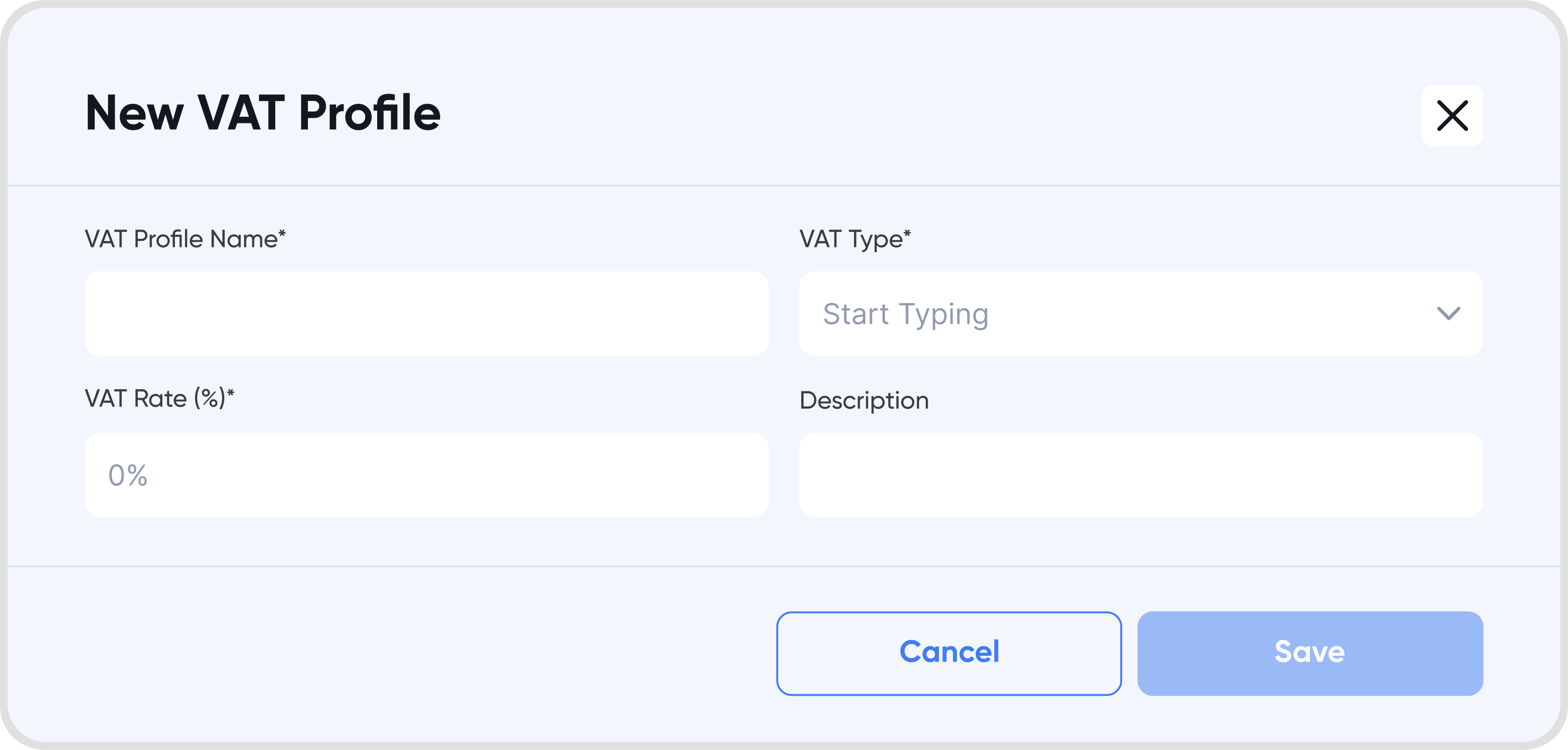

Clicking on + New Profile will add a new VAT profile.

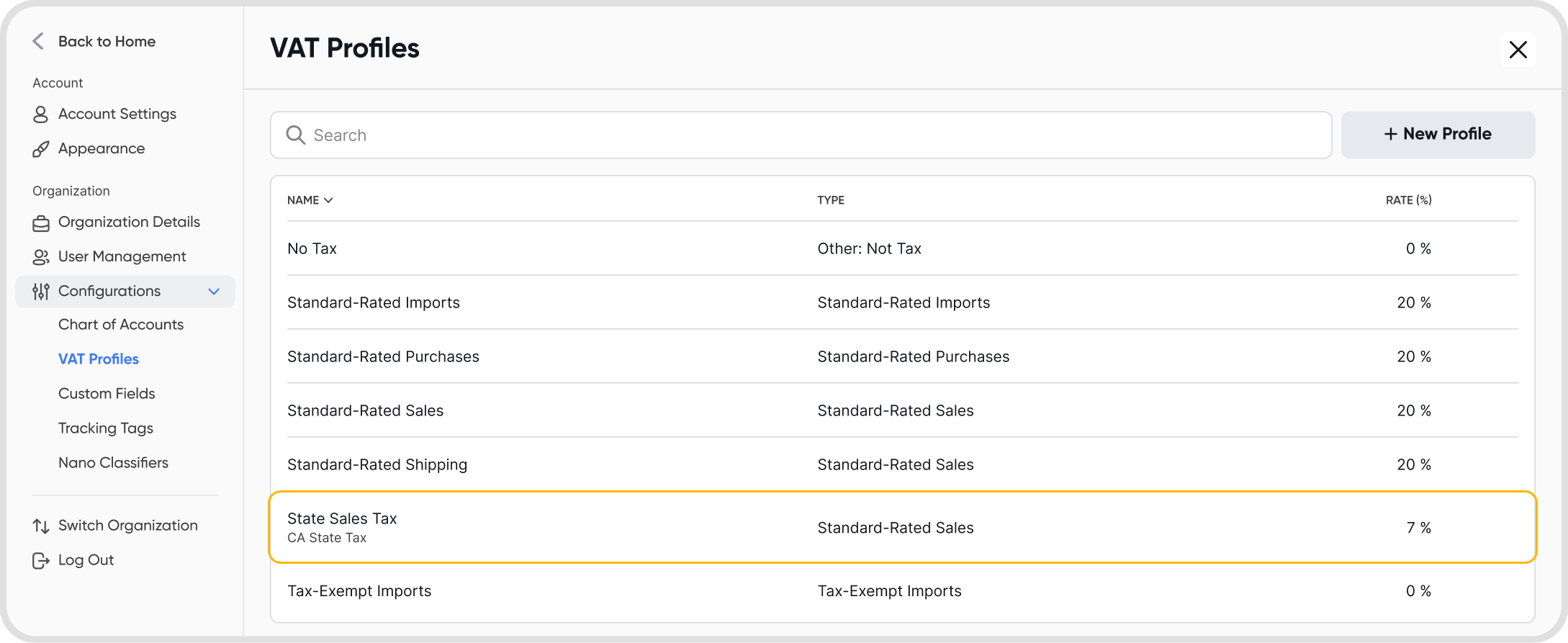

The newly created VAT profile should show up in the list of VAT profiles.

Under Settings > Configurations > VAT Profiles

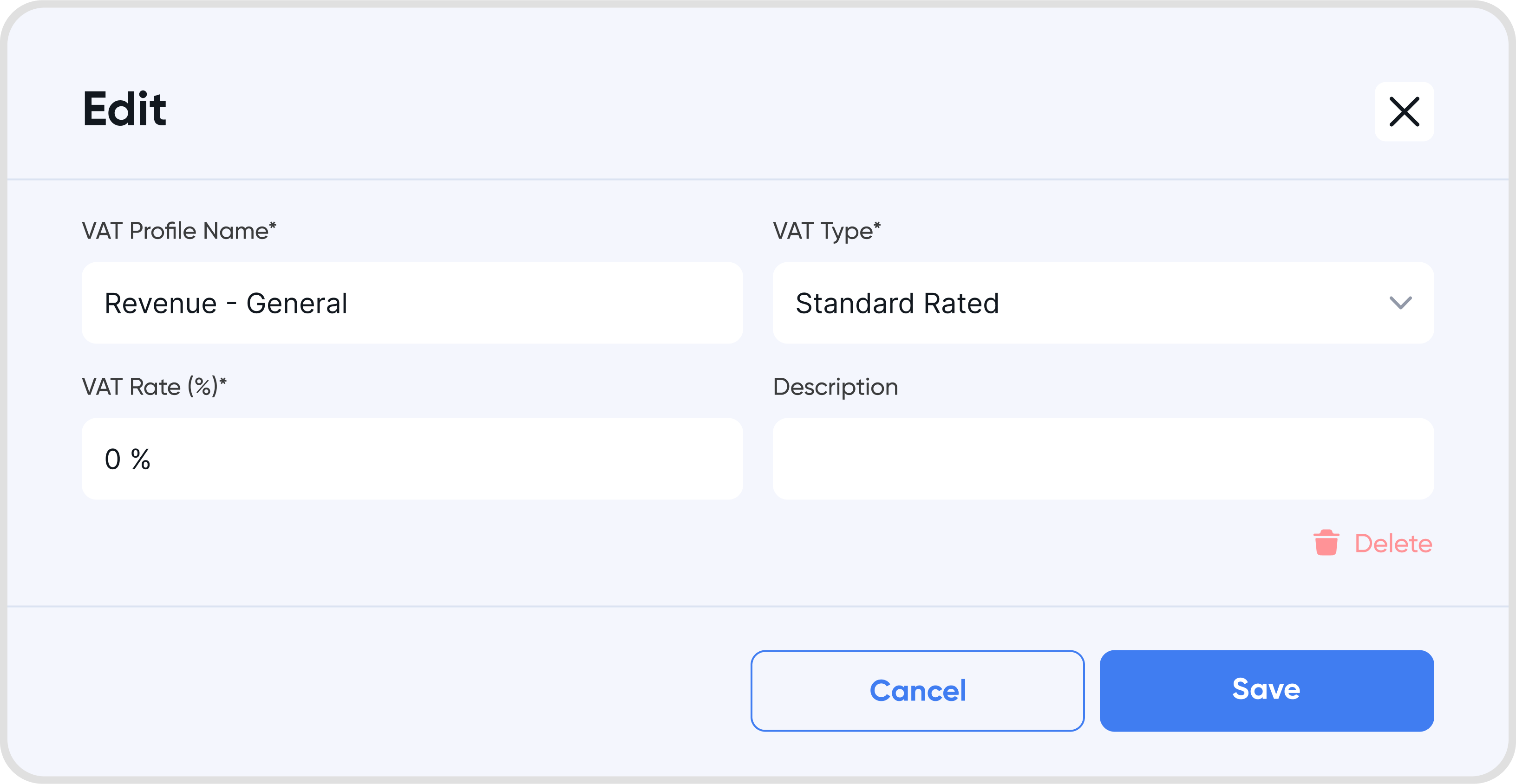

Click on the menu (3 dots) on your desired VAT profile to edit, and choose Edit.

Modify the fields (name, type or rate) as desired.

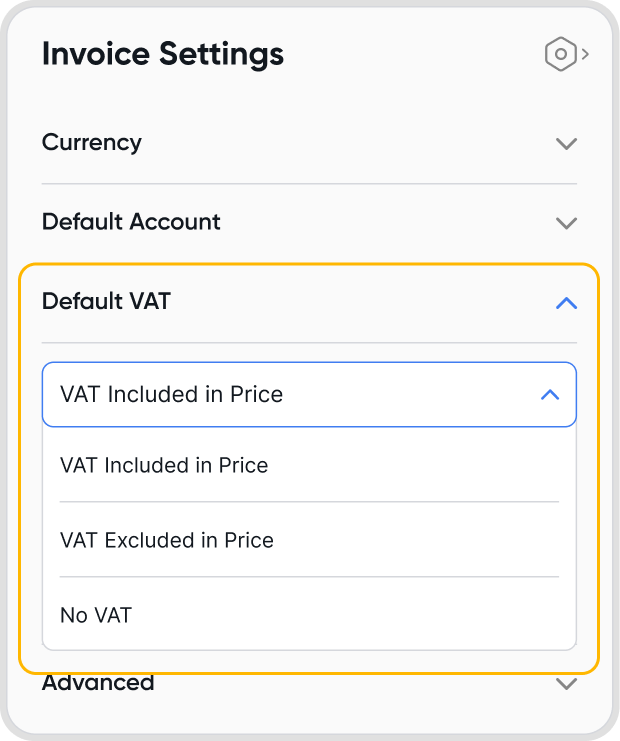

Before using VAT profiles in business transactions, you must first adjust the transaction VAT settings under the transaction settings.

Choose between VAT Included in Price or VAT Excluded in Price.

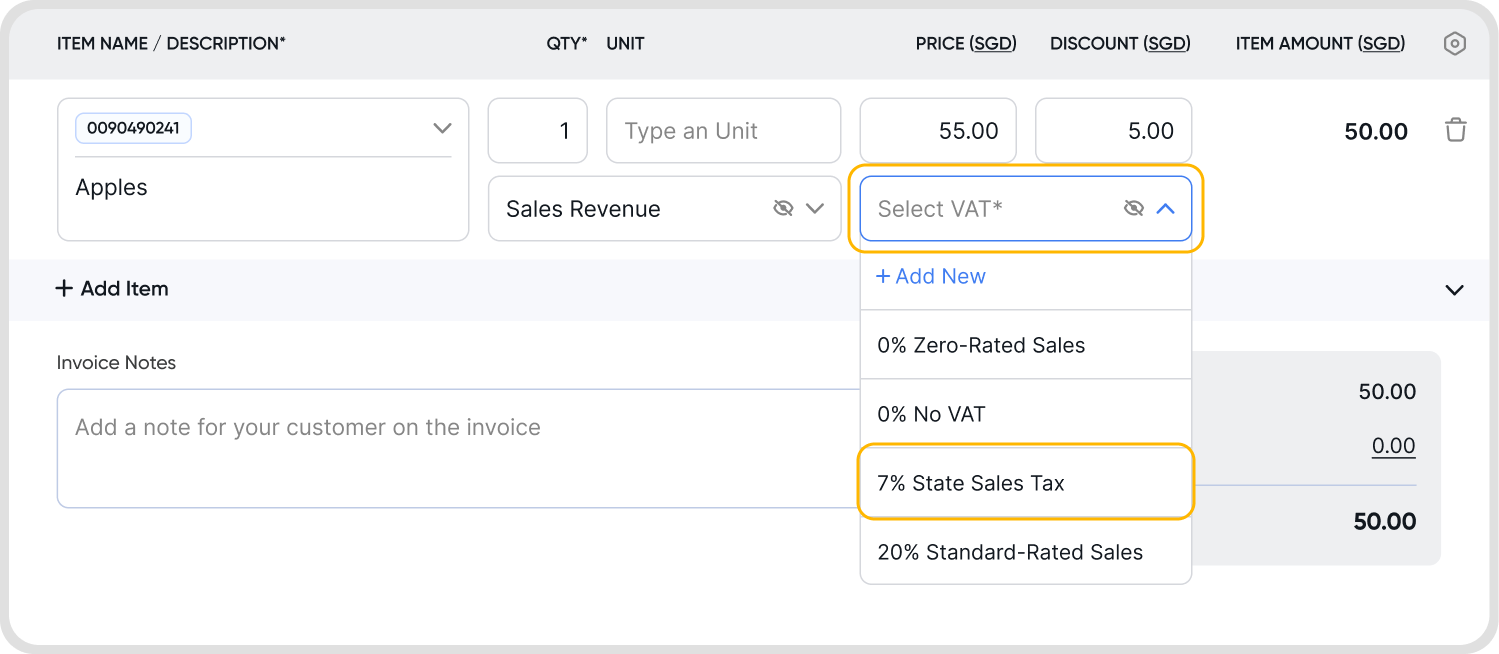

After selecting either VAT included in Price or VAT excluded in Price, a new Select VAT field will appear.

You can choose from the pre-existing VAT profiles, or select profiles that were added in.

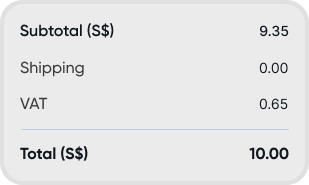

The tax amounts will then be updated accordingly, on the transaction total summary.

Yes, you can use a VAT profile for shipping.

For more information, refer to How can I add VAT for shipping fees to my invoice?

VAT Type refers to the categorization of the VAT profile.

This is pre-selected by Juan. New VAT profile types cannot be added in.

If you change the VAT profile via Configurations, the change will show up in any transactions that will make use of the VAT profile moving forward. Transactions already created will not be affected.

However, if the change is made on a transaction level, only the VAT profile for the transaction itself will be affected.