No, customer credit notes must be fully active before they can be applied.

If you would like to apply a customer credit note to an invoice, the customer credit note must be in the same currency that the invoice was created in.

For example, an invoice that was created in USD can only make use of customer credits that were also credited in USD.

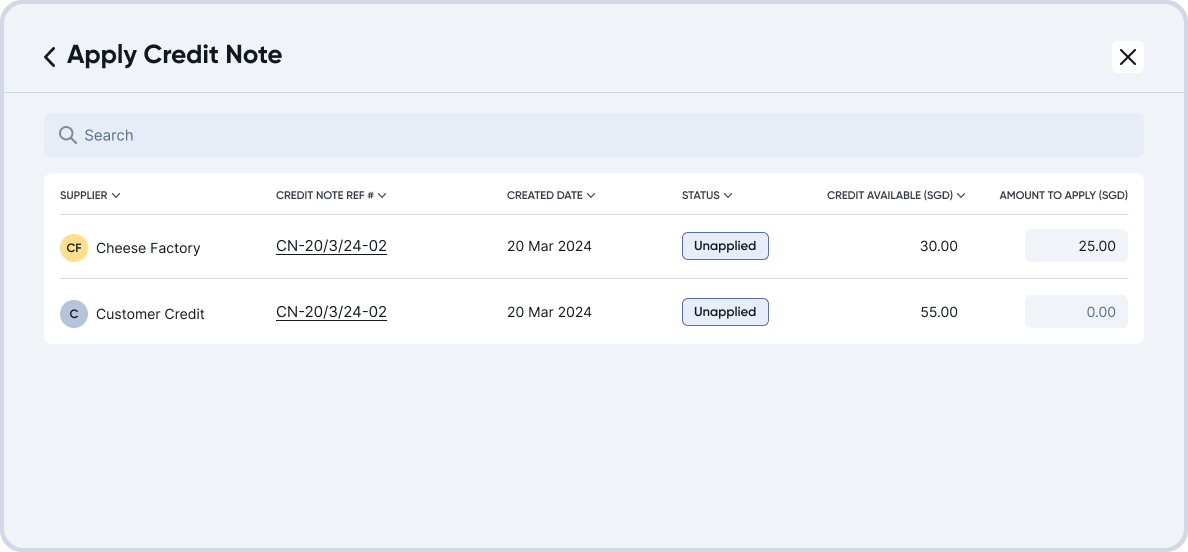

Yes, you do not have to use the full amount in the customer credit note.

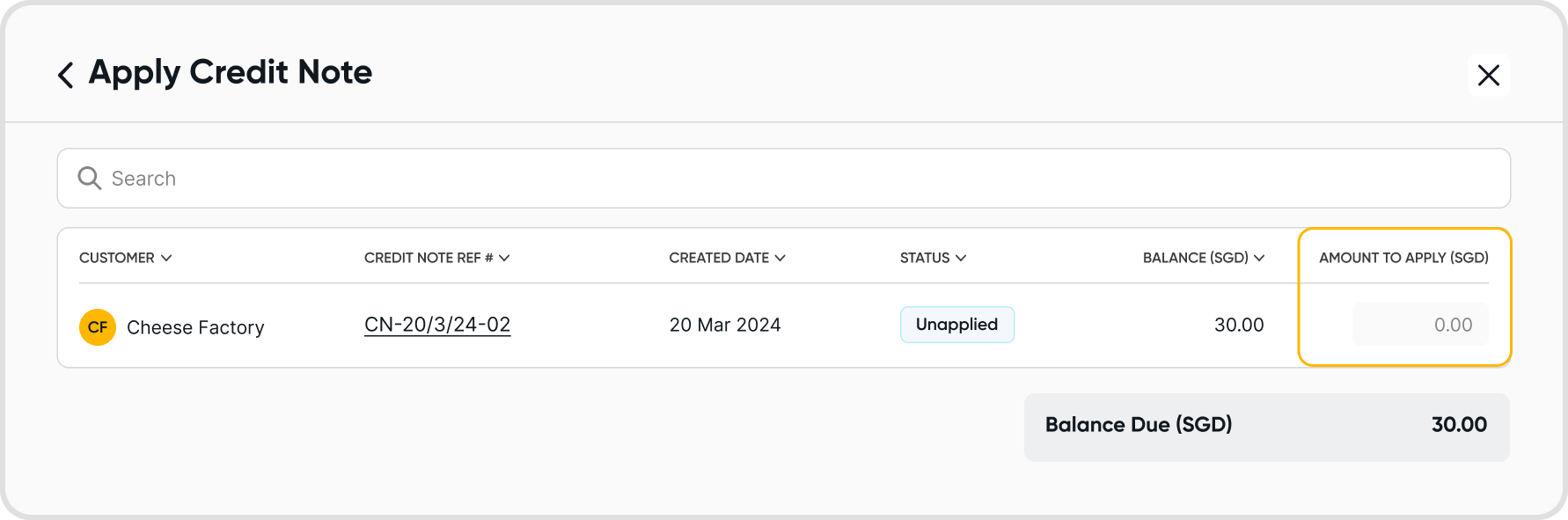

You can adjust this via the Amount to Apply field. Enter an amount smaller than the customer credit note amount to only apply the credit note partially.

Yes, customer credits do not have to cover the entire invoice amount. You can apply as much of a customer credit note as you would like to an invoice.

The rest of the invoice can be paid with other payment methods.

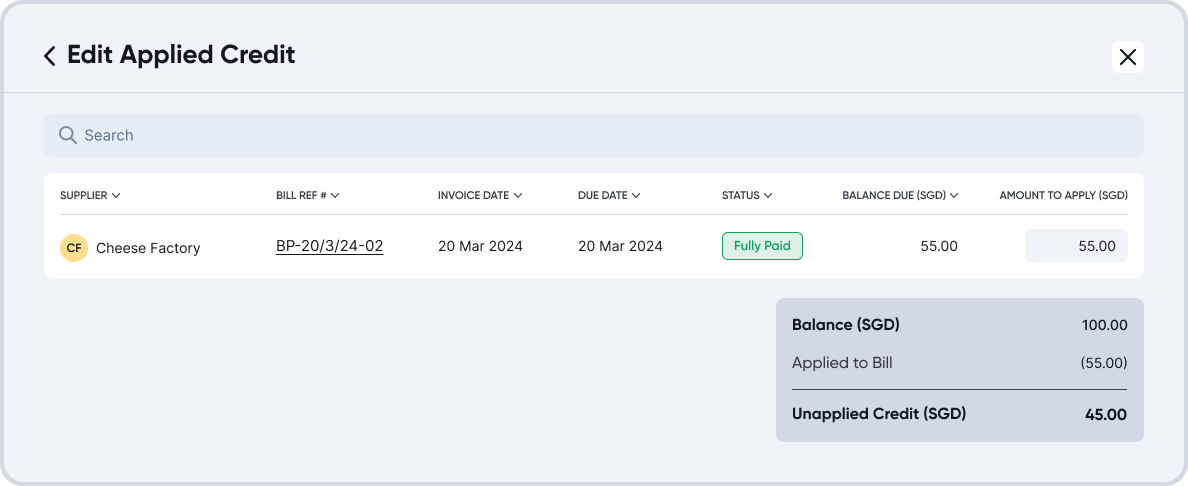

Yes, you can remove an applied customer credit note on an invoice by updating the applied amount to 0.

Change the credit Amount to Apply amount to 0 on the Edit Applied credit modal. This will remove all applied credit from the invoice.

There will be no further impact on your financial reports.

This is because the credits would have been accounted for during creation, appearing as a credit to Accounts Receivable, and a debit to the sales account used on the invoice.

The offset value date aligns with the later of the transaction date or the credit note date, ensuring accurate reporting across time zones. For example:

Transaction Date: 1 Jan 2025

Credit Note Date: 5 Jan 2025

Offset Value Date: 5 Jan 2025